If you have been watching the Indian stock market lately, you might be wondering – what’s going on? You’re not alone. The Sensex and Nifty 50, the two key benchmarks of the Indian stock market, have declined for four days straight, and investors are feeling the heat. So, what’s causing this market jitters? Let’s dive into the top 7 reasons why the Nifty50 & Sensex fell.

Sensex and Nifty Take a Hit

The Sensex opened a significant 344 points lower at 74,826.94 compared to its previous close of 75,170.45. During the day, it dipped as low as 74,454.55, a decline of 716 points. By the closing bell, the 30-share pack had shed 668 points, translating to a loss of 0.89%. Only 6 stocks managed to stay afloat, with the remaining 24 ending the day in the red.

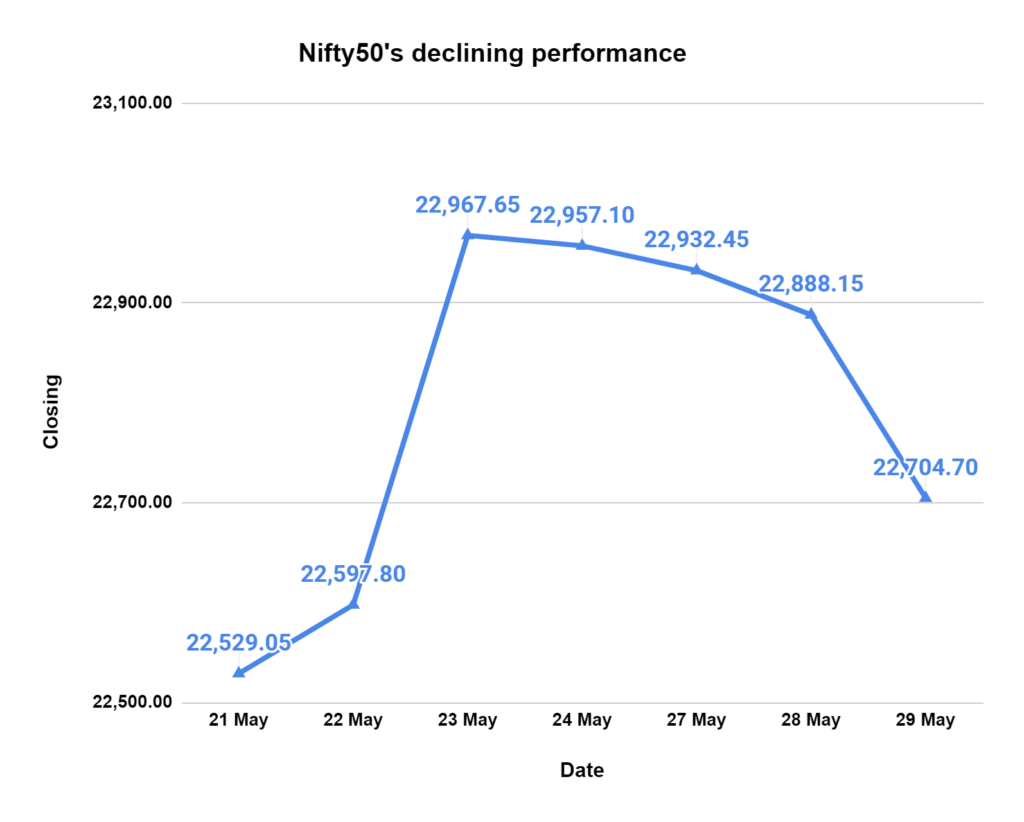

The Nifty50 displayed a similar downward trend. It opened 125 points lower at 22,762.75 compared to its previous close of 22,888.15. It remained firmly in negative territory throughout the session, briefly touching an intraday low of 22,685.45. Finally, the index closed 183 points lower, representing a decline of 0.80%, settling at 22,704.70.

Top 7 Reasons Behind the Nifty50 & Sensex Fall

- Election Jitters: With the much-anticipated Lok Sabha election results due on June 4th, 2024, nervousness clouds the market sentiment. While most analysts expect the Bharatiya Janata Party (BJP) to retain power, the question is – by how much?

Investors are worried that a narrow victory could limit the government’s ability to implement bold reforms. A Bloomberg survey suggests that the magic number for a continued market rally is 303 seats for the BJP. If they fall short of that, the Nifty50 could drop by 2%—not exactly the news investors want to hear.

- Global Market Worries: It’s not just India – stock markets across the globe are facing headwinds. Asia-Pacific markets took a beating on Wednesday, with major indices like Kospi and Hang Seng tumbling by 1.7% each. European markets followed suit, opening lower and extending losses from the previous day. FTSE100 was down 0.22%, DAX 0.4%, CAC40 0.5%, and Stoxx600 0.4%. Even Wall Street futures indicate a potential dip as investors await the release of US Q1 GDP data release today. This global uncertainty is adding to the pressure on the Indian market.

- Oil Prices on the Rise: Geopolitical tensions, particularly the recent Israeli attack on Rafah, are pushing crude oil prices up over 1%. Furthermore, expectations are high that OPEC+ will maintain production cuts at their June 2nd meeting. Benchmark Brent crude is hovering near $85 per barrel, adding another worry for investors.

- Bond Yields: Rising bond yields are making debt investments a more attractive option compared to the stock market. In the US, bond yields have surpassed 4.5%, while India’s 10-year government bond yields are above 7%. This shift in investor preference means less money flowing into stocks, which can dampen market performance.

- Banking Stocks Underperform: Banking stocks, which hold significant weightage in Sensex and Nifty50, have been underperforming. Heavyweights like ICICI Bank, HDFC Bank, Axis Bank, and SBI have all seen a downturn, dragging down the key indices. This weakness in the banking sector can be due to a number of factors, including concerns about rising interest rates or potential loan defaults.

- Foreign Investors Taking Profits: Foreign institutional investors (FIIs) seem to take advantage of India’s relatively high stock valuations by booking profits. So far in May, FIIs have sold shares worth a whopping ₹34,935.53 crore. This outflow of foreign capital can put downward pressure on stock prices.

- Technical Factors: Market analysts are keeping a close eye on technical levels. The 22,800-22,700 range is seen as immediate support for the Nifty50. However, further decline could be expected if the index breaks below that. On the other hand, surpassing the 23,000 mark seems like a hurdle for now, with the lifetime high of around 23,100 remaining a distant target.

What’s next?

The coming days will be crucial for the Indian stock market. The Lok Sabha election results, with global cues and economic data releases, will likely shape investor sentiment. Whether the market rebounds or continues its downward trajectory remains to be seen. One thing is clear – volatility is likely to persist in the near future. You can also learn about gift nifty with our blog.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.1 / 5. Vote count: 8

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.