Introduction

As the global economic landscape continues to evolve, India appears poised to make a resounding resurgence on the MSCI EM Index. With the country’s financial markets showing signs of a remarkable rally, India has the potential to elevate to the number 2 spot on the Index.

Understanding the MSCI EM Index

The MSCI EM Index is an essential tool used to measure the financial performance of companies in fast-growing economies across the world. This index tracks mid-cap and large-cap stocks in 24 countries, providing investors with valuable insights into emerging markets.

The Indian Market Rally

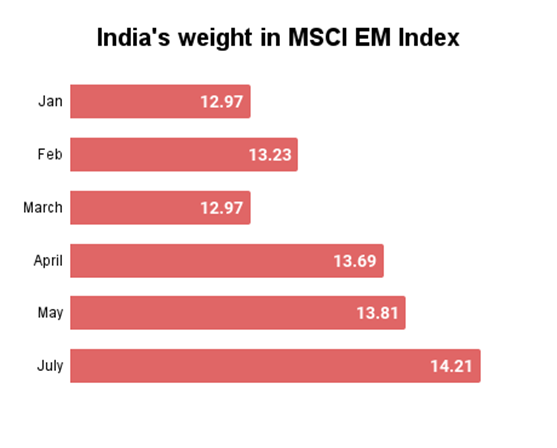

Recently, the Indian markets have witnessed a remarkable rally, bouncing back from the year’s low in March. The weights of Indian stocks in the MSCI Index have risen from 12.97% in March to 14.21% in July, showcasing the resilience and potential of the Indian economy.

India’s Rise Up The MSCI EM Index

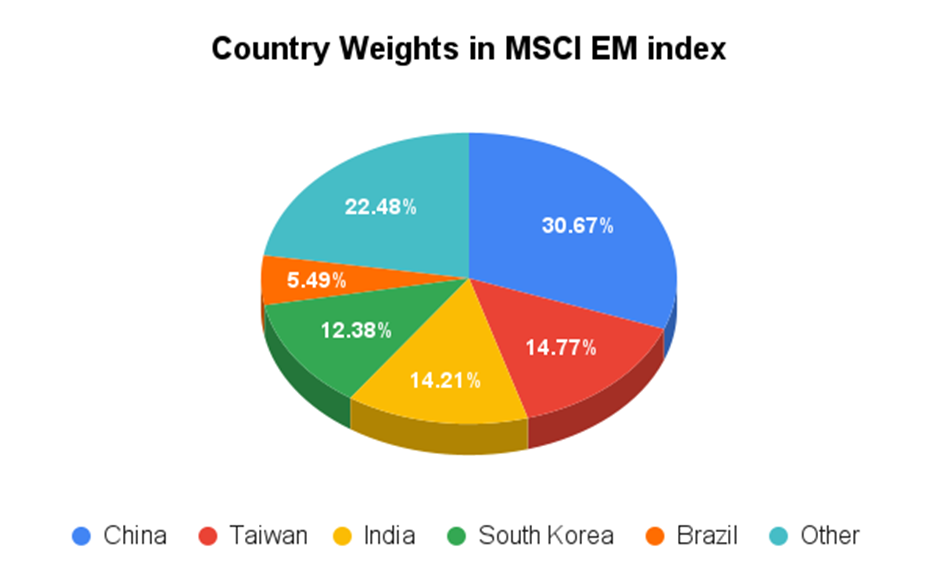

MSCI India has achieved a remarkable 9% rally this year, outperforming the 3% increase by MSCI EM and the mere 0.5% growth by MSCI China. Based on the current trend, India is on the verge of overtaking Taiwan, which currently holds the 2nd spot on the MSCI Index. While Taiwan’s weight on the index stands at 14.77%, India closely trails behind with 14.21%. At the top of the index, China commands the 1st spot with a weight of 30.67%.

Morgan Stanley’s Rating Upgrade

Adding to the optimism, global investment bank Morgan Stanley recently upgraded India’s rating to overweight while downgrading that of China and Taiwan to equal weight. This significant development holds importance as passive funds structure their investments in emerging markets based on index weights. With India’s position and weight improving, it will likely see increased fund inflows, contributing further to its growth trajectory.

Key Takeaways

As India prepares to retake the 2nd spot on the MSCI Emerging Markets Index, investors are closely watching the developments in the country’s financial markets. The impressive rally and positive rating upgrade by a renowned investment bank signal potential opportunities for investors looking to capitalize on India’s growth story.

Conclusion

India’s resurgence on the MSCI EM Index is a testament to the country’s economic resilience and potential for growth. The rally in the Indian markets and the rating upgrade by Morgan Stanley have brought renewed optimism for investors seeking exposure to emerging markets. As the nation’s position strengthens on the MSCI EM Index, India will likely attract increased fund inflows, further propelling its economic growth.

FAQs

What is the MSCI Emerging Markets Index?

The MSCI EM Index is a financial performance measurement tool that tracks companies in fast-growing economies worldwide.

How has India’s position changed on the MSCI Index?

India’s position on the MSCI Index has improved, with the weights of Indian stocks rising from 12.97% to 14.21%.

How does India compare to other countries on the index?

India is set to overtake Taiwan, which currently holds the 2nd spot on the MSCI Index, while China remains at the top.

What does Morgan Stanley’s rating upgrade mean for India?

Morgan Stanley’s rating upgrade to overweight for India signifies increased growth potential and the possibility of attracting more investment funds.

How can investors benefit from India’s resurgence?

Investors can capitalize on India’s growth story by considering investments in the country’s financial markets, displaying remarkable resilience and potential.

Retail Auto Sales Surge by 10% in July

Introduction

The Federation of Automobile Dealers Associations (FADA), the apex national body of the Automobile Retail Industry in India, regularly releases Vehicle Retail Data, providing valuable insights into the trends shaping the automobile industry. The latest report for July showcased a remarkable 10% growth in Retail Auto sales, continuing the positive momentum from the previous month.

Impressive Performance Across Categories

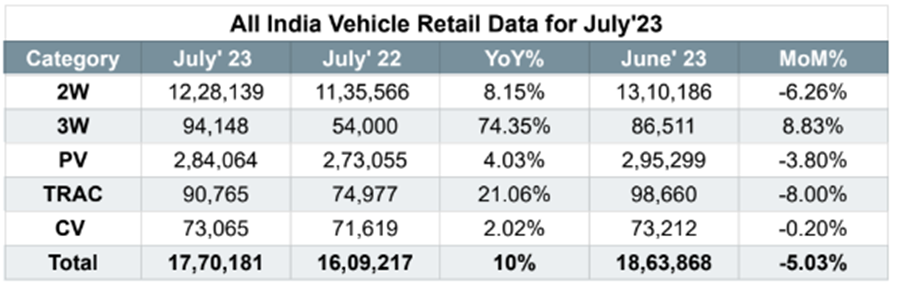

The month of July witnessed a surge in auto sales across all categories, including two-wheelers (2W), three-wheelers (3W), Passenger Vehicles (PV), Tractors, and Commercial Vehicles. In total, there were 1.77 million sales, demonstrating the industry’s resilience and strength.

Three-Wheelers Reach All-Time High

Notably, three-wheelers stood out with an all-time high in sales, recording an impressive 74% Year-on-Year (YOY) growth. This surge indicates a growing demand for three-wheelers in the market.

Month-on-Month Trend

Despite the consistent Year-on-Year growth, there was a slight dip in the month-on-month trend, with a 5% decline observed in July. This decrease suggests some short-term challenges that the industry may be facing.

Key Takeaways

Retail Auto sales serve as a vital economic indicator, and the positive trends seen in July are encouraging. While there are certain challenges, such as the rising preference for Electric Vehicles (EVs) due to high fuel prices, two-wheelers and Passenger Vehicles have shown resilience with increased demand.

The shift towards EVs has led to an increase in inventory days for Passenger Vehicles, rising from 45-49 days to 50-55 days. This means that dealers are now storing vehicles for longer periods before being able to sell them, which may impact their cash flow.

However, with the festive season on the horizon, there is hope for further growth in retail auto sales. The festive period traditionally sees higher consumer spending, and FADA remains cautiously optimistic about the industry’s prospects during this time.

Conclusion

The automobile industry in India has experienced a notable 10% growth in retail auto sales during July, indicating positive momentum in the market. Despite some challenges, certain segments like three-wheelers have achieved impressive milestones.

The shift towards Electric Vehicles poses a new landscape for the industry, and dealers are adjusting their inventory management accordingly. As the festive season approaches, there is anticipation for increased consumer activity, providing a potential boost to retail auto sales.

While challenges persist, the industry’s resilience and adaptability are expected to drive continued growth in the coming months. FADA’s insights and regular updates will play a crucial role in keeping stakeholders informed about the evolving dynamics of the automobile retail industry in India.

FAQs

What is FADA?

FADA stands for the Federation of Automobile Dealers Associations, which is the apex national body of the Automobile Retail Industry in India.

How much did retail auto sales grow in July?

Retail auto sales experienced a remarkable 10% growth in July compared to the previous year.

Which vehicle categories witnessed positive growth in July?

All categories, including two-wheelers, three-wheelers, Passenger Vehicles, Tractors, and Commercial Vehicles, witnessed positive growth in July.

What was the growth rate of three-wheelers in July?

Three-wheelers recorded an all-time high sales growth of 74% Year-on-Year in July.

Why did the month-on-month trend show a decline despite Year-on-Year growth?

While the Year-on-Year growth was positive, the month-on-month trend observed a 5% decline, indicating short-term challenges in the industry.

How has the shift towards Electric Vehicles impacted the industry?

The rising preference for Electric Vehicles due to high fuel prices has led to increased inventory days for Passenger Vehicles, impacting dealers’ cash flow.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.