Summary

IndusInd Bank started under the leadership of Mr. S.P. Hinduja to serve the NRI community. Today, IndusInd is the fifth largest private bank, creating substantial wealth for its shareholders over the long term. Let’s dig deeper into the company and see the potential of IndusInd Bank share price growth.

IndusInd Bank Overview

Induslnd Bank was incorporated 1994 as a commercial bank under the banking regulation Act of 1949. The then Finance Minister, Dr. Manmohan Singh, inaugurated the Bank in Mumbai, and the bank came out with its Initial Public Offering in November 1997. It is one of India’s leading financial services brands, serving approximately 35 million customers nationwide.

IndusInd provides banking solutions to individuals, large corporations, government entities, and PSUs. Its network includes 2606 branches/banking outlets and 2,875 ATMs across India, covering 1,38,000 villages. Additionally, the bank has representative offices in London, Dubai, and Abu Dhabi.

The Bank offers various products and services for individuals and corporates, including microfinance, personal loans, commercial vehicle loans, credit cards, and SME loans.

IndusInd Bank Journey

The following timeline illustrates the significant events and growth of the Bank since its establishment:

- 1994-1995: IndusInd Bank was founded by Mr. Srichand P. Hinduja. The first branch opened in Mumbai with an initial investment of USD 35 million and was inaugurated by Dr. Manmohan Singh.

- 1996-1997: The bank raised USD 30 million by issuing an Initial Public Offering in November 1997. It also successfully launched the concept of anywhere banking by expanding its network to 18 branches and 11 ATMs.

- 1997-2000: The bank expanded its range of services to include FAST Forex, Indus Home, Indus Estate, and Indus Auto, among others.

- 2001-2003: The bank introduced mobile banking and a suite of loan products, including housing, personal, and auto loans, to customers nationwide.

- 2003-2004: The bank merged with Ashok Leyland Finance Limited.

- 2004-2005: Bank partnered with Ashok Leyland for channel financing with a focus on expanding client relationships, and the bank opened its 100th branch in Dadar, Mumbai

- 2005-2006: Bank raised INR 170 crores through the issuance of Tier-II bonds and entered into an agreement with NCDEX as their clearing banker.

- 2008-2009: Bank launched new savings and current accounts to expand its consumer banking portfolio. It also created separate corporate, institutional, and commercial banking units to serve all corporate needs.

- 2009-2010: The bank established a microfinance unit and introduced new products for corporate clients, expanding its offerings to include loan syndication, microfinance, and warehouse finance.

- 2011-2012: Bank entered into a Memorandum of Understanding (MoU) with HDFC Bank for home loans.

- 2013-2014: The Bank got added to the NIFTY 50 benchmark index.

- 2015-2016: The bank acquired RBS’s Diamond & Jewelry Financing business in India and reached a milestone of 1,000 branches. Additionally, it achieved leadership in the Carbon Disclosure Project in the Indian corporate sector.

- 2016-2017: The bank ranked 12th among the most valuable Indian brands in 2016 by Millward Brown and WPP. Bank introduced a specialized approach to cater to industries and created business units in Healthcare, Education, Logistics, Pharma, MNC, and Financial Services.

- 2017-2018: The bank has announced a merger with Bharat Financial Inclusion Limited, one of the largest microfinance institutions in India.

- 2018-2019: The IndusInd bank launched a new product line that includes the Duo card, a debit-cum-credit card.

- 2022-2023: IndusInd Bank has partnered with MoEngage to offer its customers a unique digital experience. Additionally, the bank has announced a strategic partnership with the Asian Development Bank (ADB) to support and promote Supply Chain Finance solutions in India.

IndusInd Bank Management Profile

Mr. Sunil Mehta is the Chairman of the bank. He has 40 years of leadership experience in banking, finance, insurance, and investments with top global and domestic financial institutions, including Citibank, AIG, SBI, PNB, and YES Bank. He graduated from Shri Ram College of Commerce, Delhi University, and is a Fellow Member of the Institute of Chartered Accountants of India. He is also an alumnus of the Wharton School of Management at the University of Pennsylvania.

Mr. Sumant Kathpalia is the Managing Director and CEO of the bank. Before joining IndusInd Bank, Mr. Sumant gained years of valuable experience as a career banker at Citibank, Bank of America, and ABN AMRO. He joined IndusInd Bank as part of the management team 15 years ago and has been instrumental in turning the bank around. He holds a bachelor’s degree in B Com (Hons.) from Hindu College, Delhi University, and is also a qualified Chartered Accountant.

Mr. Gobind Jain is the Chief Financial Officer of the Bank. Mr. Jain worked as Joint President of Group Accounts and MIS at Kotak Mahindra Bank (KMB) for over 15 years. Mr. Jain has an impressive accounting and financial management background, having worked with esteemed institutions such as ICICI Bank, Bank of America, Reserve Bank of India, and Bank Internasional Indonesia. He is a qualified Chartered Accountant, Financial Analyst, Financial Risk Manager, and CPA Australia.

Mr. Zubin Mody is the Chief Human Resources Officer of the Bank. Currently, he leads the HR Function at IndusInd Bank; he joined the bank in December 2005. Before this, he was heading the HR function at ICICI Lombard. He graduated with honors in Physics from Mumbai University and holds a Management Degree in Personnel Management & Human Resources from XLRI, Jamshedpur (1993).

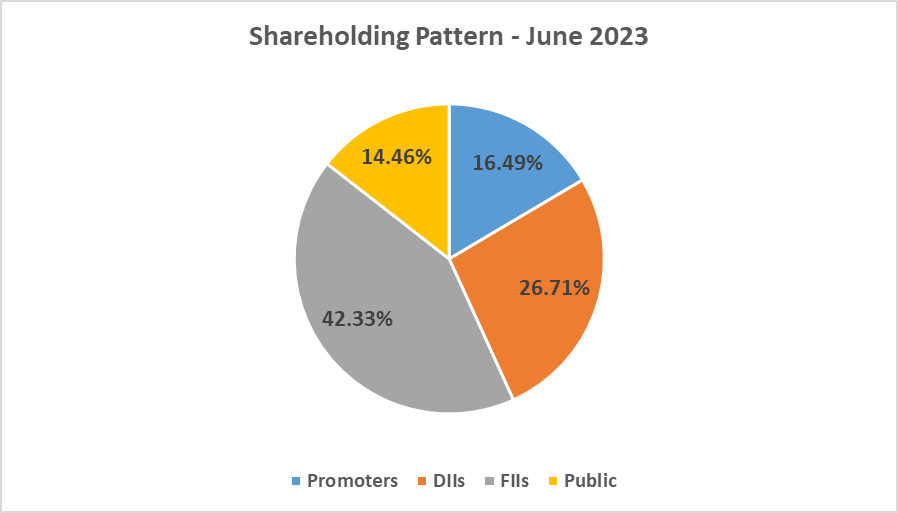

IndusInd Bank Shareholding Pattern

IndusInd Bank Business Segments

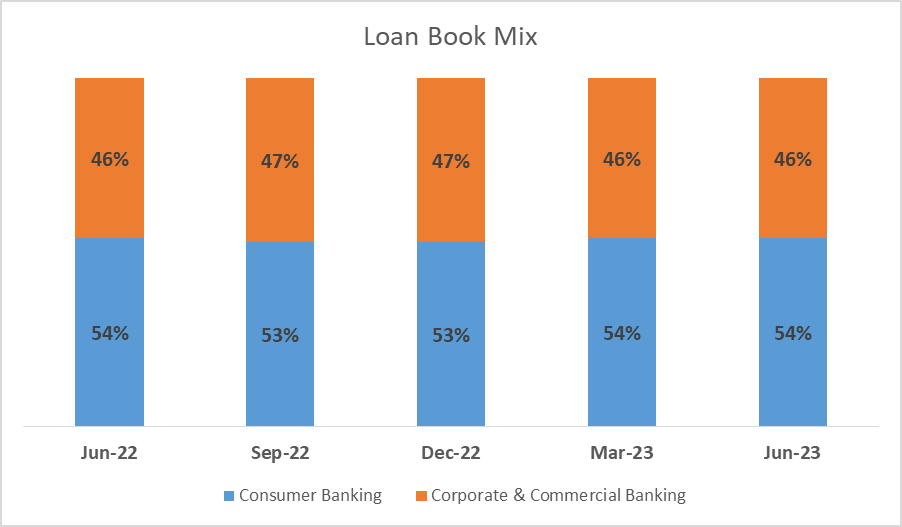

The IndusInd bank has a diversified loan book across Consumer and Corporate Products. The consumer loan book is ~54% of the total as of Jun 2023 and comprises Vehicle Finance, Non-Vehicle Finance, and Microfinance segments.

The corporate loan book is 46% of the total and comprises large and mid-size corporates. Within the corporate book, the focus is on granular, high-rated customers.

| Consumer Banking | June-23 | % of the Loan Book |

| Vehicle Finance | 78,332 Cr | 26% |

| Non-Vehicle Finance | 51,567 Cr | 17% |

| Microfinance | 31,981 Cr | 11% |

| Total Advances | 1,61,880 Cr | 54% |

| Corporate Banking | June-23 | % of the Loan Bank |

| Large Corporates | 77,065 Cr | 25% |

| Mid Corporates | 47,624 Cr | 16% |

| Small Corporates | 14,748 Cr | 5% |

| Total Advances | 1,39,437 Cr | 46% |

IndusInd Bank Financials

- Core Operating Profit and Net Profit

The company has reported an Operating Income of INR 25,758.49 Cr during the Financial Year ended March 31, 2023, compared to INR 22,335.04 Cr during the Financial Year ended March 31, 2022.

The company has posted a net profit of INR 7389.72 Cr for the Financial Year ended March 31, 2023, as against a net profit of INR 4611.12 Cr for the Financial Year ended March 31, 2022.

| In INR Cr. | FY19 | FY20 | FY21 | FY22 | FY23 |

| Interest Income | 22,261.15 | 28,782.83 | 28,999.80 | 30,822.44 | 36,367.92 |

| Interest Expense | 13,414.97 | 16,724.09 | 15,471.91 | 15,821.60 | 18,775.80 |

| Net Interest Income | 8,846.18 | 12,058.74 | 13,527.89 | 15,000.84 | 17,592.12 |

| Non-Interest Income | 5,646.72 | 6,951.31 | 6,558.61 | 7,334.20 | 8,166.37 |

| Revenue | 14,492.90 | 19,010.05 | 20,086.50 | 22,335.04 | 25,758.49 |

| Profit After Tax | 3,301.10 | 4,417.91 | 2,836.39 | 4,611.12 | 7,389.72 |

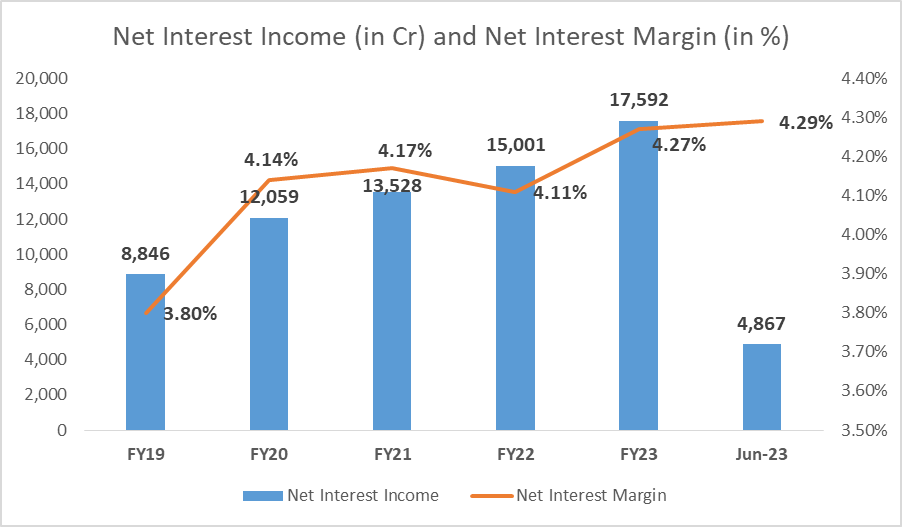

- Net Interest Income & Net Interest Margin

Net Interest Income (NII) is the difference between the interest earned on a bank’s assets (such as loans and investments) and the interest paid on its liabilities (such as deposits and borrowings).

Net Interest Margin (NIM) is calculated by dividing the NII by the average interest-earning assets.

Net Interest Income for the quarter of June 30, 2023, at INR 4,867 Cr, grew by 18% YoY and 4% QoQ. Net Interest Margin for Q1 of FY24 stood at 4.29% against 4.21% for Q1 of FY23 and 4.28% for Q4 of FY23. The bank has been increasing its NIM% consistently by focusing on high-yielding segments like MFI and vehicle finance.

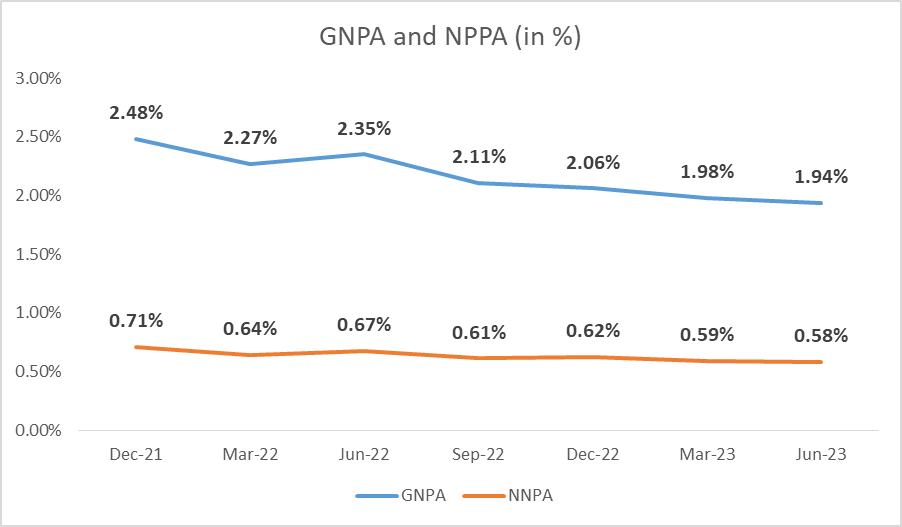

- Asset Quality (GNPA & NNPA)

NPA stands for Non-Performing Asset. It refers to a loan or an advance where the borrower has not paid the interest or the principal amount for a specified period, usually for 90 days or more.

Gross NPA refers to the total value of a bank’s non-performing assets. Net NPA, on the other hand, is the value of NPA after reducing the provisions made by the bank to cover the losses that may arise from such non-performing assets.

IndusInd’s reported asset quality metrics for corporate and retail segments have been range bound, with overall GNPA between 1.0% – 1.2% from March 31, 2014, to December 31, 2018. Since fiscal 2019, due to slippage of some corporate accounts and COVID-19-related stress in the past fiscal, the gross NPA has increased steadily to 2.9% as of June 30, 2021, which has improved to 1.94% as of June 30, 2023. The GNPA of the Bank is one of the lowest in the industry, with adequate provision coverage of 71% and a provision buffer of INR 1700 Cr, with total loan-related provision standing at 2.4% as of June 2023.

