Have you ever felt that sinking feeling when the global markets are tumbling, but your local news is reporting record highs? That’s precisely what happened yesterday. The Indian benchmark indices, the Sensex and Nifty 50, defied the global downtrend and surged to unprecedented peaks. So, what was the secret behind this impressive rally?

Let’s dive into the five key forces that propelled the Nifty 50 to a record-breaking 23,754.15.

A Look at the Peak Performance

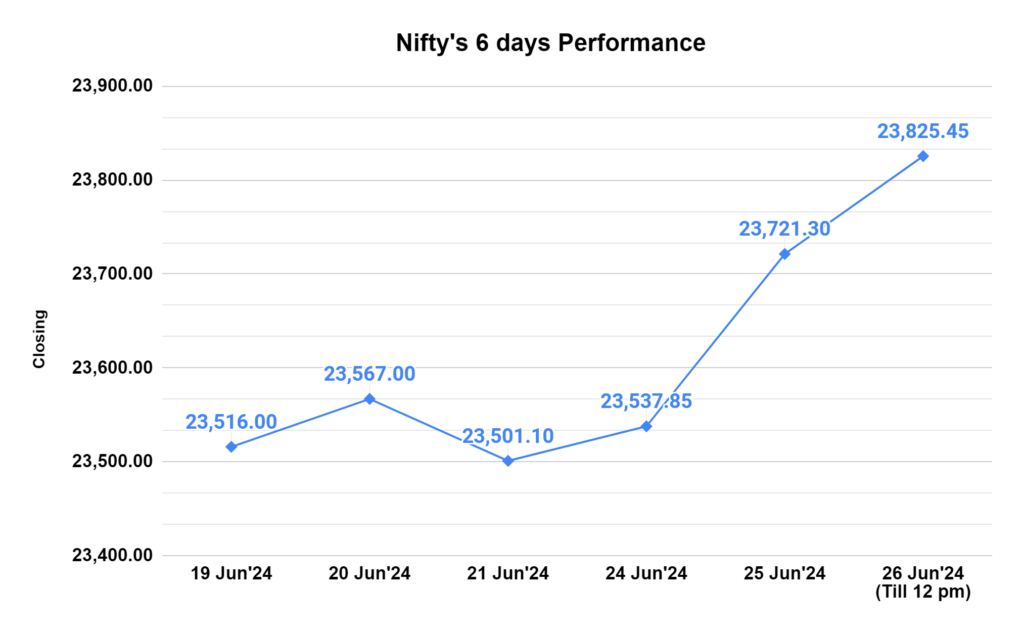

Here’s a closer look at the record-breaking performance on June 25th:

- During the trading session, the Nifty 50 reached a fresh all-time high of 23,754.15.

- The Sensex, another key market barometer, also peaked at 78,164.71 intraday.

- While these were intraday highs, both indices settled at record closing levels. The Nifty 50 closed 183 points, or 0.78% higher, at 23,721.30, while the Sensex ended with a gain of 712 points, or 0.92%, at 78,053.52.

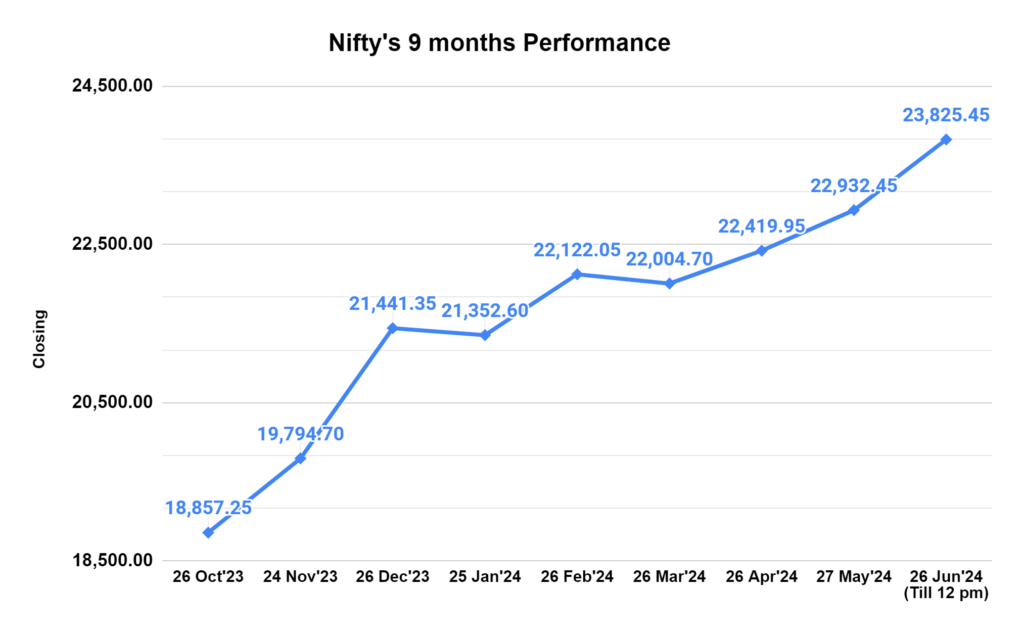

Over the past 9 months, the Nifty 50 has scaled up drastically from 18,857.25 in September 2023 to yesterday’s 23,721.30

5 Reasons Behind the Record High

1. Banking Bonanza: The Powerhouse Propelling Nifty 50

The biggest driver behind the record highs was a stellar performance by banking stocks, the heavyweights of the Nifty 50. The Nifty Bank index, a barometer for banking sector performance, mirrored the Nifty 50’s journey, reaching its own peak at 52,746.50.

This impressive rise wasn’t just a one-day wonder. The Nifty Bank index has surged almost 9% year-to-date, showcasing sustained investor confidence in the banking sector. So, what’s behind this banking bonanza? Here’s the key: Valuation comfort.

Many banking stocks, both private and public sector (PSU), are seen as attractively priced compared to their potential. This perception has fueled investor interest, leading to a buying spree that has pushed these stocks and the Nifty 50 to new heights.

2. Monsoon Magic: A Shot of Optimism for the Economy

The Indian economy is intricately linked to the monsoon. A healthy monsoon season translates to good agricultural output, which fuels rural demand and economic growth. This year, the early signs of a promising monsoon season instilled optimism in investors. This positive sentiment rippled through the market, contributing to the Nifty 50’s upward climb.

3. Macro Matters: A Stable Foundation for Growth

Beyond the monsoon, the overall macroeconomic picture for India appears robust. Strong economic fundamentals provide a stable base for market growth. This stability gives investors confidence in the long-term prospects of the Indian economy, encouraging them to invest in the stock market, thereby pushing indices like the Nifty 50 higher.

4. Policy Continuity: A Familiar Face on the Horizon

The recent change in government might have raised some concerns initially. However, the expectation of policy continuity under the new administration seems to have calmed investor anxieties. This sense of stability and a predictable policy environment are crucial factors that can influence investor decisions. With policy continuity anticipated, investors felt more comfortable putting their money into the market, contributing to the Nifty 50’s impressive rise.

5. Potential Rate Cuts by RBI

The possibility of future rate cuts by the central bank adds to the market’s positive mood. Lower interest rates can stimulate borrowing and investment, potentially leading to economic growth. This prospect has a bullish effect on the stock market, with investors anticipating higher returns. If the anticipated rate cuts materialize, it could further propel the Nifty 50 and the broader market.

Where to From Here?

Market experts are generally optimistic about the Indian stock market’s medium-term prospects, buoyed by the country’s strong macroeconomic fundamentals. The upcoming Union Budget in July is seen as the next major trigger for the market. A positive budget could further fuel the rally, while expectations of rate cuts later in the year add another layer of potential growth.

Conclusion

Looking ahead, the global market environment and the central bank’s actions will also influence the market’s trajectory. However, the factors discussed above paint a promising picture for the Indian stock market, with the Nifty 50 potentially scaling even greater heights in the coming months. Remember, this is just an analysis of the current market situation, and future performance can’t be guaranteed.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 5

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.