Dabur has been a household name in India’s FMCG sector for over 100 years. It has successfully transitioned from a family-run business to a professionally managed company with the world’s largest herbal and natural product portfolio.

In this article, we will analyze the company and understand its long-term. potential and impact on Dabur share price.

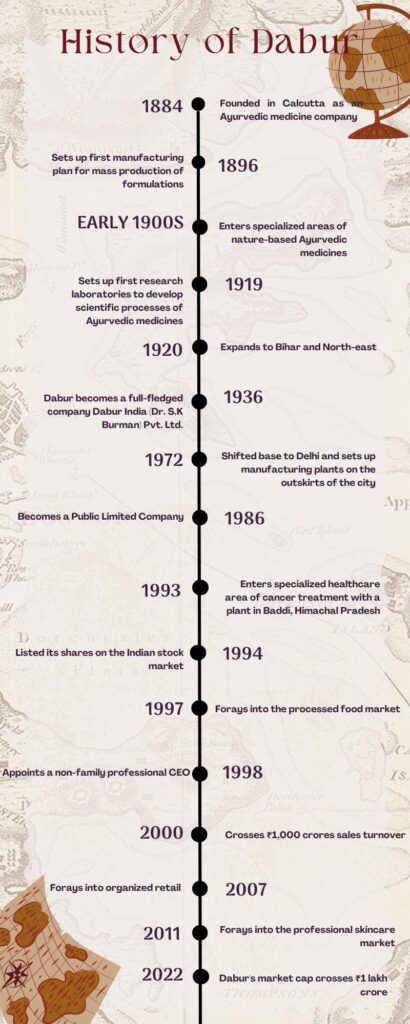

Dabur Company Journey

Dr. S.K Burman founded Dabur intending to provide an effective and affordable cure for common diseases in rural parts of the country. A timeline of how it has become a leading FMCG company in India.

Business Overview of Dabur

Dabur has expanded into multiple FMCG segments and presence in 120 countries. The group began simplifying its business activities and management based on its product mix in 1996, with the creation of three separate divisions- Healthcare, Products Division, and Family Product Division & Dabur Ayurvedic Specialties Limited.

Dabur currently operates in the three business segments listed below:

- Consumer care business: Includes home care, personal care, and health care

- Food business: Juices, beverages, and culinary

- Other segments: Guar gum, pharma, and others

Dabur Management Profile

Dabur is a professionally managed company led by CEO Mr. Mohil Malhotra. He joined the company in 1994 as a management trainee. Mr. Malhotra is a passionate advocate and is responsible for the company’s strategic direction and continued growth.

Mr. P.D Narang is the Group Director and has played an instrumental role in the growth of the company. He is the first Dabur employee to be elevated to the rank of Director. Mr. Narang is a Chartered Accountant and was behind the company’s successful IPO and has led several new ventures like Aviva Life Insurance and other overseas acquisitions.

Mr. Ankush Jain is the Chief Financial Officer and has varied experience in some of the large global MNCs. He is a Chartered Accountant and Company Secretary by profession and oversees all things related to financial matters across Dabur’s operations spanning five continents.

Mr. Biplab Bakshi is the Chief Human Resource Officer, and Mr. Rahul Awasthi is the Head of Operations, looking after the supply chain, manufacturing, procurement, packaging, and quality assurance functions across the globe.

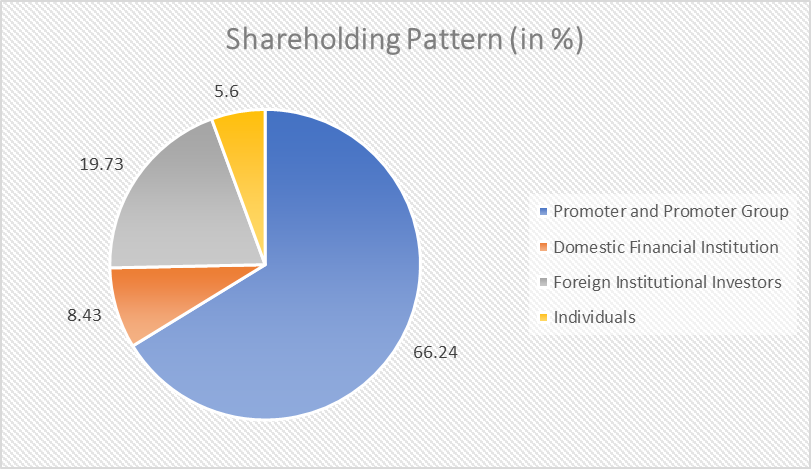

Dabur Shareholding Pattern

Dabur Company Analysis

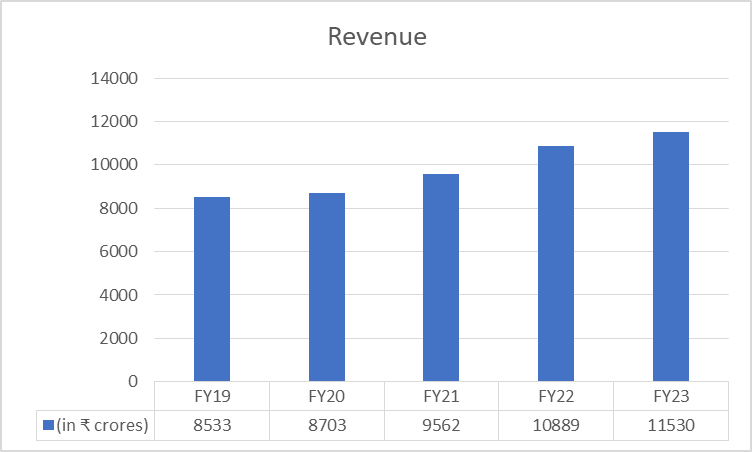

Revenue

In FY23, Dabur’s revenue from operations came in at ₹11,530 crores, up by 5.9% compared to the previous fiscal at ₹10,889 crores. During the year, 25.1% of sales revenue came from international markets, while 71.3% came from domestic markets. The consolidated revenue in the last three years has grown at a CAGR of 10%.

Segment Revenue Breakup

| FY21 (in ₹ cr.) | FY22 (in ₹ cr.) | FY23 (in ₹ cr.) | |

| Consumer care business | 8402.97 | 9193.76 | 9,261.51 |

| Food business | 984.73 | 1461.28 | 1,918.56 |

| Retail business | 57.30 | 77.19 | 110.96 |

| Other segments | 94.43 | 123.36 | 137.53 |

EBITDA

| FY19 | FY20 | FY21 | FY22 | FY23 | |

| EBITDA (in ₹ cr.) | 2035.7 | 2097.7 | 2327.9 | 2647 | 2609.5 |

| EBITDA Margin | 23.9% | 24.1% | 24.3% | 24.3% | 22.6% |

Segmental Profit Before Interest Cost, Amortisation, and Tax

| FY21 (in ₹ cr.) | FY22 (in ₹ cr.) | FY23 (in ₹ cr.) | |

| Consumer care business | 2066.5 | 2218.19 | 2041.76 |

| Food business | 130.66 | 228.15 | 313.56 |

| Retail business | -9.94 | -3.73 | -1.25 |

| Other segments | 7.34 | 9.54 | 16 |

Net Profit

| FY19 | FY20 | FY21 | FY22 | FY23 | |

| Net Profit (in ₹ cr.) | 1442.3 | 1445 | 1693.3 | 1739.2 | 1707.2 |

| Net Profit Margin | 16.9% | 16.6% | 17.7% | 16% | 14.8% |

Dabur Key Financial Ratios

Current Ratio: At the end of FY23, Dabur’s current ratio decreased marginally to 1.18 times from 1.30 times in FY22.

Debt-to-equity ratio: On 31st March 2023, Dabur’s debt-equity ratio stood at 0.13 times.

Interest service coverage ratio: The company’s interest service coverage ratio is 33.35 times at the end of 31st March 2023.

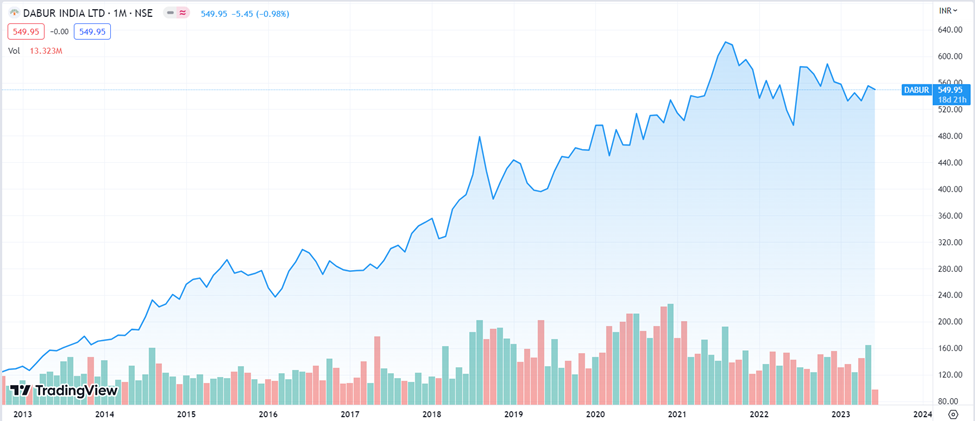

Dabur Share Price History

The company launched its IPO in the year 1994, and the issue was oversubscribed by 21 times despite its high premium. Since its listing, Dabur has announced four bonus issues, and its equity shares were split once in the ratio of 1:10.

Also, it has a consistent track record of paying dividends to its shareholders. In the last three years, it has paid dividends of ₹3.3 in 2020, ₹5.5 in 2021, and ₹5.2 in 2022.

Dabur’s share price has increased at a CAGR of 14.98% over the last decade, rising from around ₹136.10 in May 2013 to ₹550 on June 9, 2023. It reached an all-time high level of ₹658.95 on 1st September 2021. As of 9th June 2023, its market cap was ₹97,453 crores.

Dabur Fundamental Analysis

Over the years, the company has expanded both its product portfolio and geographical coverage diversifying it to target the high-growth areas of the FMCG industry. While the company’s domestic business witnessed a growth of 6.2% in FY23, the international business grew by 11% in constant currency terms.

Consumer Care Segment

The segment includes home care, personal care, and health care businesses and is the cash cow of the company. It has brought in a little over 80% of the group’s revenue in FY23. Revenue from Digestives, Home Care, Oral Care, and Shampoo witnessed strong growth in FY23. The Home Care division that houses products like Odomos, Odonil, and Sanifresh has recorded double-digit revenue growth at 23% in FY23.

Digestives, Oral Care, and Shampoo have recorded revenue growth of 10.4%, 5%, and 8%, respectively, in FY23. The Health Supplements and OTC & Ethicals division has witnessed revenue degrowth of 12.4% and 4.2%, respectively, in FY23.

Food & Beverages Segment

The food and beverages segment is a high-growth segment and continues to be on a strong trajectory. In FY23, revenue increased by 30% in the Beverages segment and 28% in the Foods segment.

Its Real juice and fruit drinks product portfolio saw a market share gain in FY23, and 3-Y CAGR revenue growth is 22%. In the last three years, the foods business, which includes Hommade cooking paste and purees, has grown at a 20% CAGR. The addition of Badshah Masala to the Foods portfolio is also adding momentum to growth.

Dabur’s Acquisition of Badshah Masala

It was a strategic acquisition made to foray into the ₹25,000 crores branded spices and seasoning market and expand its Foods business to ₹500 crores in three years. Dabur acquired a 51% stake in Badshah Masala for ₹587.52 crores. The remaining 49% stake will be acquired in the next five years.

Dabur Share Price Growth Potential

Indian FMCG Market

The country’s organized FMCG market was valued at $110 billion in 2020 and is expected to grow at a CAGR of 27.9% from 2021 to 2027, reaching nearly $615 billion.

If we look at the demographic divide, in 2022, the urban segment contributed 55% of the total FMCG sales, and the remaining came from rural India. And the Indian processed food market is projected to expand to $470 billion by 2025, up from $263 billion in FY20.

Favorable government policies like the Production Linked Incentive Scheme for the Food Processing Industry, FDI liberalization, and growth of online grocery commerce are contributing to the growth of the Indian FMCG market.

Dabur Growth Trajectory

Dabur’s FY23 has been a mixed bag due to an uncertain business environment in the first half of the fiscal year. The volume growth was almost flat in Q4FY23 at 1% compared to a degrowth of 3% in the previous quarter. Operating margin during the quarter also contracted by 270 bps to 15.3%, the lowest in the last 35 quarters.

Factors like high raw material inflation, unfavorable product mix, higher sales of low-value packs in the domestic market, higher expenses, and lackluster rural demand have hurt volume growth in the current fiscal. Despite the challenging business environment, the company may benefit from the growth of the Indian FMCG market. As per the recent management commentary post the release of Q4FY23 results, here are the key takeaways:

- The company expects the country’s central, eastern, and western regions to perform well, while the southern region is unlikely to perform as well.

- It expects high double-digit growth in the Foods segment, while the Healthcare and Home and Personal Care (HPC) segment is likely to experience high single to lower doubt-digit growth in the next 4 to 5 years.

- It expects to improve the operating margin to 19-19.5% in FY24 and further to 20% in the medium term. Further, the company wants to balance its portfolio mix with the Foods business contributing 20%, Healthcare 30%, and HPC 50% to the revenue.

- The company aims to grow in the coming years by increasing volume, improving penetration, and concentrating on eight core brands to grow.

Aiming Big on Food & Beverages (F&B) Segment

Dabur expects the food portfolio to reach revenue of ₹500 crores in FY24 and ₹1000 crores in the next five years. While revenue from the beverages portfolio currently stands at ₹200 crores, the company intends to increase it to ₹1000 crores over the next five years.

For the Badshah portfolio, Dabur aims to initially focus on developing the Andhra Pradesh, Gujarat, and Maharashtra markets before expanding to pan-India. Overall, in the next five years, Dabur intends to take the total size of F&B vertical to around ₹4000-5000 crores.

In contrast to other FMCG players, such as HUL and ITC, which operate in mass market areas with similar product portfolios, Dabur’s product portfolio is entirely different and operates in niche segments such as Ayurveda. Therefore, Dabur may scale at a different pace compared to its peers.

The key triggers for the Dabur share price increase will be the revival of rural demand, strong volume growth, and expansion of profitability margins.

Key Risks for Dabur

- El Nino: The chances of El Nino are higher in the current fiscal. A rainfall deficit could impact the recovery of rural demand or push back the recovery in demand by a few quarters.

- Entry of New Players: Reliance’s entry into the grocery retail market will likely disrupt the country’s current dynamics of the FMCG ecosystem. It is getting deeper into distribution by selling both owned and national brands, working with Kirana stores as its JioMart delivery partner, and developing its own private labels by acquiring regional and national brands. It may impact Dabur’s urban demand and mostly F&B and HPC segments.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considerea d as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

How has Dabur share price performed in the last 5 and 10 years?

As of 9th June 2023, Dabur share price in the last 5 and 10 years has grown at a CAGR of 7% and 14%, respectively.

Is Dabur a bluechip company?

Dabur is a large-cap company with a market cap of ₹97,453 crores as of 9th June 2023. Large-cap companies with increased profitability and a strong market reputation are considered blue-chip companies.

When was Dabur established?

Dabur was established in 1884 by Dr. S.K Burman in Calcutta as an Ayurvedic medicine company.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 10

No votes so far! Be the first to rate this post.