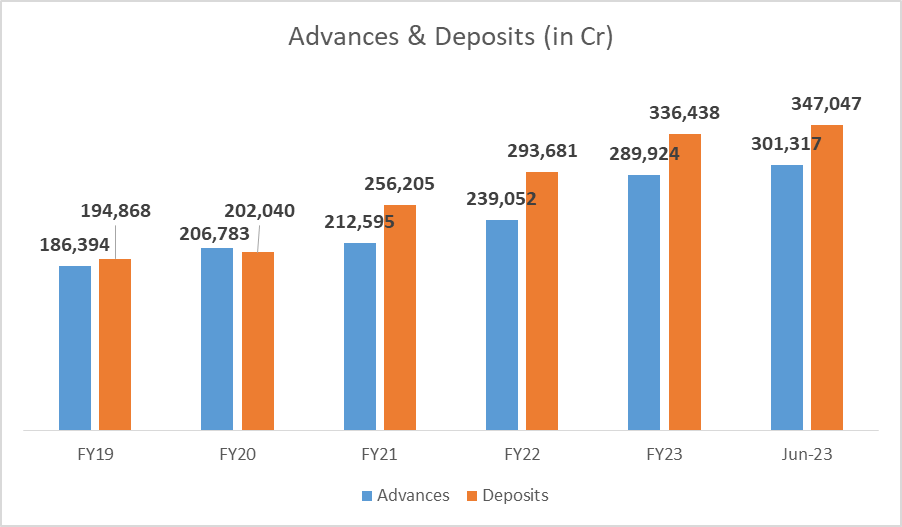

- Advances & Deposits

An advance refers to a loan or credit extended by a bank to its customers. Banks offer various advances such as personal, business, home, education, vehicle, and credit card loans. Advances as of June 30, 2023, were INR 3,01,317 Cr as against INR 2,47,960 Cr, an increase of 22% compared to June 30, 2022.

Deposits are a critical source of funding for banks, and they use these funds to provide loans and advances to customers.

Deposits as on June 30, 2023, were INR 3,47,047 Cr as against INR 3,02,719 Cr, an increase of 15% over June 30, 2022. Deposits growth is driven by granular retail deposits. The bank has a stable, low-cost deposit base, another reason contributing to the high profitability of the bank.

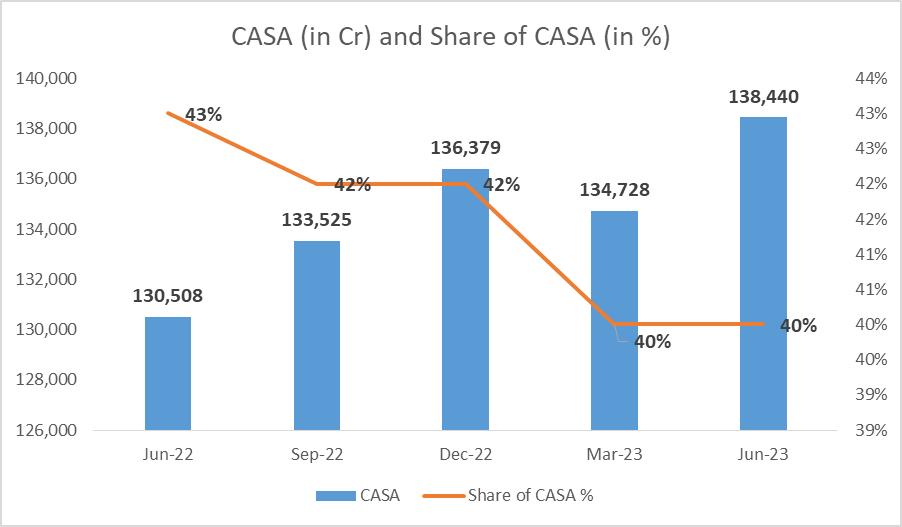

The bank’s share of CASA (Current Account & Savings Account) deposits ratio is ~40% as of Q1FY24 and has reduced slightly from 43% in Q1FY23. Bank continues to focus on this journey of growing better CASA deposits which will help reduce the overall cost of deposits and manage liquidity.

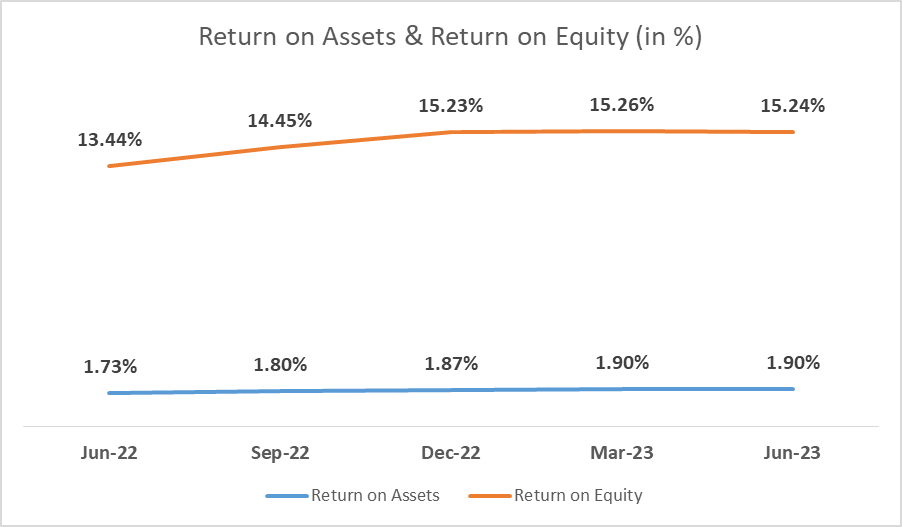

- Improving Return ratios (ROA & ROE)

IndusInd Bank has been improving its RoA (A higher RoA suggests that a bank is more efficient in generating profits from its assets) & ROE (the higher the ROE, the more efficient a company’s management is at generating income and growth from its equity financing) over the last few quarters as can be seen in the chart below.

IndusInd Bank’s ROA currently stands around 1.9%, supported by healthy net Interest margins with some exposure to high-yield segments such as vehicle finance and MFI.

IndusInd Bank Share price history

IndusInd Bank launched its IPO in Jan 1998 at ~INR 45 per share, and today, the stock trades at INR 1372 per share (as of 18th August).

Like all private banks in India, IndusInd, too, has created significant wealth for its shareholders. The stock has delivered a 10-year CAGR of ~14% (from 18th August 2003 to 18th August 2023). More recently, the stock has given a 3-year CAGR of ~39% (from 18th August 2010 to 18th August 2023).

IndusInd Bank Share Price Target Growth Potential

The management has introduced planning cycle – 6 (FY23–26), wherein they have guided for 18-23% YoY credit growth, mainly driven by retail (55-60% proportion) and PPOP margins (pre-provision operating margins) to be 5.25-5.75% range.

The focus will be on new business verticals (home loans) to aid business growth and gain market share. An uptick in NIMs is expected, led by a higher share of retail loans, including the micro-finance segment.

The company is investing in ramping up phygital distribution channels, which will keep the Cost to Income ratio elevated for a couple of quarters. However, improvement in credit cost will boost earnings growth and return ratio.

Key Risks:

- An unanticipated rise in defaults to erode margins and increase credit cost

Any unexpected rise in delinquencies, particularly in the vehicle and MFI segments, could increase the stress on assets and strain its profitability. Higher-than-anticipated failure could result in elevated interest income reversals, lower credit yield, and margin compression.

- Lower credit growth in FY24 and FY25

Any further weakness in credit quality and lower credit demand could impact interest income and fee revenue recognition, thereby impacting profitability.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Who is the promoter of IndusInd Bank?

IndusInd International Holdings Ltd, an entity belonging to promoters Hinduja Group, has a 12.57% stake in the lender. IndusInd Ltd has a 3.93% stake per the company’s latest shareholding pattern available with the Indian stock exchange BSE.

What is the 52 Week High and Low of IndusInd Bank?

52 Week high of IndusInd Bank is INR 1446 per share, and 52 Week low of IndusInd Bank is INR 990 per share.

What is the face value of IndusInd bank share?

The face value of IndusInd Bank share price is INR 10 per share.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.