Introduction

India is known as the “Pharmacy of the World” because of its ability to produce high-quality, low-cost generic and specialty drugs. The country’s pharmaceutical industry ranks the third largest globally in production volume and 13th by value. India exports pharmaceutical products to more than 200 countries, underlining its global footprint in the industry.

Many companies have helped India to earn this coveted title. Sun Pharma, Dr. Reddy’s, Cipla, Lupin, Mankind Pharma, Biocon, Torrent Pharma, and many others started from modest beginnings. However, their founders’ grit and determination helped them become industry leaders.

This article will explain more about Lupin Limited, the Mumbai-based pharmaceutical company known for its anti-TB and diabetics drugs.

Also Read: What is Paid Up Capital?

History of Lupin Limited

Every significant achievement we see today has its origins in humble beginnings. Lupin was founded by Dr. Desh Bandhu Gupta (DBG) in 1968 with ₹5,000 borrowed from his wife. Before starting Lupin, DBG had no experience in the pharma field and was a professor of science at BITS, Pilani.

DBG named the company after the Lupin flower, which grows and sustains in harsh conditions and nourishes the soil. This nature’s selfless act inspired DBG to start in the pharmaceutical sector and address unmet medical needs.

The company commenced operations as a manufacturer of vitamins. It supplied iron and folic acid tablets for the Government of India’s flagship programs aimed at improving the health of mothers and children. Later, DBG’s strong desire to reduce the impact of TB in India led to Lupin’s foray into manufacturing anti-TB drugs, the decision that accelerated the company’s growth path.

Over the years, through a series of organic and inorganic initiatives, Lupin has grown from a two-employee company to an employee footprint of more than 21,000 heads that spans 11 countries across six continents.

Today, Lupin is the 13th largest generic company in the world, with annual sales of $2 billion in FY23. Region-wise, Lupin is the third-largest in the US by prescriptions, sixth-largest in the Indian pharma market, fourth-largest in Australia, and eighth-largest in South Africa.

Build your well-diversified portfolio

Create wealth now!

Build your well-diversified portfolio

Create wealth now!

Lupin Business Overview

Lupin has 15 manufacturing sites and seven R&D sites across India, the US, the Netherlands, Brazil, and Mexico. The products and offerings of the company include:

- Key Therapeutic Areas: This includes multi-drug resistant TB, diabetes, cardiology, respiratory, central nervous system disorders, ophthalmology, and others.

- Generics: Lupin is a strong player in the generics market, with a product footprint in more than 100 countries. In the US, 70% of its generic portfolio ranks amongst the top three in their respective categories, and in India, several Lupin generic brands are ranked in the top 300 brands.

- Specialty Drugs: The company’s specialty business divisions are located in the US and Europe, where it has carved a niche in the women’s health and neurology segments.

- Over-the-counter (OTC): Lupin’s OTC portfolio includes products from bowel regulators, feminine hygiene, health supplements, and personal sanitization products.

- Active Pharmaceutical Ingredients (APIs): Lupin is the leading API manufacturer supplying to more than 70 countries. The company is among the top API manufacturers of antiretrovirals, antimalarials, and first-line TB treatment drugs.

- Biosimilars: Similar generic drugs made from chemicals; biosimilar products are made from biological (natural) sources. Lupin introduced this segment in its product line in 2008 and produces high-quality biologics that are accessible and affordable globally. Its oncology biosimilars enjoy a high market share in India.

As reported under IND AS 115, the group’s operations are limited primarily to one segment: “pharmaceuticals and related products.”

Key Management Personnel

- Mrs. Manju D Gupta is the Chairman (Non-Executive) of the company and has been a member of the Board since its incorporation.

- Ms. Vinita Gupta, the company’s Chief Executive Officer, joined the company in 1997. She has played an instrumental role in shaping the company’s growth strategy. Ms. Gupta is a pharmacy graduate from the University of Mumbai and holds an MBA from the Kellogg School of Management at Northwestern University, Illinois.

- Mr. Nilesh D Gupta is the company’s Managing Director and joined Lupin in 2002. He is responsible for the company’s research, supply chain, manufacturing, quality, and regulatory operations. Mr. Nilesh is a Chemical Engineer from the University Department of Chemical Technology (UDCT), Mumbai, and holds an MBA from The Wharton School, University of Pennsylvania.

- Mr. Ramesh Swaminathan is the company’s Executive Director, Global CFO, and Head of Corporate Affairs. On March 26, 2000, he began working for the company. Mr. Swaminathan is a CA, CS, ICWAI, and Chartered Management Accountant, UK. He has also completed the Senior Management Program at INSEAD in France and is a Lord Chevening Scholar in the UK.

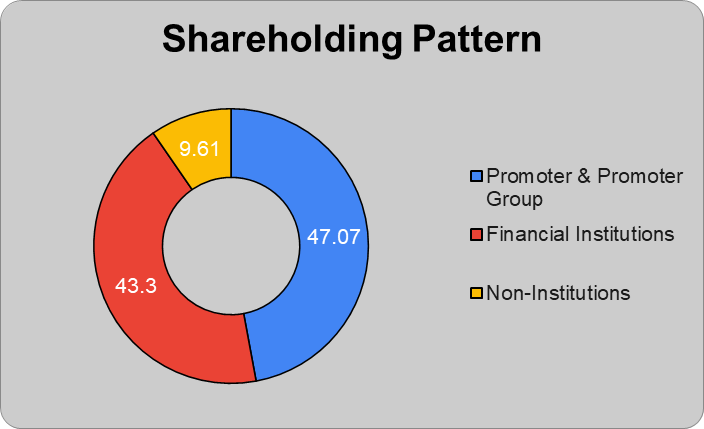

Lupin Shareholding Pattern

Lupin Financials

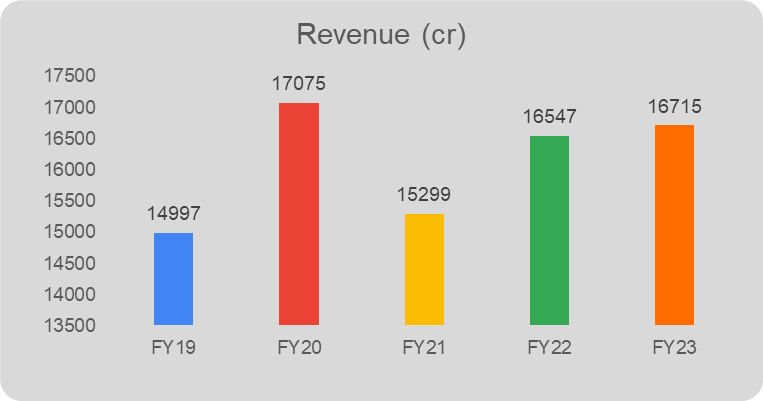

Revenue

In FY23, Lupin reported a slight 1% rise in total revenue to ₹16,715 crores from ₹16,547 crores. And, in Q1FY24, the total revenue was ₹4,814 crores, up by 28.6% compared to ₹3,743.8 crores in Q1FY23.

Geographical Distribution of Revenue

| FY21 (in ₹ cr.) | FY22 (in ₹ cr.) | FY23 (in ₹ cr.) | |

| India | 5,783.3 | 6,372.9 | 6,434.9 |

| United States of America | 5,322.2 | 5,524.1 | 5,158.3 |

| Others | 3,821.4 | 4,295.7 | 4,676.7 |

In FY23, the company’s EBITDA decreased by 18.9% to ₹1,871.5 crores from ₹2,307.3 crores in FY22. The EBITDA margin in FY23 is 11.5%, down from 14.2% in FY22. And, in Q1FY24, EBITDA was reported at ₹879.1 crores, up by 269% compared to ₹237.9 crores in Q1FY23.

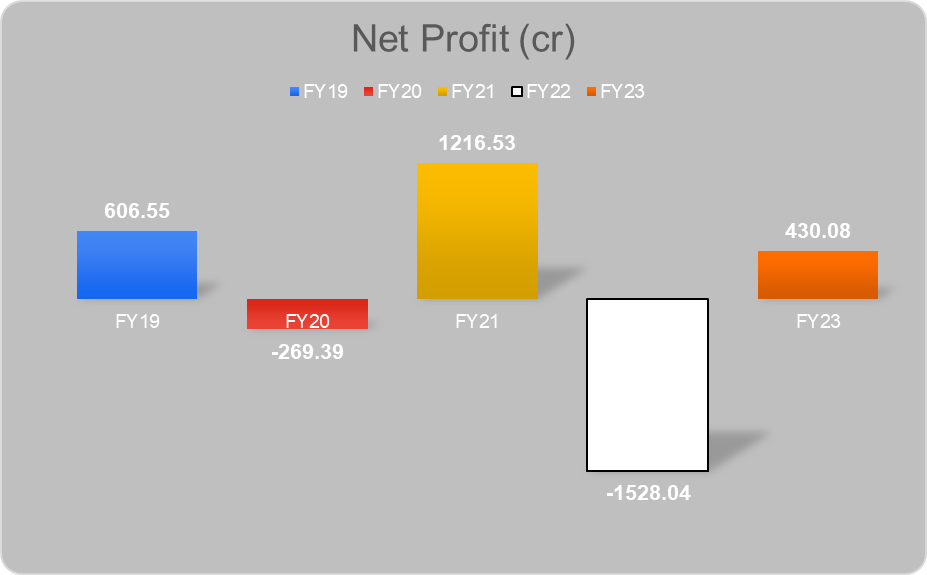

Net Profit

In FY23, Lupin reported a net profit of ₹430 crores, compared to a loss of ₹1,528 crores in FY22. And, in Q1FY24, the company reported a net profit of ₹452.3 crores, over a loss of ₹89.1 crores in Q1 of last financial year.

