Introduction

This Bank started as an NGO, became an NBFC, and finally became a universal bank. Driven by the philosophy of ‘Aapka Bhala. Sabki Bhalai.’, (Your benefit. Everyone’s welfare.) Bandhan Bank’s core purpose has graduated from financial inclusion to inclusive banking.

Let us understand more about Bandhan Bank.

Bandhan Bank Company Overview

Bandhan was set up in 2001 as a not-for-profit entity with the objective of financial inclusion and women empowerment through sustainable livelihood creation. It started its microfinance operations from Bagnan, a small village about 60 km from Kolkata. The model followed for delivering microfinance services was individual lending through group formation. Bandhan focused on serving under-banked and underpenetrated markets.

In 2006, Bandhan acquired a Non-Banking Financial Company (NBFC) and created Bandhan Financial Services Private Limited (BFSPL) to scale up its microfinance activities. 2010 it became the country’s largest microfinance institution (MFI).

In April 2014, Bandhan received in-principle approval from the Reserve Bank of India (RBI). On June 17, 2015, RBI granted the banking license to Bandhan, making it the first-ever microfinance institution to become a universal bank in India.

Bandhan Bank commenced operations on August 23, 2015. The then Union Finance Minister, Late Shri Arun Jaitley, inaugurated the Bank in Kolkata. Its public shareholders then included the International Finance Corporation; Caladium Investment Pte Ltd (Singapore’s sovereign wealth fund, an arm of GIC); and the Small Industries Development Bank of India (SIDBI).

On 27 March 2018, Bandhan Bank was listed on the bourses and became the 8th largest bank in India by market capitalization on the day of listing itself.

Bandhan Bank Journey

The timeline below depicts the Bank’s journey since inception and the most important events contributing to its growth and success.

- 2001: Bandhan started as a society for financial inclusion and women’s empowerment through sustainable livelihood creation. Started microfinance operations in rural Bengal.

- 2006: Bandhan acquired an NBFC and established Bandhan Financial Services Limited – keeping the core objective of financial inclusion intact

- 2009: The microfinance portfolio was transferred from society to NBFC

- 2010: Bandhan became the largest microfinance institution (MFI) in the country

- 2015: Bandhan Bank started operations as a universal bank on August 23. It became the first microfinance company in India to get a universal banking license. On the day of the launch, the bank started with 2523 banking outlets

- 2018: On the day of listing, Bandhan Bank emerged as the 8th most valued bank based on market capitalization

- 2019: Bandhan Bank acquired the stake of HDFC Limited in GRUH Finance, one of India’s most affordable housing companies.

- 2020: The bank set up its 1000th bank branch and 4000th booking outlet

- 2021: Crossed the milestone of INR 1,50,000 crore in total business

Bandhan Bank Management Profile

- Mr. Chandra Shekhar Ghosh: CEO and Managing Director – Chandra Shekhar Ghosh is the visionary founder of Bandhan Bank. He was crucial in establishing Bandhan as a microfinance institution and later converting it into a scheduled commercial bank. He has been recognized by esteemed enterprises for his exemplary work.

- Mr. Ratan Kumar Kesh: Chief Operating Officer – Mr. Ratan has over 27 years of experience across industries in leadership roles. During his tenures at ICICI Bank, HDFC Bank, Yes Bank, and Axis Bank, he led organizational transformations focusing on technology, digitalization, governance, quality, and customer satisfaction.

- Mr. Sunil Samdani: Chief Financial Officer – Mr. Samdani spearheads the functions of Finance, Investor Relations and Business Intelligence. In his experience of over 23 years in financial services, he has handled multiple roles within the finance and strategy functions. Before joining Bandhan Bank as CFO, Mr. Samdani held important positions like the Head of Business Analytics and Strategy at Development Credit Bank and CFO at Karvy Financial Services Ltd.

- Mr. Shantanu Banerjee: Head of Human Resources – Mr. Banerjee leads human resources, training, and legal. In his previous role, he was Head of HR – Business Relationships at Axis Bank. He was responsible for the strategic interface of Corporate HR with all business verticals at Axis Bank. He has over 25 years of experience in the banking and finance industry.

- Mr. Biswajit Das: Chief Risk Officer – Mr. Das spearheads the Risk Management for the Bank, including Information Security. He has around three decades of experience in the Banking sector, spanning areas like Risk Management and Governance, Business Development, Strategy, Post-merger integration, Process Excellence, and Service Quality. His last assignment was as Head – Risk Based Supervision and Regulatory Reporting at ICICI Bank.

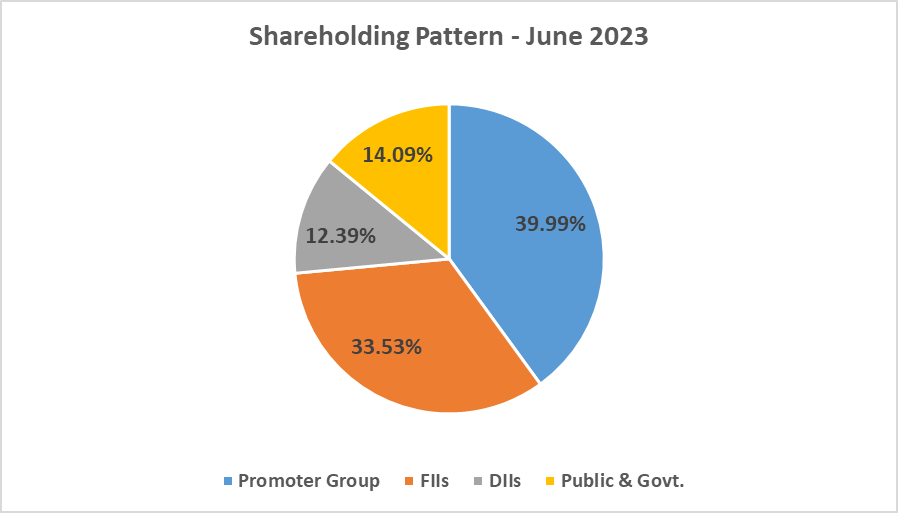

Bandhan Bank Shareholding Pattern

Bandhan Bank Business Segments

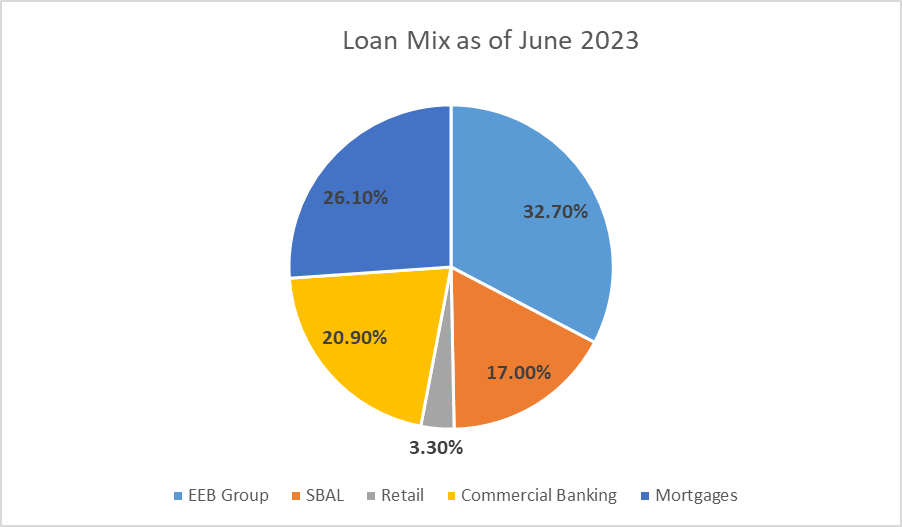

Bandhan Bank started with microfinance lending but has adopted a strategy of diversification to de-risk itself from the highly risky MFI segment. The bank now operates in the following segments:

- Microfinance lending

- Housing Finance

- Commercial banking

- Retail finance

Note:* EEB is Emerging Entrepreneurs Business, including micro loans, home loans, micro bazaar loans, and micro-enterprise loans. SBAL is Small Business & Agri Loans.

Bandhan Bank is looking to do more secured lending and reduce exposure to the MFI segment as a conscious strategy. The Bank wants to raise secured lending to 70% of the loan book by March 2025.

Bandhan Bank Financials

Core Operating Profit and Net Profit

Bandhan Bank registered a net profit of INR 721 Cr during Q1FY24 against a net profit of INR 887 Cr in Q1FY23. Net interest income (NII) in Q1FY24 came in at INR 2,491 Cr, broadly similar to INR 2,514 Cr delivered during Q1 FY23. PAT in Q1FY24 was reduced due to higher slippages, other expense growth, and income reduction.

| Particulars (In INR Cr) | Q1FY24 | Q4FY23 | QoQ% | Q1FY23 | YoY% |

| Interest Income | 4,522.9 | 4,268.3 | 5.97% | 4,055.4 | 11.53% |

| Interest Expense | 2,032.3 | 1,796.5 | 13.14% | 1,540.9 | 31.87% |

| Net Interest Income (NII) | 2,490.6 | 2,471.8 | 0.77% | 2,514.5 | -0.93% |

| Non-Interest Income | 385.1 | 629.1 | -38.79% | 329.8 | 16.78% |

| Net Total Income | 2875.7 | 3100.9 | -7.26% | 2844.3 | 1.12% |

| Operating Expenses | 1,313.4 | 1,305.3 | 0.61% | 1,023.6 | 28.29% |

| Operating Profit | 1,562.3 | 1,795.7 | -12.97% | 1,820.6 | -14.15% |

| Provision (Std. + NPA) | 602.1 | 734.8 | -18.10% | 642.4 | -6.29% |

| Profit Before Tax | 960.2 | 1,060.9 | -9.43% | 1,178.2 | -18.44% |

| Tax | 239.2 | 252.6 | -5.14% | 291.7 | -17.72% |

| Profit After Tax | 721.0 | 808.3 | -10.77% | 886.5 | -18.97% |

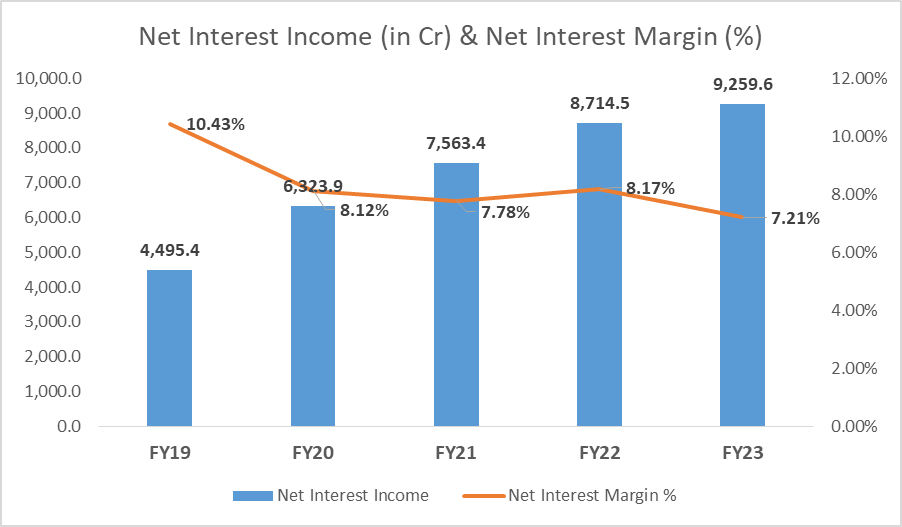

Net Interest Income & Net Interest Margin

Net Interest Income (NII) is the difference between the interest earned on a bank’s assets (such as loans and investments) and the interest paid on its liabilities (such as deposits and borrowings).

Net Interest Margin (NIM) is calculated by dividing the NII by the average interest-earning assets.

NIM has remained stable in the 7-8% range for the last four years, from FY20 to FY23. Bandhan Bank delivered a NIM of 7.3% in Q1FY24. NIM range is higher for Bandhan vs. other banks due to the nature of high-risk lending that it does, especially in the micro-finance segment.

NII, however, has grown significantly from INR ~4,500 Cr in FY19 to INR 9,260 Cr in FY23 on the back of an increase in loan book while maintaining the NIMs in the 7-8% range.

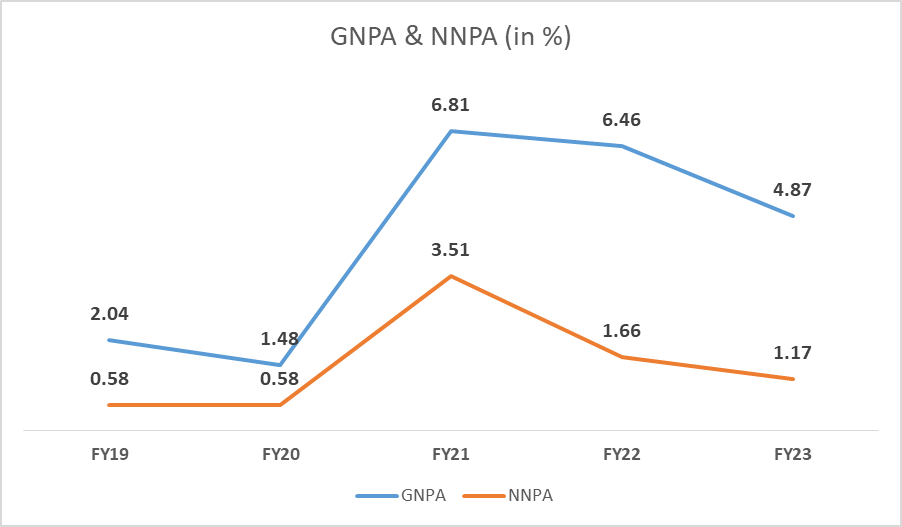

Asset Quality

NPA stands for Non-Performing Asset. It refers to a loan or an advance where the borrower has not paid the interest or the principal amount for a specified period, usually for 90 days or more.

Gross NPA refers to the total value of a bank’s non-performing assets. Net NPA, on the other hand, is the value of NPA after reducing the provisions made by the bank to cover the losses that may arise from such non-performing assets.

Bandhan Bank operates in the high-risk micro-finance segment where NPAs are traditionally very high, hence the high lending rate. NPAs went up significantly during COVID-19, as seen in the chart below. However, GNPA and NNPA have improved from FY21, driven by improved collection and recovery post-Covid.

For Q1FY24, GNPA/NNPA ratios deteriorated 189bn/101 bp to 6.8%/2.2% primarily due to ECLGS (Emergency Credit Line Guarantee Scheme) covered advances amounting to INR 5.8 bn being classified as NPA as per RBI Circular.

Note: The ECLGS scheme was launched as a part of the Atma Nirbhar Bharat package for the Micro, Small, and Medium Enterprises (MSME) borrowers to mitigate the distress caused by the COVID-19 pandemic.

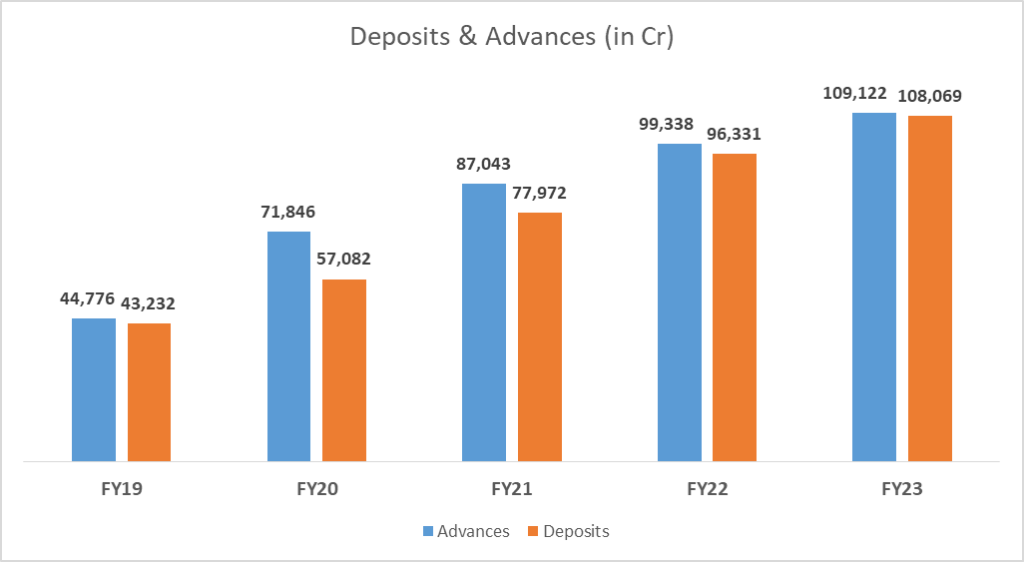

Advances & Deposits

An advance refers to a loan or credit extended by a bank to its customers. Banks offer various advances such as personal, business, home, education, vehicle, and credit card loans.

Advances grew to INR 1031.7 bn in Q1FY24, led by solid Non-MFI (Microfinance) portfolio growth. The MFI book declined 12% YoY to INR 513 bn in Q1FY24, decreasing the MFI share in the total book to 50% from 60% in Q1FY23.

Deposits are a critical source of funding for banks, and they use these funds to provide loans and advances to customers.

Deposits grew 16.6% YoY to INR 1084.8 bn in Q1FY24, led by 31% YoY growth in Term Deposits, while CASA (Current Account & Savings Account) declined 8% QoQ due to the rundown of one large account. CASA ratio declined 330 bp QoQ to ~36%. The retail deposit mix was steady at 71% in Q1FY24.

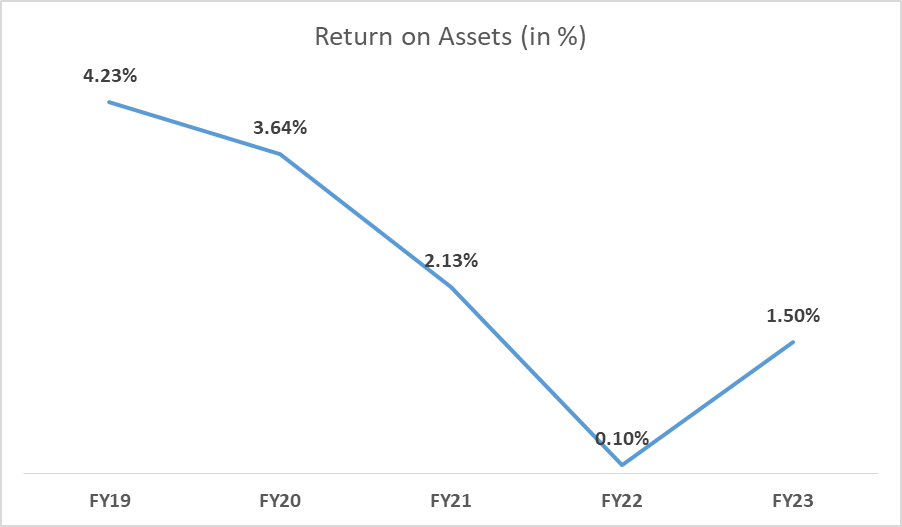

Return on Asset

Bandhan Bank has seen its ROA (A higher RoA suggests that a bank is more efficient in generating profits from its assets) reduce to 0.22% in FY22 due to Covid-related losses from ~4%+ in FY19 and FY20.

This has started to improve in FY23 and is expected to keep improving due to reduced provisions & NPA, growth in the Non-MFI loan book, and improvement in NIMs.

Bandhan Bank Share Price History

Bandhan Bank currently stands at a Market Capitalisation of INR 36,881 Cr (as of 4th July 2023), while the same at the time of IPO was at INR ~57,000 Cr in March 2018.

The stock has been correcting since then, and its five-year share price CAGR has been -20% (from 4th July 2018 to 4th July 2023). This has been chiefly due to the challenging external environment and the unsecured nature of lending done by Bandhan Bank.

However, the financial situation is improving now and is expected to improve as the economy grows. The share price is accordingly likely to do well.

Bandhan Bank

Bandhan Bank has had to face many challenges due to the unsecured nature of its lending. The Bank is now diversifying and working to achieve 70% secured lending by FY25. This should reduce the risk and provide better growth opportunities for the bank.

The bank’s operations have primarily been in the country’s West Bengal and North East regions. However, the bank is looking to grow actively outside these geographies with a sharp focus on the Small Business and Agri Loans segment.

Bandhan Bank is also looking to scale its housing business aggressively after acquiring Gruh Finance. This should further diversify the loan book and allow Bandhan Bank to expand using Gruh’s existing branch network.

Key risks:

- More than expected stress arising out of the EEB book (Emerging Entrepreneurs loan book), which is mostly unsecured loan

- Less than expected loan growth going forward

- External shocks like Covid-19 can have severe consequences on the health of the bank

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the 52 Week High and Low of Bandhan Bank?

52 Week’s high of Bandhan Bank is INR 314.75, and 52 Week low of Bandhan Bank is 182.2 per share.

What is the face value of the share of Bandhan Bank Ltd.?

The face value of Bandhan Bank’s share price is INR 10 per share.

How useful was this post?

Click on a star to rate it!

Average rating 3.4 / 5. Vote count: 9

No votes so far! Be the first to rate this post.