Dovish Fed and better-than-expected non-farm payroll data have increased investors’ confidence in the US stock markets. During a congressional hearing, Fed Chair Jerome Powell suggested that the US economy is no longer overheated and has cooled significantly from its pandemic-era extremes. The case for a rate cut is stronger.

Investors are now looking towards the upcoming inflation report, and if it is as expected, it would further strengthen the case for a rate cut in the next policy meeting. The overall inflation trend is downward; however, one of the key concerns is the rise in crude oil prices in recent months. Year-to-date, crude oil prices are up by more than 12%.

US stock market index performance during the week

Nasdaq 100

Nasdaq continued its upside momentum due to strong demand for AI and semiconductor stocks but also witnessed some profit-taking. On Tuesday (9th July 2024), Nasdaq 100 traded mainly with a positive bias but concluded the day flat. The index is up by more than 3.5% in the last five trading sessions. The index is one of the top-performing indexes in the US market and has gained by 23.6% to date in 2024.

Looking at the daily chart, the overall momentum continues to be strong. It has broken above the 20,000 level with enough strength and is currently trying to break above the 20,500 level. As the index is in uncharted territory, hitting new record highs, the market will continue to test for new support below.

S&P 500

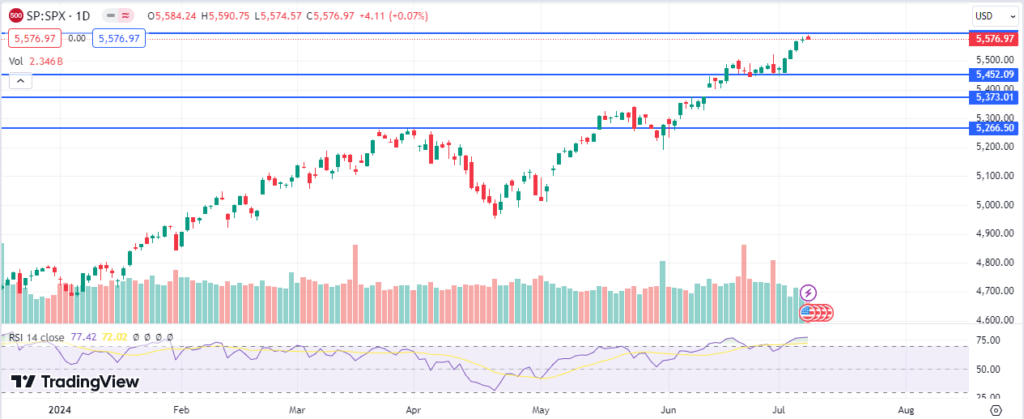

In Tuesday’s session, Powell’s remark on rate cuts and the economy sent the broader S&P 500 index to a record high. The index is trying to climb above the 5,600 level.

On Tuesday (9th July 2024), the S&P 500 concluded the day flat, but the index has gained more than 2.1% in the last five trading sessions. The index’s year-to-date performance has been quite bullish, up 17.59% in 2024.

The S&P 500 is currently trading in uncharted territory and faces strong resistance at the 5,600 level. Strong support is at the 5,450 level, and if it breaks below this level, the index could witness more selling and test the 5,380 level.

Top Gainers and Losers in the US Stock Market

The index’s top gainers continue to skew towards technology stocks, which have been the primary source of all market gains in 2024.

Top Gainers

The following are the top gainers in the last one week.

| Stocks | Last 7 Days Gains (in %) |

| Tesla | 19.85 |

| Nvidia | 8.46 |

| Applied Materials | 7.00 |

| Meta | 5.84 |

| Apple | 5.80 |

Top Losers

The following are the top losers in the last one week across various sectors:

| Stocks | Last 7 Days Loss (in %) |

| Marathon Petroleum Corporation | 8.17 |

| Service Now | 5.22 |

| Exxon Mobil | 4.28 |

| Cisco | 3.38 |

| Chipotle Mexican Grill | 6.60 |

The top gainers in the index continue to skew towards the technology stocks, which have been the primary source of all gains in the market in 2024. Tesla stock is rising because of the better than expected second quarter deliveries, growth in the company’s battery storage business, and growing optimism about its AI business. While, Applied Materials is benefitting from the growing optimism around semiconductor stocks.

On the other hand, energy stocks such as Marathon Petroleum and Exxonmobil are under selling pressure due to a weak growth outlook in these sectors and low investor confidence. Low retail spending and demand have recently impacted consumer-driven business stocks.

Conclusion:

As the current upside momentum in the US market is mainly driven by the rally in AI and tech-related stocks, the valuations of such stocks have become a concern. In the event of a rate cut by the Fed, sectors such as consumer services, consumer durables, and retail trade will further push the market higher.

When comparing the performance of the US and Indian markets, the US market continues to outperform in terms of short and long-term returns. The only difference is that while tech stocks are driving the rally in the US stock market, nearly all sectors of the economy are participating in India.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.