Introduction

If you search for the highest dividend-paying companies or dividend aristocrats, Vedanta Ltd. is sure to be at the top of your list. This metals and mining conglomerate, led by Billionaire Anil Agarwal, has managed to remain in the limelight for all types of reasons ranging from paying large dividends to making large acquisitions.

Recently, the company was in the news for trying to set up a semiconductor manufacturing business in India in partnership with Foxconn. In this article, we try to assess the current situation of Vedanta Ltd. and the impact on Vedanta Ltd share price.

Vedanta Ltd Overview

Vedanta Limited (VEDL), a subsidiary of Vedanta Resources Limited, is one of the world’s foremost natural resources conglomerates, with primary operations in zinc-lead-silver, iron ore, steel, copper, aluminum, power, nickel, and oil and gas.

As the market leader in most of these segments, Vedanta serves domestic and international demand for primary materials, thereby enabling resource sufficiency at scale. VEDL has a presence across India, UAE, East Asia, South Africa, Namibia, Liberia, Australia, and Ireland.

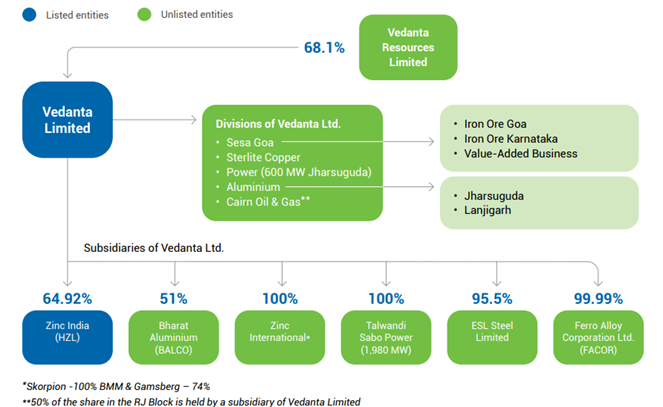

Following is a snapshot of the diversified structure of Vedanta and its shareholding in different subsidiary entities:

Vedanta Ltd Journey

Vedanta Limited has had a long and illustrious history. Here are some of the critical milestones in the company’s journey:

- 2001: Vedanta Limited acquired a 51% stake in BALCO (Bharat Aluminum Company Limited)

- 2002: Vedanta Limited acquired a 26% interest in Hindustan Zinc Limited

- 2003: Vedanta Limited became the first Indian company to be listed on LSE (London Stock Exchange)

- 2004: The Company acquired a 51% stake in Konkola Copper Mines

- 2006: Commissioned 50,000 TPA (tonnes per annum) lead smelter in India

- 2007: Listed on the NYSE (New York Stock Exchange) as the largest IPO by a non-US Company

- 2007: Acquired 51% stake in Sesa Goa Ltd

- 2010: Acquired Zinc assets in Namibia, Ireland, and South Africa, including Gamsberg, the largest undeveloped Zinc deposit in the world

- 2011: Completed acquisition of controlling stake in Cairn India, marking entry into Oil & Gas

- 2013: Sesa Goa is merged with Sterlite as a part of group consolidation

- 2013: Sesa Sterlite Ltd changed its name to Vedanta Ltd

- 2013: The merger of Vedanta Ltd and Cairn India has been approved by the shareholders of both companies

- 2017: Vedanta Ltd wholly owned subsidiary, Cairn India Holding Ltd, acquired a 51.63% stake in AvanStrate Inc. (ASI), a Japanese manufacturer of LCD glass substrate

- 2018: Acquired Electrosteel Steels Ltd under Insolvency and Bankruptcy Code (IBC)

- 2019: Acquired the Sindhudurg unit of Global Coke Ltd, which was under liquidation in the Bankruptcy Code (IBC)

- 2020: Acquired Ferro Alloys Corporation Ltd (FACOR) under the Corporate Insolvency Resolution Process (CIRP) of the Bankruptcy Code

- 2021: Acquired Bhachau and Khambhalia coke manufacturing units of Gujrat NRE Coke Ltd, which was under liquidation under the Bankruptcy code

- 2021: Acquired Nicomet, becoming the only Nickel producer in India

Vedanta Management Profile

Mr. Anil Agarwal is the Promoter of Vedanta Limited. He was appointed to the Board in May 2003 and has been the Executive Chairman of Vedanta Resource since March 2005. He became Non-Executive Chairman of Vedanta Limited in April 2020. He has over four decades of entrepreneurial and mining experience. Under his leadership, Vedanta has grown from an Indian domestic miner into a global natural resources group with entities listed in several markets. He is also a director of Sterlite Technologies Ltd, Conclave PTC Ltd, and Anil Agarwal Foundation.

Mr. Sunil Duggal is Vedanta Limited’s Chief Executive Officer (CEO). He was appointed to this position in August 2020. He has been the Whole-time Director of HZL (Hindustan Zinc Ltd.) since October 2015. He also led the Base Metal Group comprising Zinc, copper, and Iron ore businesses.

Mrs. Sonal Shrivastava is the Chief Financial Officer (CFO) of Vedanta Limited. She was appointed to this position in May 2023. As CFO, Sonal spearheads the group’s financial strategy and is responsible for accounting, tax, treasury, investor relations, financial planning, and analytics while driving digitalization and profitability. She holds a Bachelor’s degree in Chemical Engineering from BIT, Sindri, and a Master’s in Business administration from the Jamnalal Bajaj Institute of Management Studies.

Mrs. Madhu Srivastava is Vedanta Limited’s Chief Human Resources Officer (CHRO). She was appointed to this position in December 2018. She has an overall experience of 20 years across HR and Sales, Marketing, and Operations, spanning the FMCG, telecom, ITES, BFSI, and natural resources industries. She has completed her PGDM in marketing and sales from IIM, Ahmedabad.

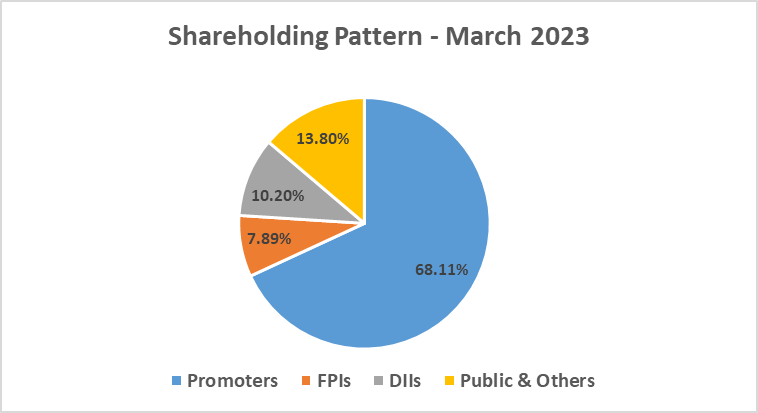

Vedanta Shareholding Pattern

Vedanta Ltd Company Analysis

Vedanta is a diversified natural resources powerhouse. It is into the following business segments:

Aluminum: VEDL has the largest aluminum smelter in India with a capacity of ~2.3mt and holds a market share of 41% among primary aluminum producers in India. It is gradually strengthening its market position in the aluminum sector by increasing its share of value-added products (VAP). The current share of VAP is around 38%, which is expected to increase to 100% by FY25-26.

Zinc India: HZL, a 64.92% subsidiary of VEDL, is India’s largest integrated zinc producer and one of the lowest-cost producers of zinc globally. HZL commands a 77% market share in the primary zinc market in India and operates the world’s largest UG mine at Rampura Agucha. HZL has a strong focus on VAP, and the share of VAP is expected to increase to 23% in FY24 from 16% in FY23.

Zinc International: Zinc International has a strong presence in Africa with a total R&R (Reserves & Resources) of 659mt, and at the current rate, the mines’ lives are expected to be over 20 years. It is setting up a Zn concentrator plant and a smelter, which would take the MIC capacity to 600kt from 300kt.

Oil and Gas (Cairn India): Cairn India is India’s largest private-sector oil and gas producer, catering to 25% of India’s crude oil production. Cairn India drilled India’s first shale well in Rajasthan and is evaluating further opportunities to drill ‘low to medium’ or ‘medium to high’ reward exploration wells, further augmenting the company’s resources.

Power: VEDL is one of India’s largest private sector power producers and has a mega 1980mw power plant at Talwandi Sabo. It has a long-term PPA with state distribution companies in Punjab, Tamil Nadu, Kerala, Odisha, and Chhattisgarh. It has a total power portfolio of 9gw, with 63% of it for captive consumption.

Others: VEDL has a strong presence across steel (3mt capacity), FACOR (140kt Ferro chrome capacity), iron ore (one of the largest private sector merchant iron ore miners), and copper.

Vedanta Fundamental Analysis

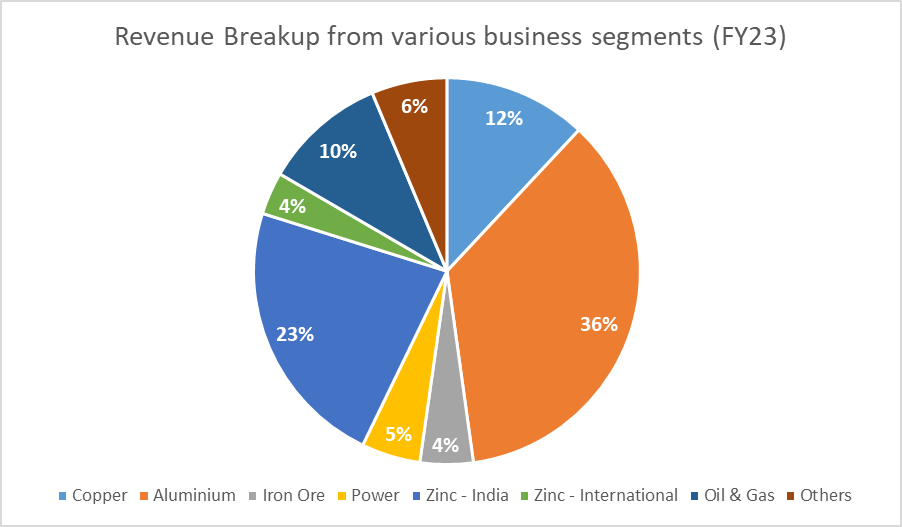

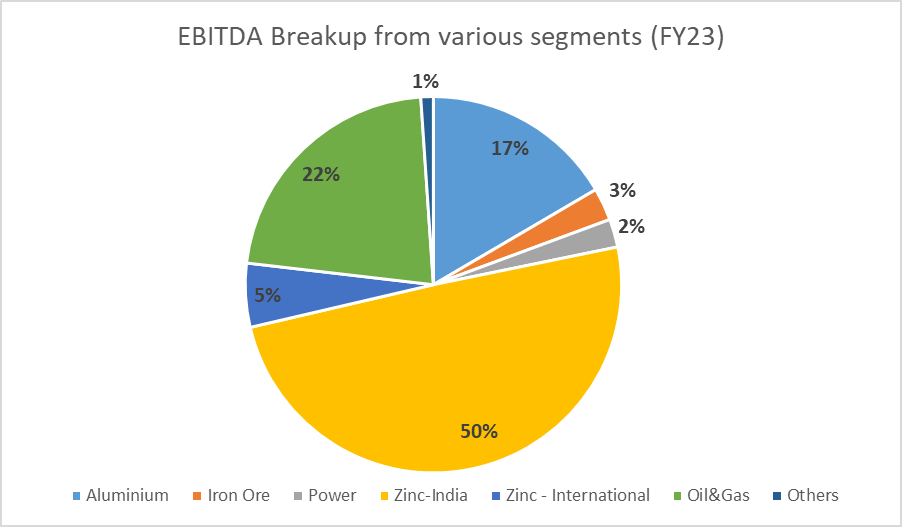

VEDL is a metal and mining powerhouse with a presence across zinc, lead, silver, aluminum, oil and gas, copper, Ferro chrome, iron ore, power, and steel.

Aluminium, Zinc, and Oil & Gas are the three largest revenue-contributing segments for the company. The company recorded best-ever production numbers in some businesses segments in FY23 like:

- Aluminum: Highest ever Aluminium production of 2,291 kt, up 1% with Jharsuguda ramp-up

- Zinc India: Historic high refined metal production at 1,032 kt, up 7% YoY

- Zinc International: Gamsberg achieved record production of 208 kt, up 22% YoY

- Steel: Highest ever hot metal production of 1,376 kt

- FACOR: Achieved all-time high ore production of 290 kt, up 16% YoY

(*Source: Vedanta Ltd. Annual Report FY23)

The company is in a capital-intensive sector, and to that extent, it has used significant debt capital to fund its expansion plans. Vedanta Resources (the parent company of Vedanta Ltd) has significant debt on its books. To adhere to its debt repayment commitments, Vedanta Resources relies heavily on dividend payouts by Vedanta Ltd., which depends on HZL.

Vedanta Ltd. declared record dividends in FY23, which helped Vedanta Resources meet its debt commitments; however, this led to HZL (Hindustan Zinc) taking debt on its book from being a cash-rich company earlier.

Vedanta Resources has adhered to all the debt repayment timelines and has already deleveraged USD 3.3b as of May’23 against its three-year USD 4b target. Vedanta Resources has a total debt of ~USD 6.4b, and it is expected to continue its deleveraging journey and adhere to its commitments.

Revenue and Profitability

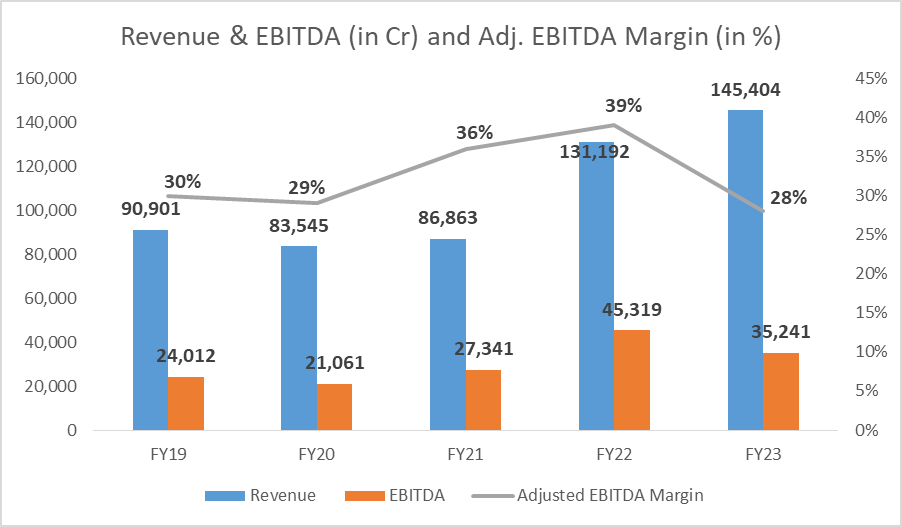

Vedanta Ltd. posted all-time high revenue of INR 145,404 Cr and the second-highest annual EBITDA of INR 35,241 Cr. FY23 started on a high note, with prices of most of the metals touching all-time highs. However, the prices gradually corrected and were down, especially in 2HFY23, which reduced EBITDA margins in FY23.

Metal prices have been under pressure since the start of FY24 due to macroeconomic volatility, high-interest rates, oversupply of metals, lower-than-expected pickup in China, struggling Chinese property sector, geo-political unrest in Europe, etc.

*Note: Adjusted EBITDA calculated as EBITDA margin excluding EBITDA and turnover from custom smelting at copper business

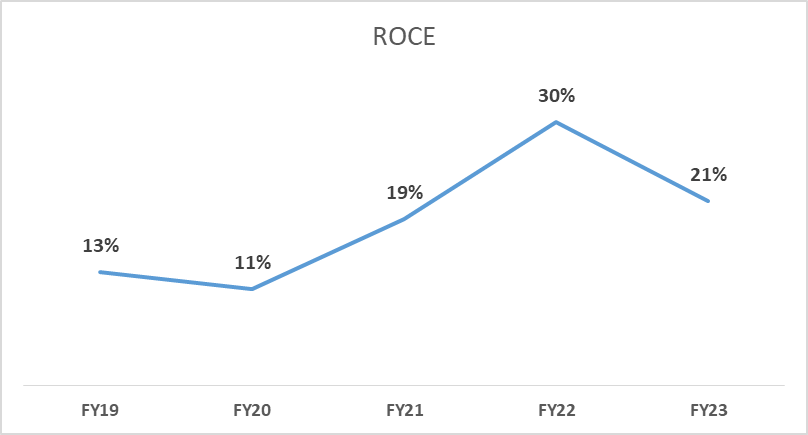

Return on Capital Employed:

Vedanta has improved its ROCE from 11% in FY20 to 21% in FY23, driven by healthy commodity prices, improved operating efficiency, and lower cost of raw materials due to captive mines. The company is using this as an opportunity to de-leverage the balance sheet, leading to further improvement in ROCE.

Vedanta Share price analysis

Vedanta Ltd, the stock price has given a modest CAGR of 6% over the last ten years (14th July 2012 to 14th July 2023). However, Vedanta has delivered a CAGR of 37% over the last three years (14th July 2020 to 14th July 2023) driven by the commodity boom during Covid-19. Additionally, the stock has given huge dividends to shareholders, increasing the total returns.

Vedanta Share Price Target Future Growth Potential

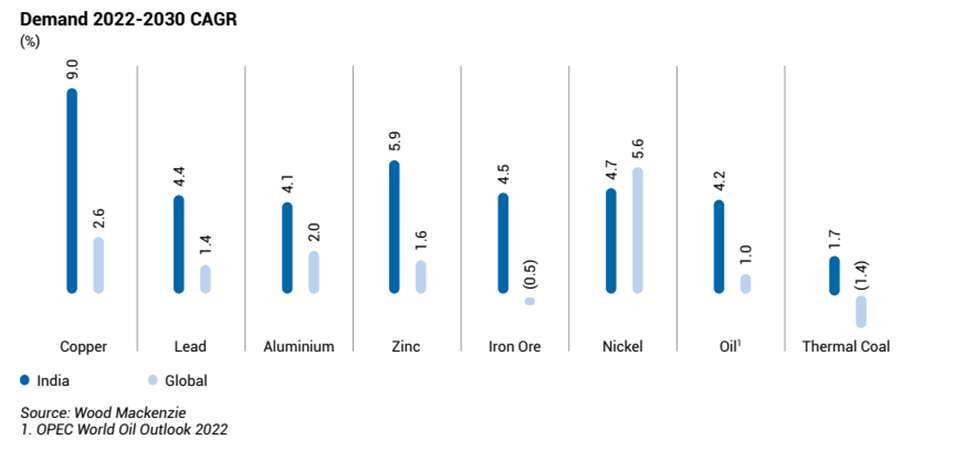

The metals and mining sector is expected to contribute substantially to India’s GDP, and VEDL expects domestic demand to outpace the global market till FY30.

- Metal consumption in India is expected to remain robust, driven by the ‘trinity of manufacturing, infrastructure, and energy.’ VEDL, India’s largest natural resources company and diversified portfolio, will benefit from buoyant domestic demand.

- Copper is expected to outpace other ferrous and non-ferrous metals and clock a CAGR of 9% till FY30.

- Natural resources such as lead/aluminum/zinc/iron ore/nickel/oil are expected to report a CAGR of 4.4%/4.1%/5.9%/4.5%/4.7%/4.2% (as shown in the chart below) until FY30.

- Improved living standards, higher income, urbanization, and industrialization, coupled with the government’s thrust on infrastructure, construction, housing, and power, greatly augment the sector’s growth.

Vedanta Ltd Key risks:

Any delay in repayment or failure to raise capital at Vedanta Resources will adversely impact Vedanta Ltd. Almost 100% of the promoter holding is pledged, and any negative scenario could probably hurt the company.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Who is the owner of Vedanta Ltd?

Vedanta Ltd. is owned by Vedanta Resources Ltd. (holding company), founded and promoted by Mr. Anil Agarwal.

Is Vedanta Ltd. an excellent stock to buy for the long term?

Vedanta Ltd. is a commodity business and hence gets significantly affected by movement in commodity prices like Aluminium, Zinc, Steel, etc. One must understand commodity cycles before investing in Vedanta Ltd. Additionally, optimizing for entry and exit in this company based on these cycles is important for investment in Vedanta to be successful.

What is the face value of Vedanta Ltd’s share?

Vedanta Ltd. has a face value of INR 1 per share.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 22

No votes so far! Be the first to rate this post.