The Unified Payments Interface (UPI) has rapidly transformed India’s digital payments landscape. Initially conceived as a peer-to-peer payment system, UPI has evolved into a versatile platform that includes a wide range of financial transactions. The recent record disbursement of Rs. 10000 cr via UPI credit has underscored UPI’s growing significance in credit disbursement.

Beyond Payments & UPI Credit

The National Payments Corporation of India (NPCI), the entity overseeing UPI, has reported a remarkable surge in credit transactions processed through the platform. With approximately Rs 10,000 crore worth of disbursed in a month via UPI credit is rapidly establishing itself as a preferred channel for lending institutions.

According to industry experts, many transactions come from the credit card feature. Pre-sanctioned credit lines on UPI are also gaining popularity, with up to ₹200 crore being disbursed through this method each month.

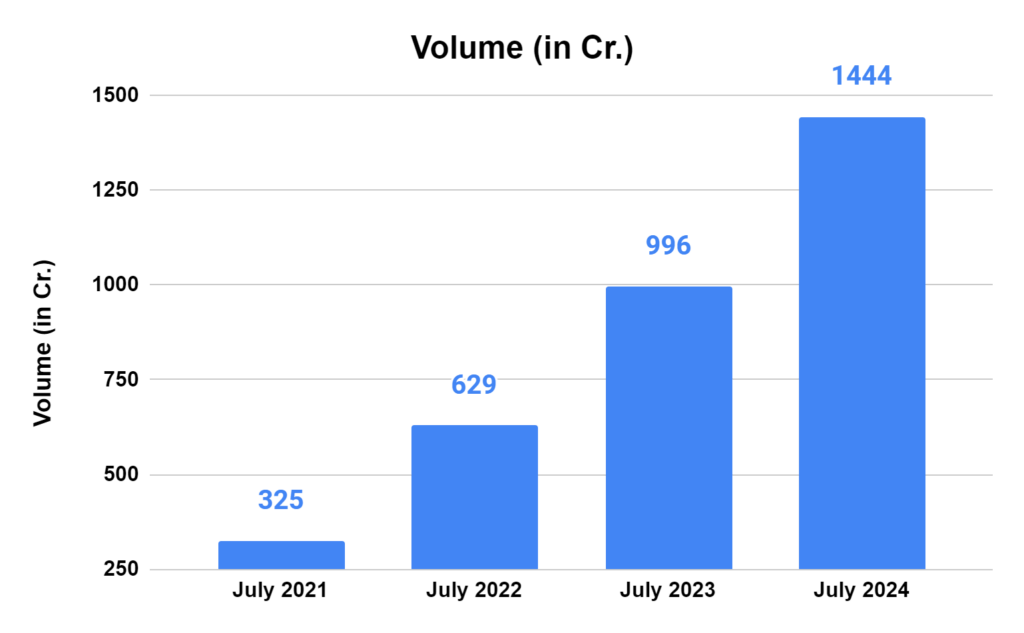

UPI Payments Y-o-Y Growth in Volume (in cr)

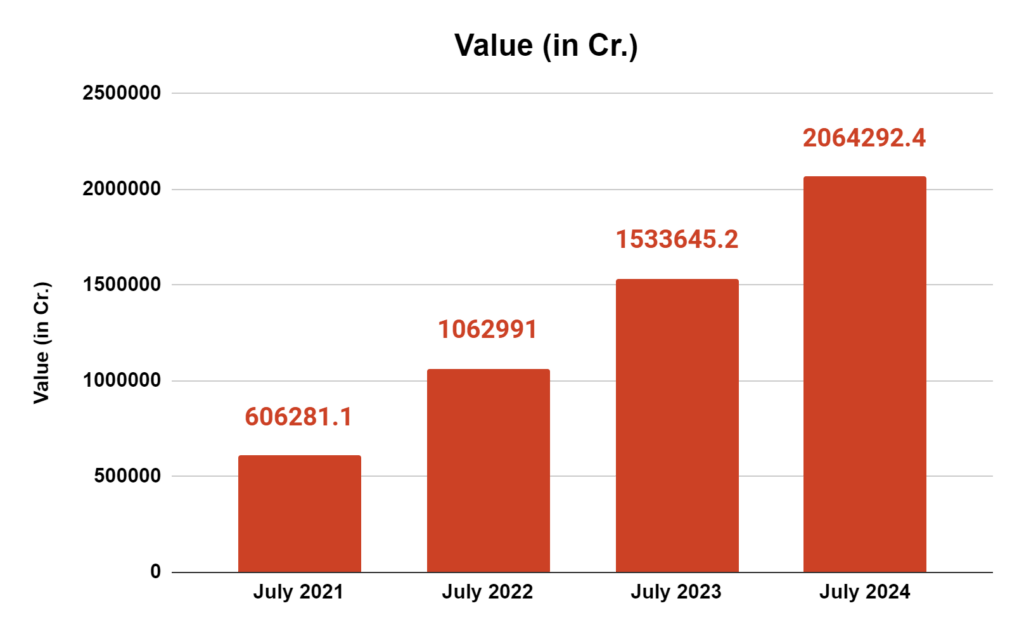

UPI Payments Y-o-Y Growth in Value (in cr)

The Mechanics of UPI Credit

There are primarily two avenues through which credit is being extended via UPI:

- Credit Card on UPI: This feature allows users to link their credit cards to their UPI apps. Subsequently, all payments made through UPI are charged to the linked credit card. This offers the convenience of using UPI for purchases while leveraging the credit facility of a credit card.

- Pre-Sanctioned Credit Lines: Several financial institutions offer pre-approved credit lines accessible through UPI. These lines of credit can be used for various purposes and provide users instant access to funds.

Driving Factors Behind the Growth

Several factors have contributed to the rapid growth of credit disbursement through UPI:

- Increased Smartphone Penetration: The widespread adoption of smartphones has made UPI credit accessible to a vast population, facilitating seamless credit transactions.

- Government Pushes for Digital Payments: The government’s concerted efforts to promote digital payments have created a conducive environment for the growth of UPI and associated services.

- Convenience and Speed: UPI’s user-friendly interface and instant transaction processing have made it an attractive option for both lenders and borrowers.

- Expanding Ecosystem: The increasing number of banks and financial institutions participating in the UPI ecosystem has broadened the range of credit products available to users.

Impact on the Financial Landscape

The integration of credit into UPI has the potential to revolutionize the Indian financial landscape in several ways:

- Financial Inclusion: By providing access to credit through a widely used platform like UPI, financial institutions can reach a larger segment of the population, including those traditionally underserved by the formal banking system.

- Boost to Consumption: Credit availability through UPI can stimulate consumption by enabling people to make larger purchases.

- Efficiency Gains: Digital lending through UPI credit can streamline loan disbursement, reducing costs and turnaround time for lenders and borrowers.

- Data-Driven Lending: UPI transactions generate valuable data that lenders can use to assess creditworthiness and tailor loan offerings to specific customer segments.

CBDC Not a UPI Competitor, Says Expert

Experts from the financial sector have clarified that the primary goal of the Central Bank Digital Currency (CBDC) is not to rival the Unified Payments Interface (UPI) but to emphasize CBDC’s unique capabilities, such as programmability, which hold immense potential for India’s financial landscape.

Challenges and Opportunities

While the growth of credit on UPI is promising, some challenges need to be addressed:

- Security Concerns: As transaction values increase, UPI’s security becomes paramount. Robust security measures are essential to protect user data and prevent fraud.

- Regulatory Framework: Clear and comprehensive regulations are required to govern credit disbursement through UPI, safeguarding the interests of both lenders and borrowers.

- Consumer Protection: Adequate measures must be in place to protect consumers from predatory lending practices and provide them with necessary information about credit products.

Despite these challenges, the potential benefits of credit on UPI are immense. UPI is poised to become a powerful tool for driving financial inclusion and economic growth in India as the ecosystem matures and regulatory frameworks are strengthened.

Conclusion

Credit integration into UPI marks a significant milestone in the evolution of digital payments in India. With its ability to reach a vast population, enhance financial inclusion, and streamline lending processes, UPI has the potential to reshape the country’s financial landscape. As the platform continues to grow and evolve, it is essential to address the associated challenges to harness its full potential.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is UPI, and how does it work for credit disbursement?

UPI stands for Unified Payments Interface. It’s a digital payment system that allows users to transfer money between bank accounts using a smartphone app. For credit disbursement, UPI can be used in two primary ways – linking your credit card to your UPI app enables you to make purchases using UPI and pay later with your credit card. Some financial institutions offer pre-approved credit lines accessible through UPI, providing instant access to funds for various needs.

Is it safe to use UPI for credit transactions?

Yes, using UPI for credit transactions is generally safe. UPI employs robust security measures to protect user data and transactions. However, as with any digital payment system, it’s essential to use strong passwords, avoid sharing sensitive information, and keep your device secure.

What are the benefits of using UPI for credit?

UPI provides several benefits for credit transactions, including convenience, as it is easy to use and accessible via smartphones. It also offers speed, with transactions processed almost instantly, and security, with an encrypted and secure payment system. Additionally, UPI promotes financial inclusion by expanding access to credit for a broader population.

Will UPI replace traditional credit cards or loans?

While UPI is gaining popularity for credit disbursement, it’s unlikely to replace traditional credit cards or loans completely. UPI offers a convenient and efficient way to access credit for smaller transactions and short-term needs. However, traditional methods may still be preferred for larger loans or long-term credit requirements.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan