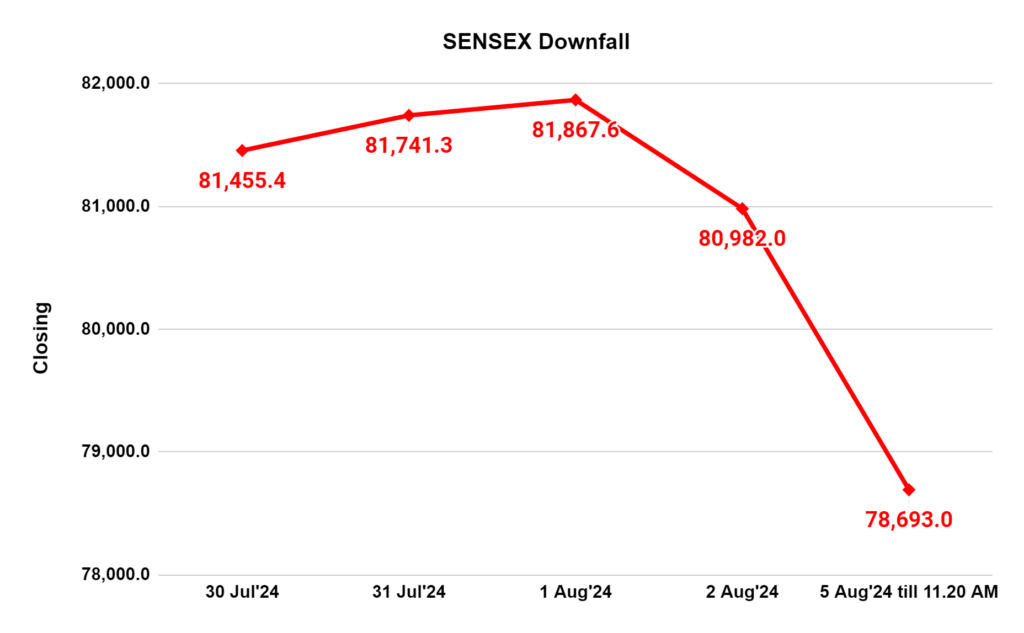

Domestic equity markets opened on a disastrous note on Monday, with benchmark indices Sensex and Nifty tumbling over 2.8% each. The steep decline extended losses from the previous session, fueled by a cocktail of negative factors, including the catastrophic fall of the Nikkei index, weak global cues, mounting recession fears in the US, and concerns over domestic market valuations. The broader market also participated in the sell-off, with significantly more decliners than advancers.

At 11:20 AM, the Sensex traded at 78,693, while the Nifty hovered around 24,025.

So, what exactly triggered this downfall?

6 Top Factors that May Have Triggered the Market Downfall

Asian Markets Nosedive

Asian stock markets experienced a catastrophic decline on Monday, led by a steep fall in Japan’s Nikkei index. The Nikkei plummeted by over 2,400 points within the first half hour of trading, reaching 33,488.08. Although it recovered slightly, the index still ended the day down by 3,790 points, closing at 31,458.42, more than Black Monday in 1987.

The broader Topix index also suffered a significant drop of over 7%, pushing both indices into bear market territory. This marked the worst three-day performance since the 2011 tsunami.

Other major Asian markets followed suit, with Taiwan’s Taiex sinking 5.7%, South Korea’s Kospi declining 3.4%, and Hong Kong’s Hang Seng losing 2.1%. Australia’s S&P/ASX 200 also declined by 1.3%.

US Recession Fear Looms Large

The specter of a US recession is casting a long shadow over global markets. Despite Federal Reserve Chair Jerome Powell hinting at potential interest rate cuts in September and analysts predicting two 25-basis-point cuts by the end of the year, concerns about the timing and efficacy of these measures in averting a downturn persist.

Recent economic indicators have added fuel to recession fears. The unemployment rate has risen, while the manufacturing index has weakened. The S&P 500 has suffered back-to-back losses of at least 1%, with the Dow Jones Industrial Average dropping 610 points and the Nasdaq Composite falling 2.4%. The Nasdaq is now 10% below its record high, officially entering correction territory.

These developments and rising geopolitical tensions have created a challenging environment for investors. A global slowdown could impact India and other emerging markets, leading to FPI outflows.

It remains to be seen how the Federal Reserve’s monetary policy will evolve and whether it can successfully steer the economy out of a recession.

Geopolitical Tensions Add to Market Volatility

Escalating geopolitical tensions in the Middle East have significantly contributed to heightened market volatility. The region’s instability, marked by conflicts and political unrest, has created uncertainty that has spooked investors.

This has led to a risk-off sentiment, with investors shifting their portfolios towards safer assets such as gold and government bonds. The ongoing situation in the Middle East continues to be a closely watched factor by market participants, as any further escalation could exacerbate market volatility.

Overvalued Indian Market

The Indian market is currently trading at significantly elevated valuations. The median trailing PE ratio of BSE 500 companies stands at a lofty 43 times, far surpassing historical averages. This metric indicates that investors are paying a premium for current earnings, which could be unsustainable in the long term. Moreover, the price-to-book (P/B) ratio of the BSE 500 is also elevated, suggesting that the market is pricing in significant future growth.

Potential FPI Outflows

The strong performance of the Indian market has attracted significant foreign portfolio investment (FPI) inflows. However, recent actions by FPIs suggest a potential shift in sentiment. Apart from selling a provisional ₹3,310 crore worth of shares on Friday, FPIs have increased their net short position in index options, acquiring 330,936 additional put contracts overnight.

This brings their total net put contracts to 473,635. Simultaneously, they have reduced their net long position in index futures by 21,170 contracts to 145,109. These actions indicate a growing cautious stance among FPIs and raise concerns about potential outflows.

Pressure on Retail Investors

Increased FPI selling activity could intensify pressure on retail investors, particularly those who rely on margin funding to participate in the market. The outstanding margin trade funding (MTF) book at brokerages has reached a record high of ₹74,180.8 crore, indicating a significant level of leverage in the market.

With the NSE recently removing over 1,000 stocks as collateral for margin funding, the margin pool has already been constrained. A market correction triggered by weak global cues could force some retail investors to unwind their positions, potentially exacerbating the sell-off.

Conclusion

The Indian equity market is undergoing a significant correction, primarily driven by negative global sentiment and concerns over domestic valuations. The sharp decline in benchmark indices and a broader market sell-off indicate a high level of investor anxiety.

The ongoing geopolitical tensions and the looming threat of a US recession add to the market’s woes. It remains to be seen if the market can stabilize in the coming sessions or if further downside is on the cards. Investors are advised to exercise caution and adopt a defensive stance soon.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan