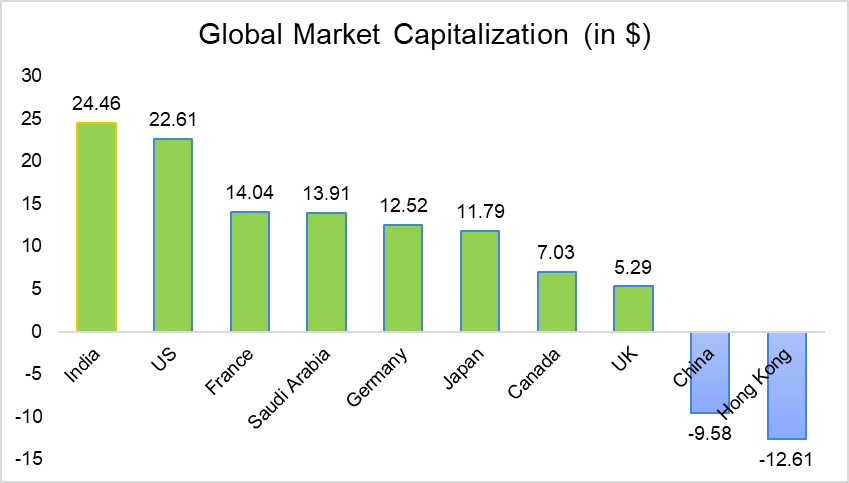

While the year was filled with economic uncertainties globally, India’s stock market has been a champion with a 25% surge in valuation, reaching a massive $4.16 trillion. The nation raced ahead of all the top 10 global markets, including giants like the US and China. This remarkable achievement marks a fifth consecutive year of growth for the Indian market.

Sturdy Fundamentals

Many factors contributed to India’s superior performance:

- India’s economic stability attracted investors with its promising growth potential.

- Increased inflows from foreign and domestic institutional investors contributed to the surge in the market.

- Despite geopolitical tensions, Indian investors remained positive, driving the market upwards.

Smaller Companies Contributed

The gains were not limited to only leading companies’ stocks. Smaller and mid-cap organizations that often have high-growth potential experienced a higher surge. The BSE MidCap and SmallCap indices shot up by 43% and 46%, and the Sensex and Nifty jumped by 17.3 % and 18.5 %, respectively.

Strong Corporate Earnings

Indian stock markets will likely see further upside because of substantial corporate earnings and a stable political environment. Nifty companies reported a 30% increase in net profits in the first half of the Financial Year 2024. Analysts expect this trend to continue, with Nifty’s EPS (earning per share) growing at an average rate of 20% over the next three years.

Bharatiya Janata Party’s (BJP) victory in essential state elections has further strengthened investor confidence. This, coupled with positive sentiment due to robust economic data, suggests that India’s macro and policy momentum will likely remain strong.

Other Markets Performances

The United States, with the world’s largest stock market at a $50.35 trillion valuation, also enjoyed a significant rally in 2023. Eased concerns about Fed interest rates, cooling inflation, and a strong job market resulted in a remarkable 22.61% expansion overall. The Dow Jones Industrial Average (DJIA), a key indicator of US market performance, climbed 12.8% throughout the year.

However, the reality differed in China, the second-largest global market with a $10.57 trillion valuation. Internal challenges like a struggling property sector and a slow post-pandemic recovery led to an 8.81% decline in 2023. This downturn showed in the Shanghai Composite Index’s performance, falling 5.7% over the year.

Different Realities in Asian Markets

While India dominated the headlines, other Asian markets experienced different luck. While Japan’s stock market grew by 11.6% to reach $6.09 trillion, Hong Kong’s shrank by 12.6% to $4.56 trillion, making the Hang Seng index drop 17.4% during the year.

Europe Recovers

In Europe, stock markets showed a positive trend. France’s stock market experienced a significant increase of 13.77%, reaching a valuation of $3.27 trillion. Similarly, the British market performed well, with an impressive growth of 5.3% to reach $3.07 trillion.

Other Market Winners

Notable gains weren’t limited to Asia and Europe. Saudi Arabia’s market capitalization saw a 13.1% increase, reaching $2.97 trillion. Similarly, Canada’s market grew by 6.63% to $2.89 trillion. Finally, Germany’s market experienced a healthy 12.25% rise, pushing its valuation to $2.39 trillion.

Looking Ahead

India’s stock market had a great year because of a strong economy. Its excellent performance increased the country’s share in the global market value to 3.77%, a significant rise from 3.4% in 2023. Given the economy’s solid performance, this is expected, with a 7.7% growth in the first half of the fiscal year (FY24).

The manufacturing and investment sectors led the charge, prompting the Reserve Bank of India (RBI) to adjust its FY24 GDP forecast to 7%. Even with a projected 6.5% average growth in the first three quarters of FY25, India’s economic engine appears firmly on track. It is pushing the stock market forward, setting the country up for more success in the future.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan