Introduction

If you’re a salaried employee, here’s some fantastic news that directly impacts your finances – the Employee Provident Fund (EPF) has raised its interest rate on mandatory deposits for the upcoming fiscal year.

Understanding the Significance of EPF Investments

Before we delve into the exciting update, let’s take a moment to know where your hard-earned money is invested. The Employee Provident Fund is an automatic savings tool for many, affecting take-home pay and offering tax-deductible contributions.

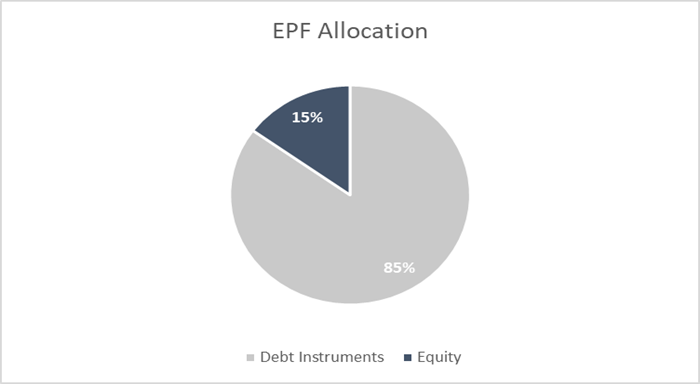

Despite being the primary retirement savings tool for numerous Indians, many don’t fully grasp how the funds contributed to the Employees’ Provident Fund are invested. Surprisingly, the Employees’ Provident Fund Organization also allocates a portion to equities. While most funds are invested in debt products like government securities, approximately 15% of your money is also invested in equities.

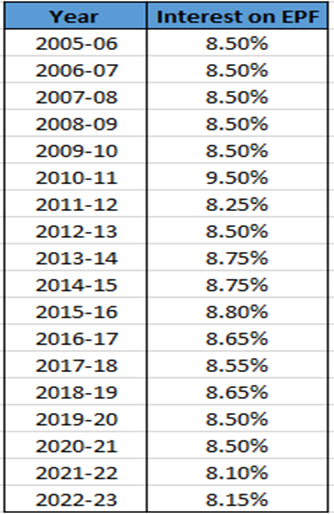

Now, let’s talk about the interest earned on these deposits. The EPFO has decided to increase the interest rate to 8.15% for FY23, a slight improvement from the previous year’s rate of 8.1%. Interestingly, the previous year’s rate of 8.10% marked the lowest return in the last 40 years, as the rates fluctuated between 8.5% and 9.5% during this period.

Key Takeaways

The EPFO stands as one of the largest organizations globally in terms of its customer base and the magnitude of financial transactions it handles. With a current subscriber base exceeding 6 lakh members, these individuals will now benefit from an increased interest rate of 8.15%. It’s worth noting that the investments made under this scheme follow conservative practices and adhere to the guidelines set by the Finance Ministry.

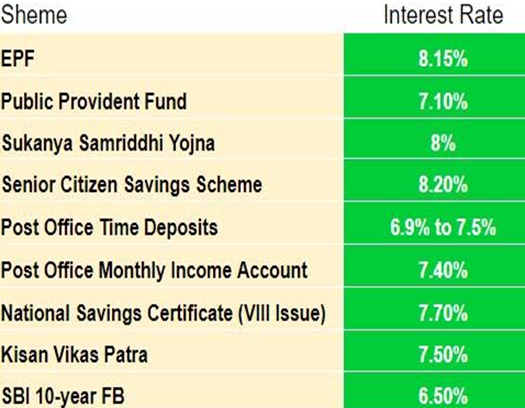

While a 0.05% hike might seem modest at first glance, it becomes significantly more meaningful compared to the interest rates offered by other savings schemes. This highlights that the EPF remains an attractive option for depositing funds with the assurance of a fixed return.

The rise in the EPF interest rate for 2022-23 brings a ray of financial hope for salaried employees. This increased return on mandatory deposits is a positive development, especially after a year of lower interest rates. As the EPFO continues to focus on conservative yet profitable investment strategies, it reaffirms the EPF’s status as a reliable and attractive choice for securing your hard-earned money. So, if you’re a salaried employee, make the most of this opportunity to grow your savings and secure your financial future.

Rupee Surges to an 11-Week High Against the US Dollar Amidst Strong Foreign Investments

Introduction

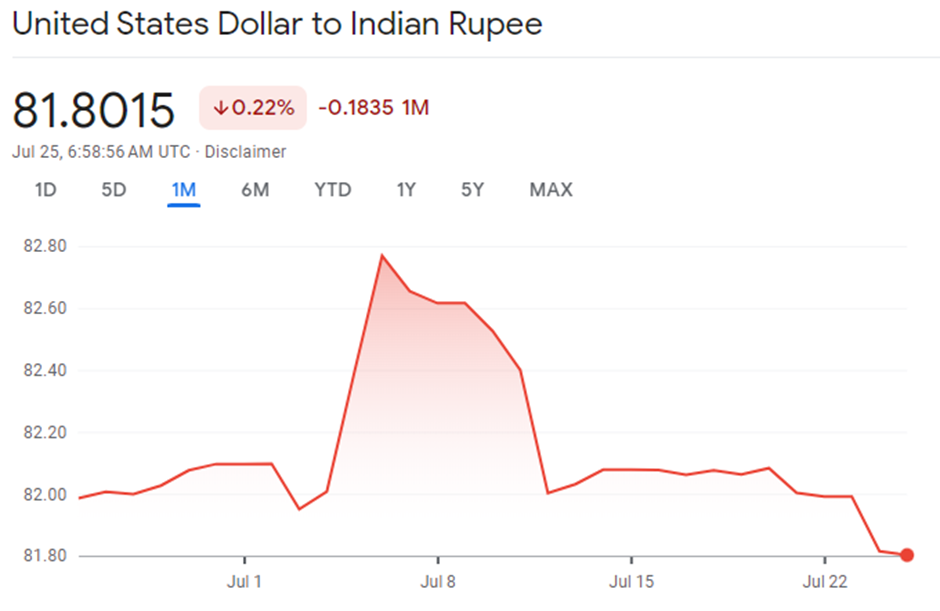

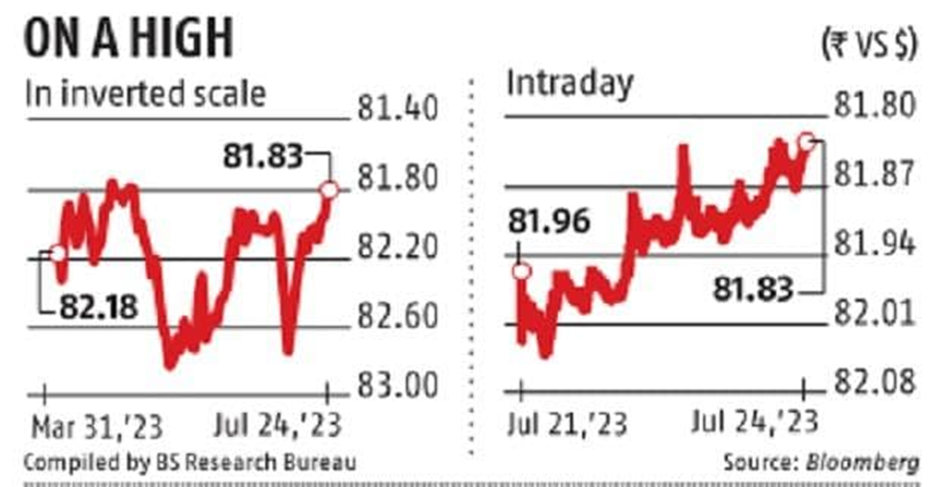

In the face of the US Federal Reserve’s measures to combat rising inflation, the US dollar has been on the rise, exerting pressure on currencies worldwide, particularly in emerging economies like India. However, the Indian rupee has shown resilience and made a remarkable comeback in 2023, hitting an 11-week high against the US dollar, thanks to robust foreign portfolio investments (FPI) inflows.

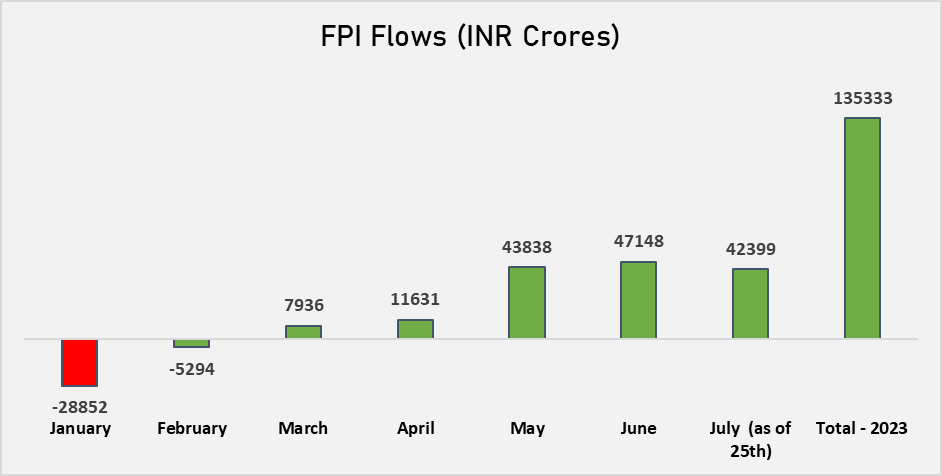

Increased Interest of Foreign Portfolio Investors: Foreign portfolio investors have significantly increased their interest in Indian equities, marking a shift in their investment behavior. After being net sellers for two consecutive financial years, they have become net buyers since March 2023. This year alone, they have injected approximately ₹1.35 lakh crore into Indian equities, with July witnessing an impressive inflow of ₹43,399 crore.

It marks the fifth consecutive month of FPIs being net buyers of Indian equities. This trend has bolstered the Indian rupee, as the increased foreign investment in assets like stocks and bonds necessitates the conversion of foreign currencies into Indian rupees. This surge in demand for the Indian rupee has resulted in its appreciation, strengthening its value.

Key Takeaways

The recent surge in the value of the Indian rupee can largely be attributed to strong FPI inflows. Additionally, India’s ongoing efforts to promote the use of the rupee in international trade signal a potential move towards de-dollarization and currency diversification. However, breaking free from the dominance of the US dollar is a formidable challenge, given its status as a safe-haven currency and its widespread acceptance worldwide.

Looking Forward

The long-term prospects of the Indian rupee becoming a global currency hinge on various factors, including sustained economic growth, export expansion, and the ease of converting capital accounts. Although challenges persist, these factors may contribute to the rupee gaining more recognition on the international stage.

In the short term, the rupee movement will be influenced by the outcome of this week’s upcoming Federal Reserve meeting. As the Fed’s decisions continue to impact the global financial landscape, investors will closely monitor its impact on currencies like the Indian rupee.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 3.7 / 5. Vote count: 3

No votes so far! Be the first to rate this post.