If you remember, in January 2023, some financial advisors signed off the Nifty Next 50 Index (NN50). They dismissed it as a dead investment, “difficult to classify either in terms of investment style or market caps.”

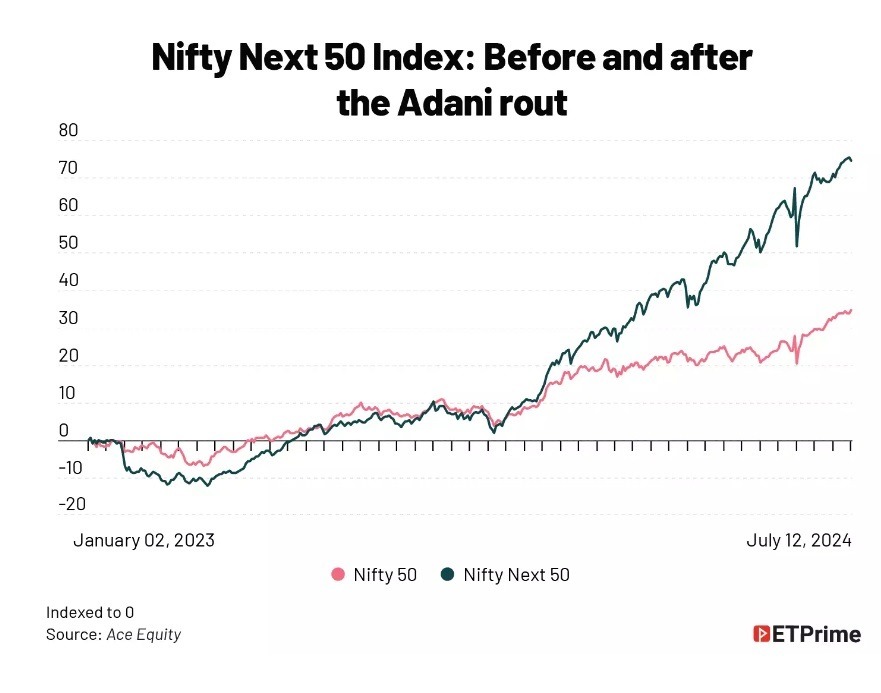

Fast-forward to today and the NN50 is making these advisors eat their words—it’s up a staggering 76% in the past year, reducing the Nifty 50’s 36% gain. So, what exactly revived the Nifty Next 50 from its near-death experience and propelled it to become one of the best-performing indices?

Let’s break down the key factors behind this remarkable comeback. But first, let’s get our basics right.

What is the Nifty Next 50 Index?

The Nifty Next 50 Index is a basket of 50 large-cap stocks from the NIFTY 100, excluding the heavyweights already present in the Nifty 50. These 50 companies represent the next generation of potential leaders, and many have graduated to the Nifty 50 itself over the past 18 years. Each stock in the NN50 carries a different weight based on its market capitalization, with larger companies having a greater influence on the index’s overall performance.

A Look at Nifty Next 50’s Volatility

This isn’t the first time the Nifty Next 50 has defied expectations. In October 2008, it jumped 40% in a month, only to surge 140% the following year. This volatility is a defining characteristic of the index. Why? Because the NN50 is constantly evolving, incorporating new and emerging companies based on market capitalization. This constant movement allows it to capture high-growth opportunities and exposes it to short-term fluctuations.

The Adani Rollercoaster and Portfolio Diversification:

In January 2023, the NN50 faced a significant challenge with the Hindenburg report on the Adani Group. At the time, Adani stocks comprised a hefty 6% of the index, making it vulnerable to the negative sentiment surrounding the report. The NN50 did experience a dip, but it was short-lived. This highlights two key strengths of the index.

- The NN50’s focus on momentum allows it to adapt quickly to changing market conditions. As the Adani situation unfolded, the weightage of Adani stocks automatically decreased due to their declining market capitalization. This built-in diversification protected the index from being overly dependent on any single company.

- The Nifty Next 50’s regular rebalancing ensured that rising stars gradually replaced underperforming companies like those in the Adani Group. This continuous churn helps the index maintain a focus on high-growth potential.

While the Adani situation caused some initial turbulence, it ultimately testified to the NN50’s resilience and ability to self-correct. This diversification benefit is a key advantage over concentrated bets on individual companies. The Hindenburg report’s impact was temporary.

By December 2022, the Adani Group’s weightage had already shrunk to 2.78%, replaced by other companies. Investors who stayed the course with the NN50 have been handsomely rewarded. Since January 2023, the Nifty 50 has been up 36%—a respectable gain but nowhere near the Nifty Next 50’s impressive 76% increase.

Riding the Momentum Wave

Looking at a 10-year horizon, the NN50 continues to outperform, delivering an annualized return of 16.43% compared to the Nifty 50’s 12.53%. This superior performance can be attributed to the NN50’s focus on momentum. Unlike the Nifty 50, which balances market cap, value, and growth, the NN50 prioritizes momentum stocks with high growth potential. This translates to higher volatility, reflected in the NN50’s PE multiple of 26x compared to the Nifty 50’s 23x.

However, volatility doesn’t necessarily equate to higher risk. Compared to the Nifty Midcap 100 Index (a more volatile index), the NN50 boasts a lower standard deviation (10% vs 12.46%) over the past 10 years, indicating smoother returns despite its focus on momentum. The NN50’s three-year rolling returns average of 14% is slightly lower than the Nifty Midcap 100’s 14.79%.

The Trent Factor: A Case Study in Momentum

The NN50’s resurgence can also be attributed to specific stock selections. In August 2023, the index reshuffled, including companies like Trent (up 235% in the past year) and Bharat Electronics (BEL, up 161% in the past year). Trent, a retail giant, was deemed “expensive” by many fund managers, but its inclusion propelled the index forward. Currently, the top 10 holdings of the NN50, representing 36% of the total, contribute 25% to its overall returns.

This concentration can be a double-edged sword. While it amplifies potential gains, it also increases risk. However, the NN50 has a history of recovering from setbacks. When the Adani Group’s weightage dropped due to the Hindenburg report, it was quickly replaced by other rising stars.

Key Takeaways

The Nifty Next 50’s remarkable comeback story offers valuable insights for investors:

- Momentum Matters: The NN50 prioritizes momentum, leading to potentially higher returns and greater volatility. Investors seeking high growth should be comfortable with this risk profile.

- Long-Term Advantage: Despite its volatility, the NN50 has historically delivered strong returns, surpassing the Nifty 50 over a 10-year horizon. It suggests it might be a good fit for investors with a long-term perspective.

- Dynamic Composition: The NN50’s regular rebalancing allows it to capture rising stars and shed underperformers. This dynamic nature helps it stay relevant and reduces concentration risk compared to holdings in individual companies.

- Not for Everyone: The NN50’s volatility might not suit risk-averse investors. Careful evaluation of your risk tolerance is crucial before investing.

Overall, the Nifty Next 50 presents a compelling option for investors seeking exposure to high-growth potential companies. Its focus on momentum and dynamic composition offers a unique approach to capturing market opportunities, but remember, it comes with inherent volatility.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 13

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan