Vodafone Idea’s (Vi) recent strategic decision to issue equity (shares in the company) to key vendors Nokia and Ericsson to settle a portion of their outstanding debt took everyone by surprise.

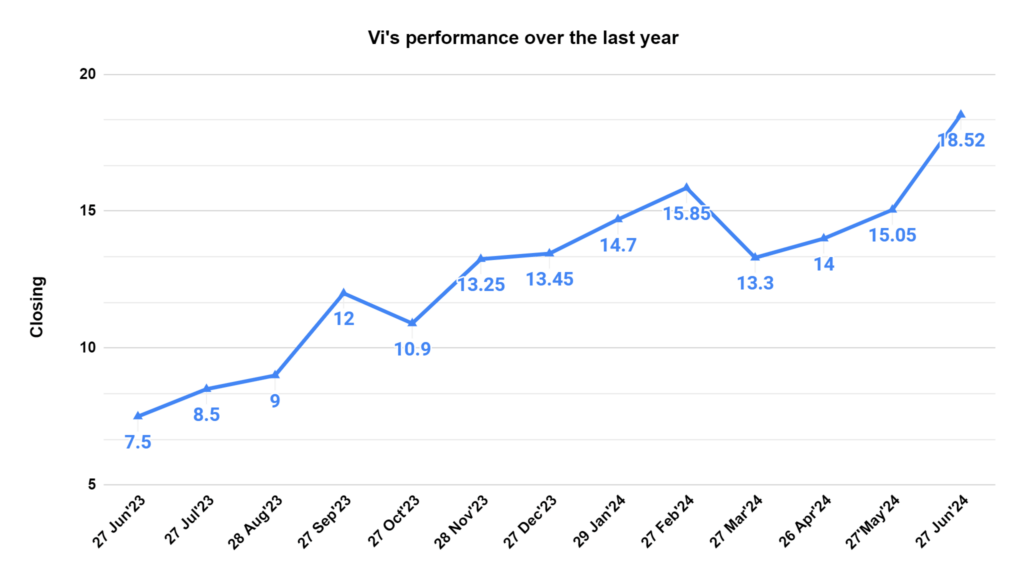

While some critics questioned the decision, investors are welcoming it, as one can see from the significant upward climb in Vi’s stock price since the announcement. The price saw an impressive 26% increase in the past month (as of June 14th), suggesting investors believe the move could benefit Vi’s long-term prospects.

This positive sentiment builds on Vi’s impressive year-long performance. Over the past year, Vi’s stock has surged an impressive 120%, significantly outperforming the Nifty’s 25% return in the same period. This effectively doubled investor gains, showcasing the market’s positive reception to Vi’s strategic moves. With this month’s rally, Vi’s market price has zoomed 68% against its follow-on public offer (FPO) price of INR 11 per share.

Vodafone Idea Breakdown of the Equity Allotment

In a strategic move, Vi’s board approved the preferential allotment of equity shares to address cash flow concerns and outstanding dues. This preferential allotment totals INR 2,458 crore, with an issue price of INR 14.80 per share. Nokia will receive 102.7 crore shares worth INR 1,520 crore, representing 1.48% of Vi’s post-issuance capital. Similarly, Ericsson will receive 63.3 crore shares valued at INR 938 crore, accounting for 0.91% of the company’s post-issuance shareholding.

Financial Implications of the Move

Vodafone Idea expects to incur a capital expenditure of INR 50,000 to INR 55,000 crore over the next three years. These funds will expand 4G coverage, launch 5G services, and grow its enterprise business. However, this move raises questions about the government’s intentions regarding its stake in Vi and the broader implications for the telecom sector.

Following the equity issuance, Vodafone Idea’s promoters will hold a 37.3% stake, while the Indian government will hold a 23.2% stake. Vi raised INR 18,000 crore through a public offer in the previous months, followed by an additional INR 2,070 crore equity infusion from an Aditya Birla Group entity in May. These funds are set aside for capital expenditures and subscriber base growth. Clearing vendor dues is crucial for Vi to sustain operational growth.

While the lower share issue price could potentially cause a short-term stock dip, its long-term benefits depend on Vi’s effectiveness in utilizing the freed-up capital to improve profitability. Vi needs a clear strategic direction and strong financial performance to manage the next business and operational growth phase.

Potential Benefits: A Win-Win Situation?

Vodafone Idea’s preferential allotment strategy involves issuing shares to a select group of investors at a fixed price. The benefits include saved cash flow and fulfilled debt repayment, creating a short-term win-win situation for Vi and its vendors.

Issuing shares to creditors also makes them equity partners, providing them with potential upside in the company’s growth and eliminating the need for Vi to raise additional loans. This approach also ensures continued service provision by these key vendors and potentially facilitates future network upgrades.

The strategic timing could also convert vendor dues into long-term equity partnerships, enhancing Vodafone Idea’s operational efficiency. This, in turn, could support Vi’s growth plans over the next 12-18 months, particularly in expanding 4G coverage and launching 5G networks.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Why did Vi issue equity to Nokia and Ericsson instead of cash?

Vi faces cash flow challenges. Issuing equity allows them to settle some debt without a large upfront cash outflow. This approach can be a viable strategy for companies in similar financial situations.

How has the stock market reacted to this move?

Investors seem to approve. Vi’s stock price has seen a significant increase since the announcement, suggesting they believe the move could benefit Vi’s long-term prospects.

What are the potential benefits of this move for Vi?

Improved Cash Flow: Freed-up cash can be used for crucial network upgrades, potentially leading to more subscribers and higher revenue for Vi.

Win-Win with Vendors: Nokia and Ericsson become partial owners of Vi, incentivizing them to provide good service and potentially collaborate on network upgrades.Are there any potential risks associated with this move?

Equity Dilution: Existing shareholders’ ownership percentage will be slightly reduced due to the new shares issued.

Government Stake: The government owns a share in Vi. Their long-term plans regarding Vi remain unclear.How will this move impact Vi’s future?

The long-term impact depends on how effectively Vi uses the freed-up capital. With a clear strategic direction and robust financial performance, Vi is positioned for the next phase of business and operational growth.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.