The Reserve Bank of India (RBI) made significant announcements during its fourth bi-monthly monetary policy review. The 6-member Monetary Policy Committee (MPC) addressed these decisions against global challenges and macroeconomic uncertainties.

Unanimous Stand: Rates Remain Unchanged

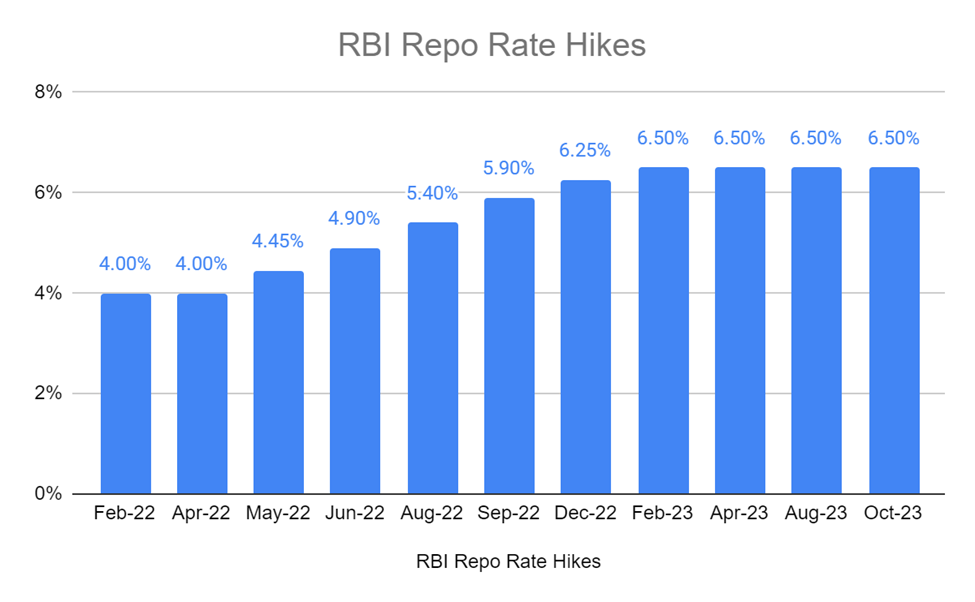

The MPC has unanimously chosen to maintain the current rates. The repo rate, which dictates how banks borrow from the RBI, has stood at 6.5% since its last increase in February 2023.

The RBI’s stance remains consistent – focusing on “withdrawal of accommodation”. This implies a deliberate approach to managing the money supply and curbing potential inflationary pressures.

Rationale Behind Policy Stance

Governor Shaktikanta Das cited several factors influencing the MPC’s decision. These include uncertainties from reduced Kharif sowing in vital crops like pulses and oil seeds, declining reservoir levels, and fluctuating global food and energy prices.

Consumer Price Index

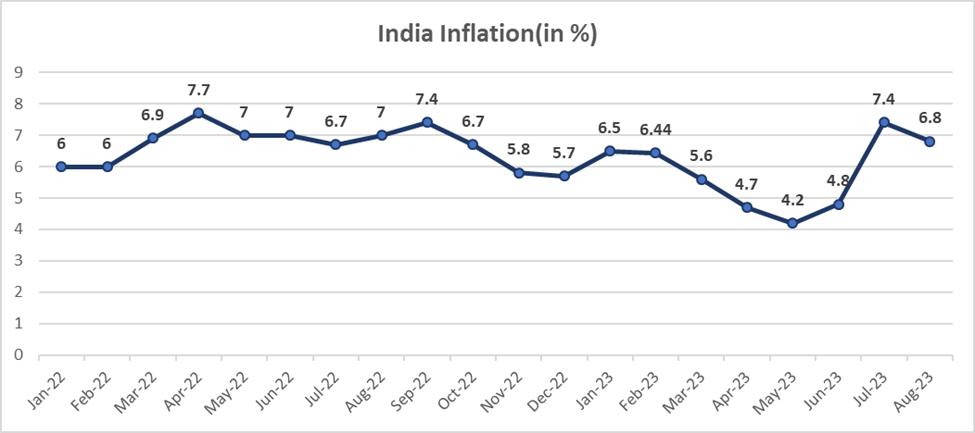

The Consumer Price Index (CPI)–based inflation, or retail inflation, showed a notable decrease from 7.44% in July to 6.83% in August. The reaffirmation of the 4% inflation target is significant, as opposed to the earlier 2 – 6% band.

Considering the cumulative 250 basis point policy repo rate hike and evolving inflation growth dynamics, the MPC opted to maintain the status quo.

Key Takeaways

- While the decision to keep rates unchanged wasn’t surprising, the MPC’s guidance tone was noteworthy.

- The RBI retains its GDP growth forecast at 6.5% and inflation at 5.4% for FY24.

- The RBI may consider open market government securities operations to align with its monetary policy stance.

- This fourth pause in rate hikes brings relief to the markets. Investors and businesses keenly follow these decisions, as rate hikes can significantly impact various sectors of the economy.

The RBI’s decision to maintain the current rates reflects a cautious approach in the face of economic uncertainties. This steady stance aims to balance inflation control and economic growth.

FAQs

Why did the MPC choose to keep rates unchanged?

The MPC aims to balance inflation control with economic growth amidst uncertain global and domestic factors.

How does the RBI’s decision impact the market?

The decision provides relief and avoids increased borrowing costs, which could have widespread economic repercussions.

What is the potential role of open market operations in the RBI’s strategy?

Open market operations in government securities could be used to align with the RBI’s monetary policy stance.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan