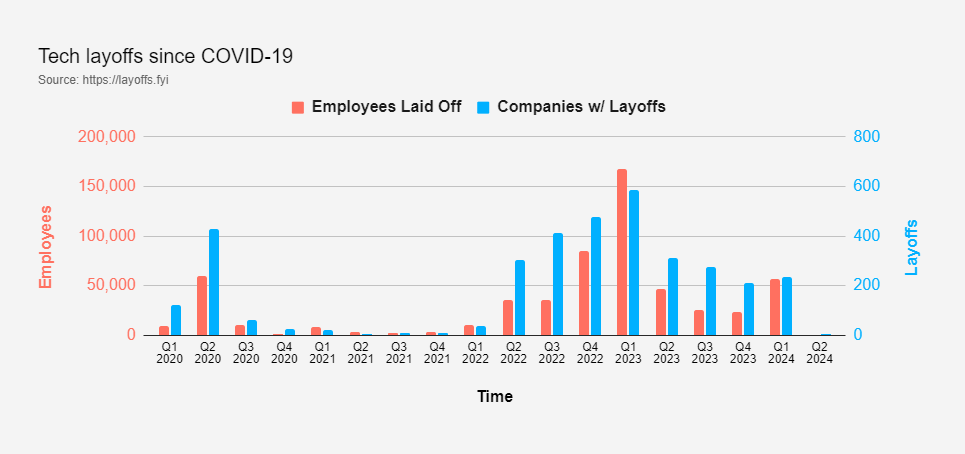

There was a time when tech stocks were booming and there were endless job opportunities. Fast-forward to 2024, and the narrative has shifted. Headlines scream “layoffs,” and social media is flooded with anxieties about tech workers. This is happening despite a projection of an 8% increase in global IT spending. So, what’s going on?

Let’s face it: The tech sector went on a hiring spree during the pandemic. Lockdowns fueled a surge in e-commerce and remote work needs, creating a tech buying frenzy. Now, with a return to normalcy and revenue dips, companies are tightening their belts.

As many as 57,505 tech jobs have been cut in 2024, reported Layoffs.fyi, a startup tracking job cuts in the industry since the pandemic.

Layoffs since COVID-19

Industry-wise Layoffs

Why Are Tech Businesses Laying Off People?

Cost-Cutting Measures

Several tech companies are prioritizing cost management, leading to workforce reductions.

- Ericsson: Facing a slowdown in demand for 5G equipment, Ericsson laid off 1,200 employees in Sweden as part of its 2024 cost-saving plan. This follows the layoffs of 8,500 employees in 2023.

- Dell: Dell’s workforce reductions reflect a sluggish PC market. After shedding 6,000 employees in 2023, they continued trimming their workforce in 2024.

- Zee Entertainment: Zee Entertainment exemplifies this trend with a company-wide overhaul aimed at achieving a 50% cost reduction in its tech division, likely to result in job cuts.

- IBM: IBM also resorted to layoffs, but details regarding the extent of workforce reduction within their marketing and communications department remain undisclosed.

Redundancy: When Skills Become Surplus

The pandemic hiring surge has left some companies with more staff than they currently need.

- Apple: Apple’s cancellation of their microLED display project exemplifies this. The project’s closure led to team reshuffles and layoffs, impacting display engineering teams across multiple locations, including the US and Asia.

- Meta & Amazon: Similarly, Meta and Amazon, fueled by the surge in demand during the pandemic, are now streamlining their workforces. These companies are identifying and letting go of employees deemed “redundant” in the current business climate.

Mergers and Buyouts: Reorganization Shuffle

Mergers and acquisitions can be a recipe for layoffs. When companies join forces or one buys another, restructuring is inevitable. This often means streamlining teams, eliminating duplicate roles, and merging departments. The unfortunate consequence? Job losses.

Profit Doesn’t Guarantee Job Security

Even profitable companies can resort to layoffs.

- Bumble: Bumble serves as a prime example. Despite experiencing revenue growth, they laid off 30% of their workforce, highlighting the pressure to optimize financial performance.

- Paramount: Paramount’s story is another case in point. Facing declining revenue from streaming services, they laid off 800 employees in pursuit of long-term financial goals. It suggests that job cuts can be a strategic move to improve profitability.

- Investor Influence: Investor pressure for higher profit margins can also be a factor in layoffs. Companies may reduce their workforce to appease investors and boost their bottom line.

The Rise of Automation and AI

The increasing adoption of AI and automation is a significant driver of layoffs in the tech industry.

- Shift Towards Cloud and AI: Companies like SAP embrace AI to transition to cloud-based services. This transformation often leads to workforce reductions as certain roles become automated.

- Transparency About AI’s Impact: Plagiarism detection firm Turnitin serves as a transparent example. Their CEO openly acknowledged that AI would lead to a 20% reduction in their engineering workforce within 18 months, highlighting the potential impact of AI on jobs.

- Survey Results Reinforce the Trend: A survey by ResumeBuilder.com underscores this concern. It found that nearly 70% of employers are laying off to save money, and 40% specifically cite the adoption of AI as a reason for these cuts.

- AI Tools Displacing Manual Labor: The growing presence of AI tools like ChatGPT and Gemini (formerly Bard) is displacing manual labor across various company functions.

- Impact on Higher-Level Roles: Automation’s reach isn’t limited to lower-level positions. McKinsey & Company offering 9-month severance packages to some UK staffers to resign exemplifies this. This move, likely driven by a desire to streamline operations through automation, could impact even high-level positions in the future.

- Google’s Feeling the Heat: Even Google, a tech giant at the forefront of AI development, faces internal pressure regarding potential job cuts. This follows their decision to lay off thousands of employees across various platforms in early 2024, suggesting a potential restructuring driven by automation within the company.

The Final Word

Despite positive economic indicators, the tech industry’s ongoing layoffs paint a concerning picture. While some of these cuts continue trends from 2023, others reflect a more fundamental shift—a tech industry adjusting to a post-pandemic landscape and embracing automation. As the industry evolves, the question remains: Will these layoffs be a temporary issue or a sign of a future where robots reign supreme? Only time will tell.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.