Resuming the Rate-Hike Campaign

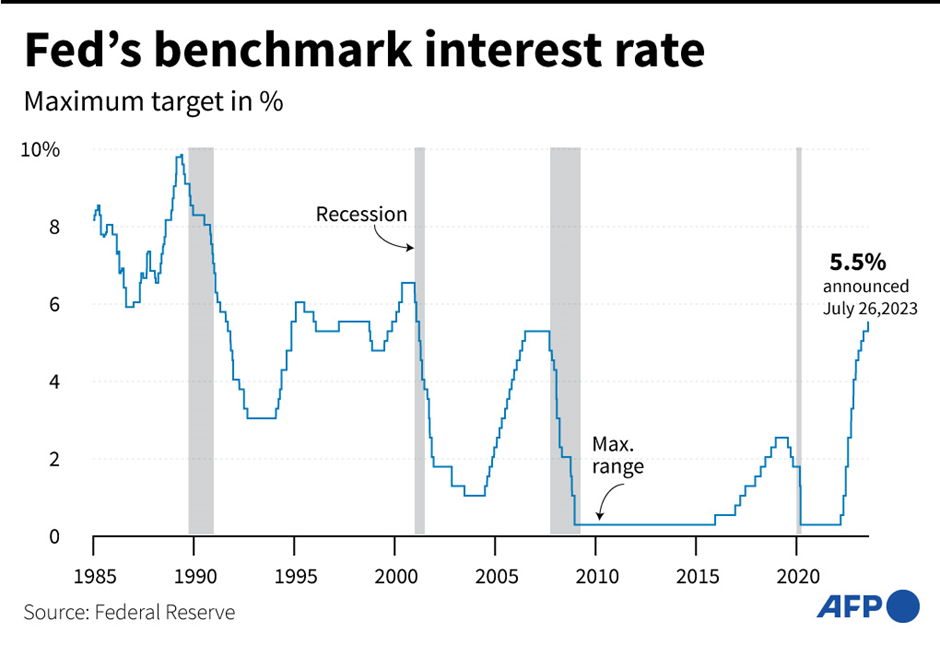

The Federal Reserve rate hike pause in the previous FOMC meeting was viewed as a hawkish pause, leaving the possibility of a rate hike open for the next meeting in July. As anticipated, the Federal Reserve recently resumed its rate-hike campaign, raising its target rate by 25 basis points. This move now brings the overnight federal funds rate to a range of 5.25% to 5.5%, marking the highest level in 22 years.

Combatting Rising Prices

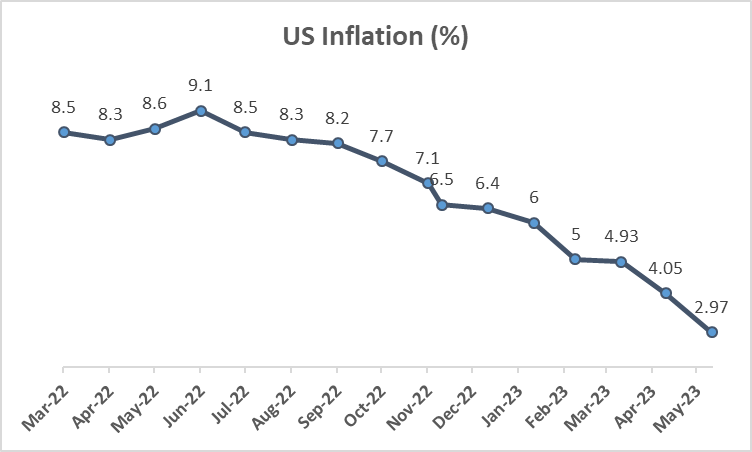

The primary motivation behind the rate hike is the Federal Reserve’s ongoing efforts to combat the price surge, even though headline inflation has started to ease. The US economy has been grappling with inflation concerns for several months, experiencing high rates. However, recent data indicates a significant improvement, with inflation now measured at 3%, down from the alarming 40-year high of 9.1%. This marks the twelfth month of decelerating price increases, bringing it closer to the Fed’s target of 2%.

Fed Chair’s Cautious Approach

Despite the positive signs of easing inflation, Federal Reserve Chair Powell has emphasized the need for caution and not making decisions solely based on one data point. Core inflation, which excludes food and energy prices, has slowed to show signs of decline, warranting careful consideration.

Assessing the State of the US Economy

Strong Economic Indicators

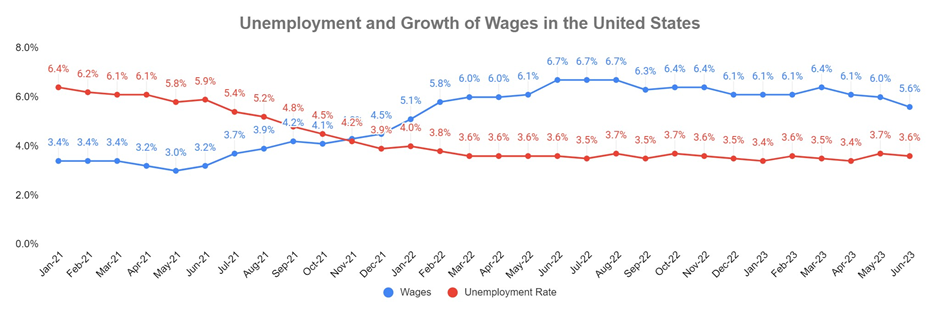

The Fed chair also said other economic indicators reflect that the U.S. economy is still running too hot, which has been a critical reason to enact another rate hike.

The US economy has exhibited resilience with stable wage growth, low unemployment, and robust consumer spending. These solid economic indicators have contributed to the Federal Reserve’s decision to implement another rate hike.

Future Rate Hike Possibilities

- The Federal Reserve will decide on rate increases on a meeting-by-meeting basis.

- There is a possibility of another rate hike in September, but they may also choose to keep rates steady at that time

- The Fed no longer predicts a recession in 2023, indicating confidence in the economy’s strength

- The Fed aims to achieve a ‘soft landing’ by controlling inflation without causing a sharp economic downturn.

Key Takeaways

- Taking a “Meeting by Meeting” Approach: Looking ahead, the Federal Reserve plans to assess the need for further rate increases on a meeting-by-meeting basis. While the possibility of another rate hike in September is hinted at, the central bank may also choose to keep rates steady.

- The Goal: Engineering a Soft Landing: The Federal Reserve’s current objective is to engineer a ‘soft landing,’ seeking to curb inflation without causing a severe economic downturn. This delicate balancing act will be crucial in shaping the future trajectory of the US economy.

Will the Federal Reserve Achieve a Soft Landing?

As investors, the pivotal question is whether the Federal Reserve can successfully engineer a soft landing for the US economy. The delicate balance between controlling inflation and maintaining economic growth will have significant implications for financial markets and investment decisions.

Given the evolving economic conditions and ongoing uncertainties, investors should closely monitor the Federal Reserve’s actions and statements for clues about future rate hikes and their impact on the broader financial landscape. Remaining informed and adaptable will be key to making well-informed investment choices in these dynamic times.

Jio and BlackRock Forge Powerful Partnership to Enter Booming Indian Asset Management Sector

In a recent breakthrough for the Indian financial landscape, Jio Financial Services Limited, following its successful demerger from Reliance Industries, has partnered with BlackRock, the world’s largest asset manager, to establish a pioneering asset management company in the country.

The newly formed entity, aptly named ‘Jio BlackRock,’ will witness equal ownership of 50% by both Jio Financial Services Limited and BlackRock. Both entities have committed an initial investment of $300 million to kickstart their venture, each contributing $150 million.

For BlackRock, this marks a noteworthy return to the Indian asset management industry after a hiatus of five years. In 2018, the firm had previously been associated with DSP mutual fund. As it handles a staggering 7% of the world’s financial assets, BlackRock’s re-entry holds promising implications for the growth and development of India’s asset management sector.

Key Takeaways

This joint collaboration is a major stride for the Indian asset management industry, poised to unleash a host of new products and services for investors in the country. The hope is that it will also lead to increased accessibility of asset management services for a wider range of individuals, thereby bolstering and deepening the Indian market.

Reliance Industries has earned a reputation for entering various business sectors and rapidly capturing significant market share by offering competitive and disruptive solutions. With this latest endeavor, the spotlight is now on Jio BlackRock, which aims to substantially impact an already fiercely competitive Indian asset management space dominated by several prominent players.

As this strategic partnership takes shape, industry observers eagerly await its progress, wondering whether Jio BlackRock can revolutionize the Indian asset management landscape and challenge the existing status quo.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.