Introduction

In the dynamic landscape of Corporate India, the credit profile has emerged as a pivotal barometer of economic health. The period from April to September 2023 witnessed a nuanced shift in this domain. This article delves into the intricate details, dissecting the trends and factors that shaped this evolution.

Crisil Ratings: Unveiling the Credit Ratio

Crisil Ratings, a prominent player in the financial analysis arena, introduces us to a critical metric – the “credit ratio.” This metric acts as a compass, indicating the equilibrium between rating upgrades and downgrades.

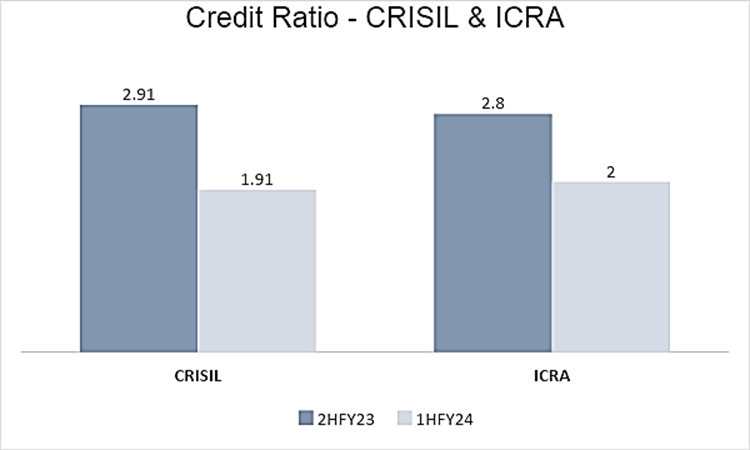

In the first half of fiscal year 2024, the credit ratio stood at 1.91, marking a marginal dip from the 2.19 observed in the preceding fiscal year. A credit ratio exceeding 1 signifies a prevalence of rating upgrades over downgrades.

Crisil’s Perspective: A Closer Look

The data unveils a distinctive trend – 443 companies basked in upgraded credit ratings, while 232 witnessed a dip during this period.

ICRA’s Valuable Insights

ICRA, another authoritative voice in the financial sphere, supplements this narrative with its observations. ICRA’s report for H1 FY24 highlights an encouraging revelation – upgrades outnumbered downgrades by a factor of two. This amplifies the positive momentum in the creditworthiness of Indian corporates.

Unpacking the Drivers

A confluence of factors underpins these favorable developments. Foremost among them is the anticipation of augmented cash flows in sectors tightly interwoven with domestic demand. Industries spanning infrastructure, services, and consumables have been instrumental in sustaining this upward trajectory in credit ratings.

A Broader Canvas: ICRA’s Take

ICRA’s experts extend the canvas, affirming that in H1 FY24, India Inc.’s credit quality has continued its upward trajectory. This builds on the robust performance witnessed in the preceding fiscal years.

Sectors Driving the Change

This growth story is scripted by sectors focusing on domestic consumption and investment. Both investment-grade and non-investment-grade categories have fortified their credit profiles. However, it is imperative to note that the pace of this improvement has tempered compared to prior years.

In summation, Corporate India’s credit profile in the first half of fiscal year 2023 has retained its robustness. Factors such as steadfast domestic demand, strategic government spending, and widespread credit rating improvements across sectors have fostered this encouraging trend. While the pace of advancement may have slackened marginally, the overall credit quality of India Inc. stands as a testament to resilience and progress.

FAQs

How does the credit ratio impact corporate performance?

The credit ratio is vital, reflecting the balance between rating upgrades and downgrades. A ratio above 1 indicates a favorable climate for businesses, with more upgrades than downgrades, signifying enhanced creditworthiness.

Which sectors have been the main drivers of credit profile improvement?

Sectors tightly linked to domestic consumption and investment have spearheaded improving credit profiles. Notably, both investment-grade and non-investment-grade categories have shown significant progress.

What factors contributed to the positive trend in credit ratings?

Anticipated surges in cash flows, particularly in sectors closely aligned with domestic demand, have played a pivotal role. Additionally, substantial government spending has further bolstered this positive trajectory.

What implications does this have for investors and businesses?

The strengthened credit profile of Corporate India in H1 FY24 provides a conducive environment for both investors and businesses. It indicates a stable and resilient economic landscape, encouraging investment and expansion opportunities.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.