The week starting June 24, 2024, political uncertainty and French President Emmanuel Macron’s warning of civil unrest kept European markets under pressure, with investors mostly ignoring economic reports.

The coming days in the European stock market are likely to be volatile. The United Kingdom is also preparing for its general elections, which are scheduled for 4 July 2024. Investors are expecting distorted election results.

The Euro area inflation was 2.6% in May 2024, exceeding the forecast of 2.5%. It is up from 2.4% in April 2024. Core inflation also increased to 2.9%, thus potentially delaying the European Central Bank’s rate cut.

The HCOB Eurozone Manufacturing Purchasing Manager Index (PMI) for June came in at 45.6, a drop from May’s 47.3, marking six consecutive months of contraction. Also, Services PMI contracted from May’s 53.2 to 52.6 in June.

STOXX Europe 600

STOXX Europe 600 is the standard household index replicating almost 90% of Europe’s underlying investible market. The index traded on a mixed note and was sideways in the last seven trading days. Profit booking in the stocks of global chip companies, weak economic data, and rising inflation kept the market under pressure.

STOXX 600 is currently experiencing a pullback from the higher level and is lacking strength to go higher. Relative Strength Index, which indicates the strength in the selected stock or index, is falling. The index has a strong support at the 500 level and strong resistance at the 525 level.

NOW READ: SEBI Registered Investment Advisor: Meaning & Eligibility

FTSE 100

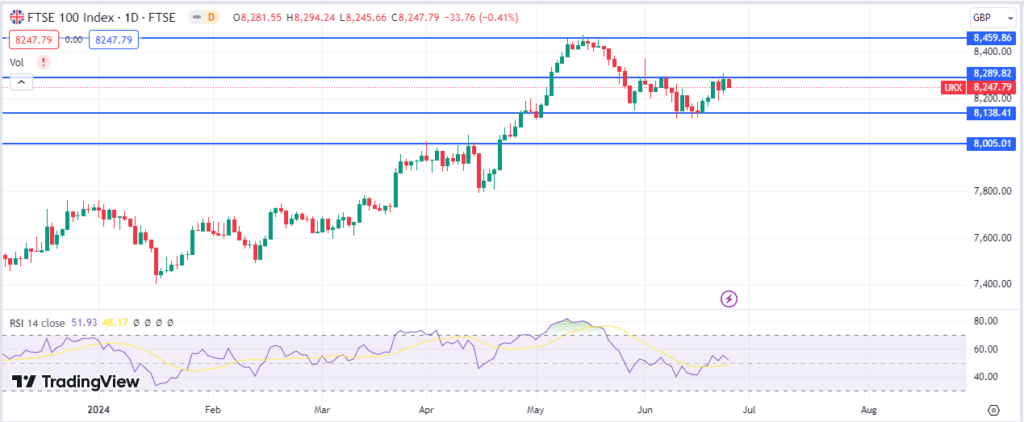

The UK’s headline inflation fell from 2.3% in April to 2% in May, bringing it back within the Bank of England’s target range. The FTSE 100, the UK’s flagship stock market index, has been largely volatile over the last seven trading days as the country prepares for the general election in July. On Tuesday (25th June 2024), the index was slightly down by 0.41%, while it has gained 0.52%. In 2024, the index is up by 6.82%.

The FTSE 100 is currently trading in a rangebound movement, and the overall strength to go higher is mainly missing, likely due to weak investor sentiment. The index has bounced higher from its strong support at the 8,140 level but is currently experiencing resistance at the 8,290 level. Failure to break above the resistance level may result in further weakness.

CAC 40

French stocks were under pressure due to President Emmanuel Macron’s snap election call. The index has slightly recovered this week after a severe decline of over 6% the previous week, the largest since March 2022.

On Tuesday (25th June 2024), the CAC 40 was down by 0.58%; last week, it was up by 1.22%. In 2024, this index has lagged in terms of returns and has only risen by 1.75%. CAC 40 has bounced higher from one of its strong support levels at 7,550 after declining severely by over 6%. The overall sentiment continues to remain weak and has to break above the 7,900 level with strong momentum to continue moving higher.

DAX

In Tuesday’s session (25th June 2024), DAX was the worst performer in the European stock market and was down by 0.81%, due to the sharp decline in aerospace and defense stocks. The index slightly increased by 0.61% in the last seven trading days. In 2024, DAX is the best-performing index in Europe, which has gone up by 8.40%.

DAX pulled back at the start of the week to test one of its strong support levels at around 17,950. In order to continue moving higher, it needs to break above the 18,800 level with strong momentum. Below, there is strong support at the 16,900 level.

Top Gainers and Losers in the European Stock Market

Top Gainers

The following are the top gainers in the last one week.

| Stocks | Last 7 Days Gains (in %) |

| Covestro AG O.N | 8.61 |

| Anglo American | 5.31 |

| DSM Firmenich | 5.70 |

| Kering | 5.09 |

| Novo Nordisk | 4.90 |

| ROCHE | 3.22 |

| Shell | 3.05 |

| SAP | 2.96 |

Know More: Can The 15x15x15 Rule Help You Become a Crorepati?

Top Losers of European Stock Market

The following are the top losers in the last one week across various sectors:

| Stocks | Last 7 Days Loss (in %) |

| Airbus | 8.74 |

| STMicroelectronics | 7.30 |

| IFX | 6.58 |

| Schindler | 5.46 |

| ADYEN | 5.11 |

| UBS | 4.47 |

| Holcim | 3.38 |

| Loreal | 2.92 |

Conclusion

Factors like Inflation concerns, slowdown in manufacturing and services, uncertainty over rate cuts, and political uncertainity in two large European countries are likely to dominate the European stock market in the near term. For the market’s current sentiment to reverse, lower inflation and increase in manufacturing and services will be required.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What are the most tracked European stock market indexes?

DAX of Germany, CAC 40 of France, FTSE 100 of the United Kingdom, and Stoxx Europe 600 are Europe’s leading stock market indexes.

What are the largest stock exchanges in Europe based on high market cap?

As of March 2024, Euronext is the largest stock exchange in Europe, with a market cap of around $7.2 trillion.

What are the best-performing sectors in the European stock market in 2023?

Real estate, Health Care, Information Technology, Finacials, and Industrials are the best-performing sectors in the European stock market in 2023.

How useful was this post?

Click on a star to rate it!

Average rating 3 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.