Have you noticed how India’s railway network is undergoing a massive transformation? New stations, faster trains, and improved infrastructure are all signs of progress. But this development isn’t just good for commuters – it’s also creating a buzz in the stock market, particularly around Rail Vikas Nigam Ltd (RVNL).

This morning, RVNL shares rocketed to a new high of ₹619, making investors take notice. But what’s driving this surge? Let’s dive into the details and uncover the reasons behind this exciting rally.

Why did RVNL Share Price Surge?

- Big Bloc Deals Fueling the Rally

The recent action in RVNL can be partly attributed to two consecutive block deals. Early this morning, a whopping 1.4 crore shares, representing 0.7% of the company’s total equity, changed hands in a transaction valued at a staggering ₹827 crore. Interestingly, the identity of both the buyer and seller remains unknown. This mystery, coupled with the sheer size of the deal, has undoubtedly added to the market frenzy.

It isn’t the first time such a large trade has happened. Just yesterday, another block deal involving 1.5 crore shares (0.8% of total equity) was inked for ₹806 crore. This trend suggests significant investor interest in RVNL, pushing the stock price upwards.

- Riding the Wave of Positive Railway News

The excitement surrounding RVNL isn’t just about block deals. Positive developments in the Indian railway sector are playing a major role. Last week, Railway Minister Ashwini Vaishnav announced plans to manufacture 2,500 new general passenger coaches and 10,000 coaches. This significant increase in production capacity clearly signals the government’s commitment to railway infrastructure development.

Adding further fuel to the fire, Vaishnav announced the production of 50 new Amrit Bharat Trains, a high-speed and luxurious train service. This initiative is expected to revolutionize travel experiences and further improve the image of Indian Railways.

Reports suggest the Ministry plans to manufacture a staggering number of non-AC coaches – 4,485 in the current financial year and 5,444 in the next – to meet the growing demand and enhance passenger experience. This aligns perfectly with the government’s focus on improving railway infrastructure.

- Budget Expectations

The upcoming Union Budget on 23rd July 2024 is another factor driving investor optimism. Expectations of a budget bonanza for the railways are keeping investor sentiment positive. The government’s focus on faster-track development, electrification projects, and improved rolling stock production aligns perfectly with RVNL’s core business. Analysts predict a significant increase in capital expenditure by railway companies, leading to sustained volume growth for RVNL.

- Strong Company Fundamentals

Beyond the recent block deals and government initiatives, RVNL boasts strong company fundamentals. Established in 2003, RVNL acts as the executing arm of Indian Railways, undertaking various infrastructure projects assigned by the Ministry. This close association with the government ensures a steady stream of projects for the company.

- Strategic Partnerships

RVNL’s recent MoU with Delhi Metro Rail Corporation Ltd. (DMRC) signifies its potential for participation in upcoming projects not just domestically but internationally as well. This partnership goes beyond just another project. It’s a strategic move with significant implications for RVNL’s future. Here’s why:

- Global Ambitions: This MoU allows RVNL to participate in upcoming international projects alongside DMRC. DMRC is a globally recognized leader in metro rail development. Partnering with them allows RVNL to leverage their expertise and gain a foothold in new markets.

- Combined Expertise: The collaboration combines RVNL’s vast railway infrastructure experience with DMRC’s metro project expertise. This creates a powerhouse team capable of undertaking complex and large-scale transportation projects worldwide.

- Increased Competitiveness: By joining forces, both companies can offer more comprehensive and competitive bids for international tenders. This expands their reach and increases their chances of securing lucrative projects.

- Technological Advancement: Collaboration fosters knowledge sharing and the exchange of best practices. This can lead to the adoption of new technologies and innovative approaches, further strengthening RVNL’s position in the global market.

- Market Diversification: Partnering with DMRC allows RVNL to diversify its project portfolio beyond Indian railways. This reduces its dependence on a single market and mitigates potential risks.

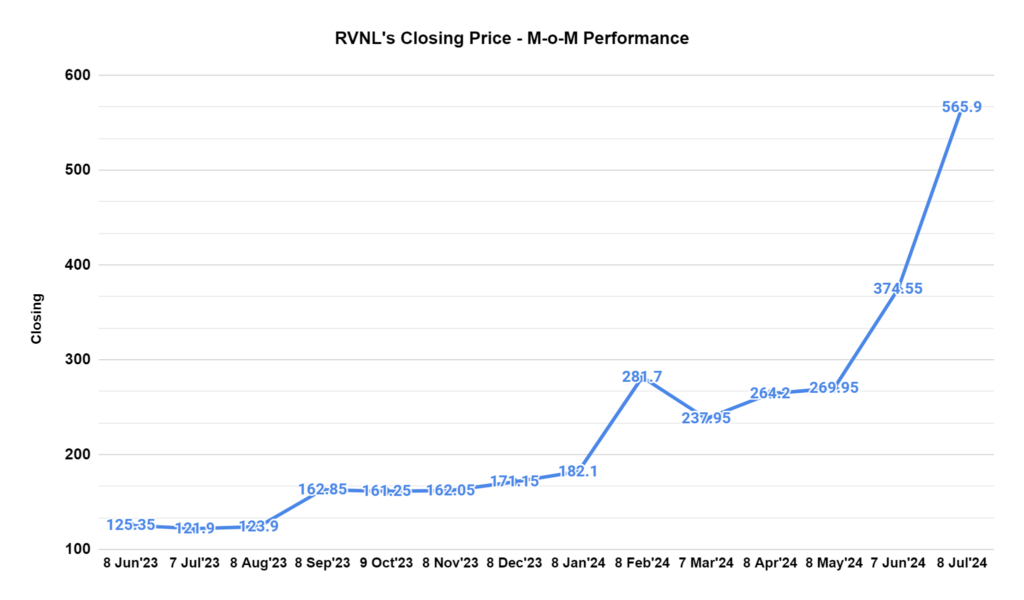

All these positive developments have translated into impressive market performance for RVNL. The stock has surged a remarkable 350% in the last 12 months and crossed the ₹1 lakh crore market capitalization mark last week. Currently, it boasts a market cap of over ₹1.22 lakh crore.

Looking Ahead

With the Indian government’s unwavering focus on infrastructure development and the upcoming budget promising further impetus to the railway sector, RVNL may be well-positioned for continued growth. The recent block deals, positive railway news, and the company’s strong fundamentals point to a good future.

While the outlook for RVNL is positive, a word of caution is necessary. The stock’s Relative Strength Index (RSI) currently sits at 82.5, indicating it’s trading in the overbought zone. Additionally, RVNL shares are trading significantly higher than all their key moving averages. This suggests some short-term correction might be possible.

The Final Word

The transformation of the Indian railway sector has placed RVNL firmly in the spotlight. This morning’s record-high share price reflects a confluence of factors—big-ticket block deals, positive railway announcements, and budgetary expectations. While the company’s strong fundamentals and strategic partnerships like the DMRC MoU paint a promising picture, you must be cautious, too.

Only time will tell how RVNL navigates the short-term technicals. However, its role as an integral part of India’s railway infrastructure development plans suggests a significant journey ahead. As always, thorough research is essential before making any investment decisions.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.