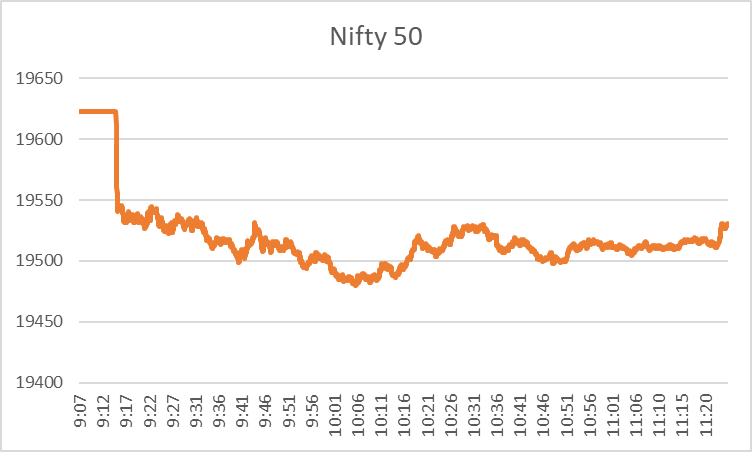

The stock market today opened in the red. Nifty 50 closed at 19638.30 in the previous session, while today, it opened at 19622.40. In the last market session, most sectors performed well except for the IT sector, which ended in the red. During the previous session, only 12 out of 50 stocks of Nifty 50 went down by nominal margins.

Today, the stock market has been telling a different story since the beginning of the session. In the first market session, 37 stocks are in the red, while only 13 stocks have moved up.

Share Market Today as of 11:30 a.m.

Today, at around 10:51 a.m., only a few sectors are in the green, which includes PSU Banks, Media, and Consumer durables. Apart from these, all the other sectors are declining.

Sectors in the Green

NSE Media Sector Today

Until now, the top-performing sector in the stock market today has been Media. Nifty Media surged by 0.49%, with most stocks moving up the ladder. Zee Ltd., on the other hand, has declined by 1.08% during the same period.

Top Media Gainer Stocks Today

- Network 18 has gained 7.52% during this half of the market session

- TV 18 Broadcast by 4.35%.

NSE Consumer Durable Sector Today

The Consumer Durables sector has also increased marginally by 0.29% by around 11.23 a.m. This is primarily due to an increase in the sales of consumer durable products during the festive season. The stocks that are performing well today within this sector include

Top Consumer Durable Gainer Stocks Today

- Kajaria Ceramic, which surged by 2.29%,

- Voltas surged by 1.91%, and Whirlpool by 1.47%.

In this sector, the declining stocks are Amber, which fell by 2.57%, followed by Crompton, with a decline of 1.24%.

Sectors in the Red

NSE Auto Sector Today

In this half of the stock market today, the Automobile sector has been the worst performer. The Nifty Auto index has declined by 1.12% compared to the previous day’s closing price. Rising crude oil prices are one of the primary factors behind the drop in automobile sales amidst the festive season.

Top Auto Loser Stocks Today

- Eicher Motor has been the biggest loser until now, losing around 115.00, close to 3.34%.

- Following the trend, Maruti declined by 2.24% within the first 2 hours of today’s market session.

NSE Pharma Sector Today

The pharmaceutical sector comes next on the list of declining sectors in the stock market today. The Nifty Pharma has reduced by 0.77% until now.

Top Pharma Loser Stocks Today

- Auro Pharma which declined by 3.05%

- Dr. Reddy declined by 1.58%.

NSE Finance Sector Today

The Financial Services sector comes next in today’s list of declining sectors. The Nifty Financial Services dropped by 0.60% during the first half of the day, possibly due to the rising inflationary pressure.

Top Finance Loser Stocks Today

- Muthoot Finance, which declined by 1.35%,

- SBI Life’s share price fell by 1.05%

- HDFC Bank’s share price declined by 1.03%.

However, there are Reliance Capital Ltd. and Chola Finance Ltd. that are pulling the sector up at the same time. The former stock rose by 2.07% until now since the market opened, while the latter increased by 1.66%. So, the financial services are in the red currently, but the whole sector is unaffected.

In the early hours of the stock market today, negative global cues and rising tension of inflationary pressure have taken a toll on Indian equities, especially the IT and Financial services, which are down heavily. On the other hand, the automobile sector, the top performer in the previous stock market session, has become the worst performer today due to rising crude prices.

Apart from these factors, untimely rains also affect the economy, increasing the inflationary pressure, which, in turn, takes a toll on multiple sectors.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 2.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.