It was not an easy journey for the celebrated fund manager Prashant Jain. He took a contrarian bet on PSU stocks when everyone else wrote them off as value creators. Because of severe underperformance, he endured constant criticism from investors about the funds he managed.

He had to defend his positions multiple times, and questions about whether he had lost the magic touch were raised. But his conviction and patience—more than eight years—paid off, and he had the last laugh in the market. PSU stocks are now street favorites. Everyone wants to have them in their portfolio. Some stocks have now jumped more than 300% in the last year.

The question is whether the surge in PSU stocks will continue in the coming months and years or if it is a fad. Let’s take a closer look at the PSU sector.

How Did PSU Stocks Perform?

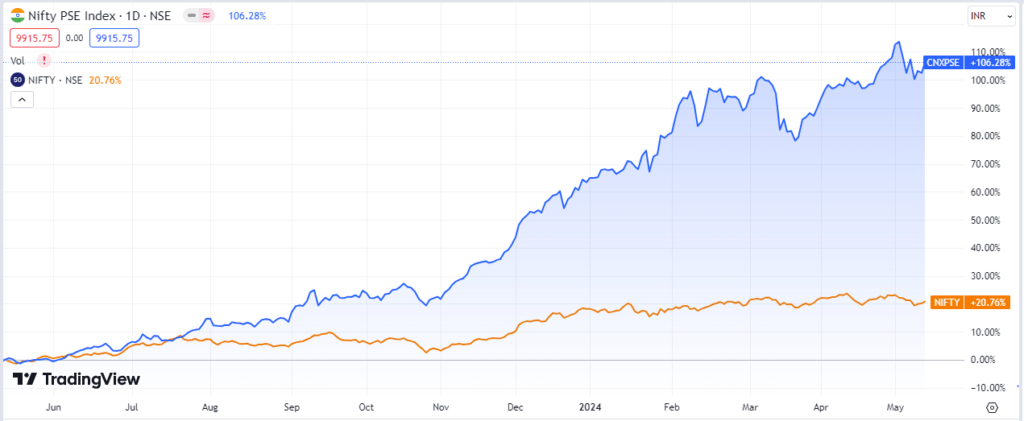

If we look at the Nifty PSE index, which comprises 20 public sector enterprises, as of 30 April 2024, it has returned more than 113% in a year ending 30th April 2024. The Nifty 50 index returned around 25% during the period.

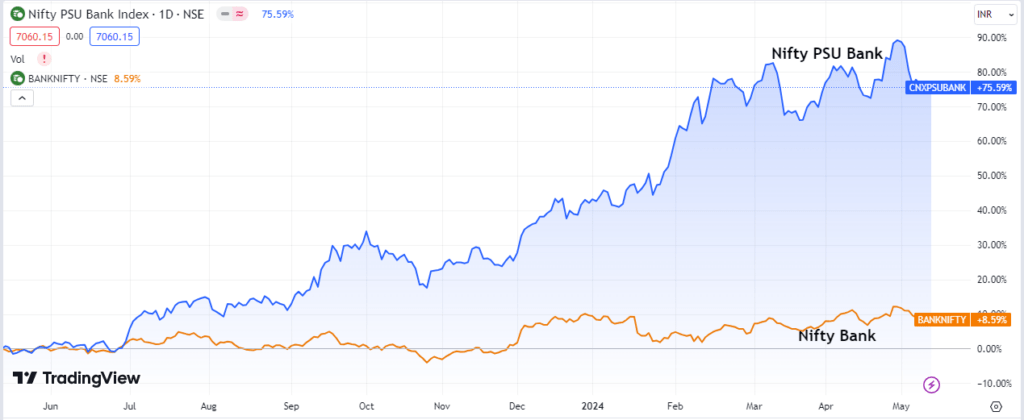

When it comes to public sector banks, the Nifty PSU Bank index, which comprises 12 public sector banks, rose by close to 82.49% in the last year, as of 30 April 2024, while the Nifty Bank index rose by 14.25% during the same period.

Railway Stocks

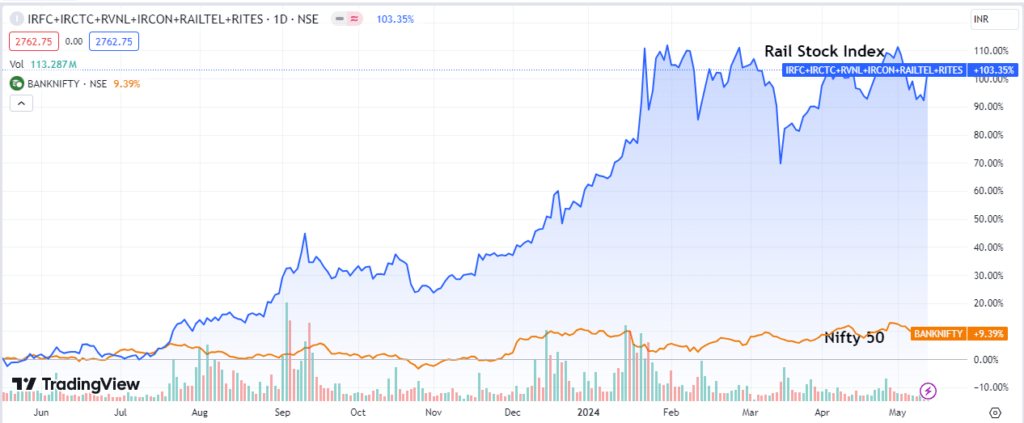

We also analyzed the performance of railway stocks during the same period, and it outperformed both the Nifty CPSE index and the Nifty PSU Bank index, creating significant value for investors.

In the chart above, we have curated a custom railway stock index of equal weightage on TradingView that includes IRFC, IRCTC, RVNL, IRCON, RAILTEL, and RITES. As of May 14th, 2024, the index rose by more than 133% in the last year.

Factors Contributing To The Great PSU Rally

The impressive rally provided insight into the space’s long-term growth potential. This segment will discuss the factors contributing to the impressive rally in PSU and PSU bank stocks.

Attractive Valuations

The rally in PSU stocks began in 2020, following a sharp market drop during which many stocks’ values became extremely attractive. But, if you closely analyze the PSU stocks, they were experiencing a steep decline in their price, even before the Covid-induced fall in the market.

Between 2018 and 2020, the Nifty CPSE index declined by 55%. From 2009 to 2017, PSU stocks stayed mostly range-bound without giving good returns to investors. This resulted in attractive valuations of PSU stocks. Since many traded at deep discounts, investors lapped them up when the situation turned favorable, fueling their historic rally.

Improved Efficiency of Public Sector Companies

The government’s consistent effort to improve the fundamentals of PSU companies has yielded huge dividends. Since FY20, their operational capabilities have become starkly efficient.

| Nifty CPSE Index Stocks | FY20 | FY23 | ||

| Revenue (in ₹ cr) | Net Profit (in ₹ cr) | Revenue (in ₹ cr) | Net Profit (in ₹ cr) | |

| NTPC | 109464 | 11902 | 176207 | 17121 |

| Power Grid | 37744 | 11059 | 45581 | 15417 |

| ONGC | 396728 | 11456 | 632291 | 32778 |

| Coal India | 96080 | 16700 | 138252 | 28125 |

| Bharat Electronics | 12968 | 1825 | 17734 | 2986 |

| NHPC | 10008 | 3345 | 10067 | 4235 |

| Oil India | 18612 | 5030 | 36097 | 13144 |

| SJVN Ltd | 2703 | 1567 | 2938 | 1359 |

| NBCC | 5210 | 80 | 6736 | 231 |

| NLC India Ltd | 10325 | 1453 | 16165 | 1426 |

| Total | 699842 | 64417 | 1082068 | 116822 |

| % Growth | 54.62 | 81.35 | ||

Studying the revenue and profit growth of Nifty CPSE index companies, you can see that, despite slower revenue growth between FY20 and FY23, these companies have increased profitability, indicating improved operational efficiencies.

In public sector banks, NPAs decreased significantly during the same period, and net profit multiplied several times.

| Top 5 PSBs | FY20 | FY23 | ||

| NPA (in %) | Net Profit (in ₹ cr) | NPA (in %) | Net Profit (in ₹ cr) | |

| State Bank of India | 2.23 | 14488 | 0.67 | 50232 |

| Bank of Baroda | 3.13 | 546 | 0.89 | 14110 |

| Canara Bank | 5.73 | -2236 | 1.73 | 10604 |

| Punjab National Bank | 5.78 | 336 | 2.72 | 2507 |

| Union Bank of India | 5.49 | -2898 | 1.70 | 8433 |

The table above shows how the asset quality of the top five public sectors has improved, leading to operational efficiency, business expansion, and profitability surge.

Low Free Float

One of the hidden factors contributing to the impressive rally of PSU stocks is the low free float, which means fewer shares are available for trading to the public. Therefore, when the demand for PSU stocks exploded, the price of stocks increased dramatically due to the fewer stocks available for trading.

For example, the total market cap of LIC is ₹6.15 lakh crores and has a free float of ₹24,618 crores as of 20th April 2024, meaning just 4% of the total shares are available for trading. IRFC also has a total market cap of ₹1,84,265.93 crores and has a free float of ₹25,797.23 crores as of 20th April 2024. Only 14% of the total shares are available for trading.

Are PSU Stocks Overvalued?

Questions arising after the historic rally revolve around PSU stocks becoming expensive and less attractive. One of the best ways to find the answer is to examine PE ratios, which provide key details about valuations. PE, or the price-to-earnings ratio, indicates how much you pay for every rupee of earnings. So, if the PE is 20, you are paying ₹19 as a premium for the stock.

The Nifty CPSE index’s PE ratio hovers around 13. However, it is difficult to determine whether the index is overvalued with a single number. Therefore, we will consider the index’s 5-year average PE of approximately 8.25, which indicates that the PSU stocks are overvalued.

What’s Next?

The government’s continuous push to increase economic demand through massive capital spending is expected to help PSU companies boost their profitability with future revenue growth and other operational metrics. PSU stocks may appear expensive presently and may not give investors the same impressive returns as they did in the previous three years. However, keeping a long-term outlook is essential for investing in PSU stocks because predicting the market is difficult and impossible.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What are PSU Stocks?

PSU stocks are stocks of companies where the government is the majority stakeholder, meaning it holds more than 50% of the company’s shares.

Should we invest in PSU Stocks?

The fundamentals of PSU stocks have improved over the last few years. If the PSU stocks showcase impressive earnings growth in the coming quarter, along with improved fundamentals, then you can consider investing in those PSU stocks.

What are the top PSU stocks in India?

Top PSU stocks in India by market capitalization include ONGC, NTPC, Coal India, Power Grid, SBI, Bank of Baroda, etc.

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 15

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan