Introduction

In a startling turn of events, the Indian indices faced their steepest decline in over two months, plummeting by over 1% in a single day this week. This abrupt downturn can be attributed to factors that have sent shockwaves through the financial landscape. Let’s delve into this event to unravel the intricacies.

Crude Oil Prices Approach $100 per Barrel

Crude oil prices have increased over the past few months due to supply deficit concerns. The pivotal move came in July when Saudi Arabia slashed its daily oil production to 9 million barrels. This was in addition to the 1.66 million barrels OPEC+ countries had already trimmed earlier in the year, with a substantial portion of these reductions originating from Saudi Arabia.

Furthermore, Russia and Saudi Arabia recently agreed to extend their oil supply cuts well into 2023. Such decisions by two of the world’s largest oil producers hold profound implications. The surge in crude oil prices, coupled with a burgeoning current account deficit, exerts additional pressure on the market, further contributing to the decline in market indices.

HDFC Bank Merger and its Aftermath

The financial landscape of India witnessed a seismic shift on July 1, as HDFC and HDFC Bank, two behemoths of the Indian financial sector, merged, with HDFC Bank emerging as the surviving entity. While this merger generated considerable buzz in the market, it also raised concerns about potential adverse effects on key financial ratios, such as net interest margins and an upswing in bad loans, which subsequently affected the asset quality. This led to a staggering 4% decline for HDFC Bank, marking its sharpest drop since the merger took effect.

In the wake of this development, several broking firms, including Nomura, downgraded their rating on the bank. Moreover, given the substantial weightage of the bank in Sensex and Nifty, a decline in its performance reverberated throughout the major indexes.

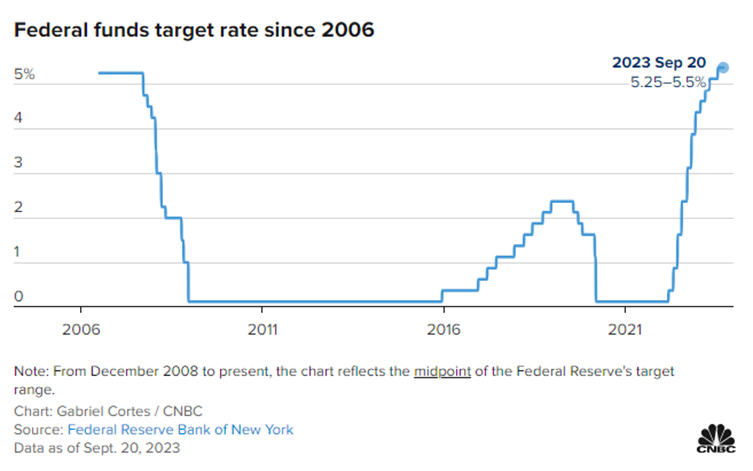

The resolute decision of the US Federal Reserve to maintain its hawkish stance on interest rates reverberated across the Indian indices, exerting further downward pressure.

Key Takeaways

The decline in the market indices this week can be attributed to the convergence of three pivotal factors:

- Crude Oil Price Surge: With crude oil prices edging towards the $100 mark, the implications for oil-dependent countries like India are profound as they grapple with the repercussions of this surge.

- HDFC’s Impact: The merger of HDFC and HDFC Bank has had a ripple effect, negatively impacting key financial metrics and leading to a significant slump in HDFC Bank’s performance.

- US Fed’s Hawkish Stance: The unwavering stance of the US Federal Reserve on interest rates has added another layer of complexity to the market dynamics.

The surge in oil prices, coupled with a soaring trade deficit in goods, reaching a 10-month high in August, has exerted pressure on the rupee and deterred foreign investors from the Indian markets. Additionally, the drag exerted by HDFC and the hawkish stance of the US Fed have collectively pushed the broad market indexes into the red.

The recent turbulence in the Indian financial markets serves as a stark reminder of the interconnectedness of global economies. The confluence of rising crude oil prices, the aftermath of the HDFC Bank merger, and the resolute stance of the US Federal Reserve have created a complex web of challenges for investors and policymakers alike.

FOMC holds rates unchanged at 22-year high-mark!

Introduction

In a recent update, the US Federal Reserve unveiled its decision on interest rates after a comprehensive two-day Federal Open Market Committee (FOMC) meeting. This article delves into the key details of this announcement and its potential implications for the economy.

Maintaining Stability: Rates Unchanged

The Federal Reserve has maintained the benchmark interest rates between 5.25 to 5.50 percent.

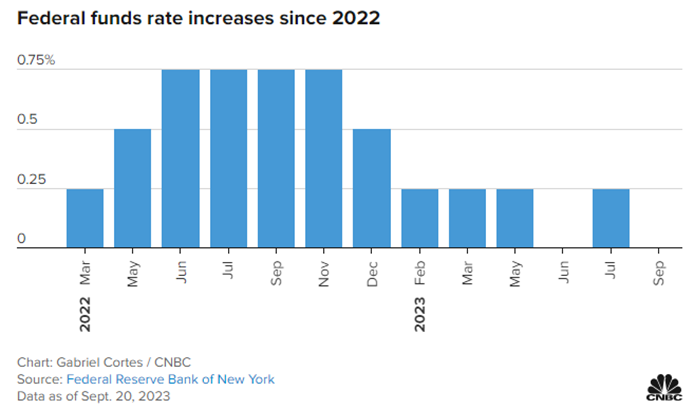

This decision is no surprise, considering the Fed’s prior increase in policy rates by 525 basis points since March 2022.

Inflation Insights

Recent data suggests a slight improvement in inflation figures, signaling a positive shift from the alarming 41-year high of 9.1%. However, it’s crucial to note that the inflation rate still hovers well above the Fed’s targeted 2%.

The focal point of interest lies in the projections outlined by Fed officials. As indicated during the announcement, there is a prevailing likelihood of another rate increase later in the year. This signals a proactive stance in managing economic dynamics.

The Federal Reserve has strategically planned meetings in early November and mid-December. These gatherings will be pivotal platforms for shaping future monetary policies and addressing potential economic challenges.

Key Takeaways

Looking ahead, the Fed envisions a more measured approach to implementing rate cuts in 2024 and 2025 compared to their earlier projections. This deliberate strategy reflects a commitment to maintaining economic stability amidst potential fluctuations.

The Fed Chair refrained from making sensational statements, emphasizing the need for cautious optimism. While pleased with the recent progress on inflation, the Fed remains vigilant and acknowledges that victory cannot be declared just yet.

The indication of a potential rate increase later in the year underscores the Fed’s adaptability to evolving economic conditions. Although inflation is displaying signs of moderation, there are still underlying risks that could lead to uncomfortable price escalations.

While the Federal Reserve’s decision to uphold interest rates was widely anticipated, the true intrigue lies in the forward-looking projections. The Fed’s measured approach underscores their commitment to economic stability in the face of potential challenges.

FAQs

How does inflation factor into the Fed’s decision-making process?

The Fed closely monitors inflation as it directly impacts consumers’ purchasing power and the economy’s overall stability.

What are the potential risks associated with the Fed’s decision?

While the decision provides short-term stability, there are lingering risks of inflation and economic fluctuations that the Fed aims to address.

How can global economic conditions influence future Fed decisions?

Global economic trends and events can significantly influence the Federal Reserve’s approach to monetary policy as it seeks to navigate a complex and interconnected financial landscape.

What are the potential long-term effects of the surge in crude oil prices?

The surge in crude oil prices could lead to higher inflation rates, increased production costs, and potential economic slowdowns in oil-dependent economies.

How will the HDFC Bank merger impact the broader Indian financial sector?

The merger could lead to shifts in key financial metrics, potentially affecting net interest margins and asset quality and consequently influencing the performance of major indexes.

What are the implications of a hawkish stance by the US Federal Reserve?

A hawkish stance typically involves tightening monetary policy to curb inflation. This can lead to higher interest rates, potentially impacting borrowing costs and economic growth.

How can investors navigate the current market conditions?

Investors may consider diversifying their portfolios, staying updated on global economic trends, and seeking advice from financial experts to make informed investment decisions.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.