Key Financial Metrics

Current Ratio: At the end of FY23, the company’s current ratio was 1.34 times, which declined from 1.51 times at the end of FY22.

Debt-to-equity Ratio: The company’s debt-to-equity ratio as of 31st March 2023 is 0.34 times.

Debt Service Coverage Ratio: The debt service coverage ratio at the end of FY23 improved significantly to 3.82 times from 0.20 at the end of FY22.

Return on Equity (ROE): The ROE at the end of FY23 grew to 0.03% from -0.12% at the end of FY22.

Return on Capital Employed (ROCE): At the end of FY23, the ROCE of the company was 0.08%, which increased marginally from 0.09% at the end of FY22.

Lupin Share Price History

Lupin has been listed on the stock market since June 20, 1993, when it came out with its public issue.

As one of the country’s leading pharma stocks, its stock has always been the focus of investors and traders. However, over the long term, the stock has underperformed the market. As of 11th September 2023, Lupin share price has given a CAGR return of 3% and 5% in the last five and three years, respectively.

Lupin share price has increased from ₹635 on 19th September 2022 to a 52-week high level of ₹1,148 on 6th September 2023.

The company has a consistent track record of paying dividends to its shareholders. In the last three years, the company paid ₹4 in 2023, ₹4 in 2022, and ₹6.5 in 2021 as dividends.

Lupin did a bonus issue once on 11th August 2006 at a 1:1 ratio and a stock split on 27th August 2010 at a 10:2 ratio. This means that 100 shares allotted in the IPO have now turned into 1000 stocks with a face value of ₹2.

The company has a market capitalization of ₹51,279 crores as of 11th September 2023.

Fundamental Analysis of Lupin

Revenue and Profitability: The company’s revenue has increased by 2.19% over the last five years. However, in terms of profitability, the company made a net profit in only three of the previous five years. The company has been EBITDA positive during these years.

The loss of ₹1,528 crores in FY22 was due to deferred tax payout, a spike in input cost due to supply-chain constraints, forex losses, and a one-time impairment charge.

Growth Drivers

Lupin has a diverse portfolio of products and services in the generics, specialty, biosimilars, APIs, and OTC drugs. In FY23, the company’s India sales were 37%, US sales were 32%, and Emerging Market sales were 10% of total sales, and it continues to grow rapidly with new product launches.

The company has six R&D units and spent ₹1,280 crores in R&D expenditure in FY23, which was 7.69%. It has a total of 911 active patents.

Lupin has further planned to expand its complex generics and biosimilar portfolio and aims to strengthen its position with new launches in the regulated market by FY28. 70% of the U.S. FDA filing in FY24 is focused on complex dosage forms.

Risk & Challenges

Over the years, Lupin has strengthened its position in the market and brand equity. The company is world-leader in anti-TB drugs, the third-largest in the US in prescription drugs, and the sixth-largest in the Indian pharmacy market.

Lupin faces various risks and challenges in its business environment, such as regulatory uncertainties, patent expiries, and competition from other players in the market. The company’s is highly dependent on the US market, from where it earns one-third of its revenue. Increased cost pressure in the US market resulted in losses in FY22.

Since the company operates mainly in the generics segment, pricing pressure is constant from other players in the market, government, and other stakeholders. For example, the sales of the company’s flagship product, Glumetza, declined by 28% in 2021 due to increased competition and price erosion.

Similarly, delay in launch or securing approvals for new products could be a considerable risk as the company loses the price premium advantage.

Key Con-call Takeaways Q1FY24

- Added over 1,300 new sales forces in Q3 and Q4 of FY23 in India, the benefit of which is likely to start yielding results from Q2FY24. It is also likely to increase expenses.

- Increased R&D spending on new platforms. Over 50% of the R&D spend goes towards biosimilars, injectables, and complex generics.

- India’s growth may be slightly impacted in the short term due to the patent expiry of a key drug, Ondero, in August 2023.

- US business continues to see margin expansion for the fourth straight quarter.

- Net debt of the company reduced to ₹1,300 crores from ₹2,500 crore in Q1FY24.

- The company has maintained a guidance of 18% or higher exit EBITDA margin. And full-year margin guidance of +15% in FY24 with double-digit revenue growth.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When was Lupin established?

Lupin was established in 1968 on the day of Gudi Padwa by Dr. Desh Bandhu Gupta, popularly known as DBG in the pharma circle. Before founding Lupin, he was a professor of science at BITS, Pilani.

How has Lupin share price performed in the last five years?

As of 11th August 2023, Lupin share price has given a CAGR return of 3% in the last five years, underperforming the broader market and index like Nifty50.

What does Lupin company do?

Lupin is a global pharmaceutical company offering various products in the generics, specialty drugs, APIs, biosimilars, over-the-counter drugs, etc. It is the sixth-largest pharma company by sales in India and third-largest by prescription sales in the US.

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 18

No votes so far! Be the first to rate this post.