Fintech trends are expected to play a significant role in the financial industry, with potential growth areas including the use of artificial intelligence and machine learning, the advancement of blockchain technology, and the rising popularity of Robo-advisory services.

Fintech has transformed financial and banking operations tremendously. More consumers are turning to digital channels for their requirements, with new businesses entering the market to provide various services. As a result, the fintech market has experienced substantial development and innovation.

As a result, consumers now have more competition and options and more effective and accessible financial services. This innovation and the encouragement of entrepreneurship in several economic segments are being driven by the global advancement of technology and growing investment in banking and finance.

9 Fintech Trends For 2023 to Watch For

Fintech Trends – Advances in Blockchain Technology and Digital Currencies

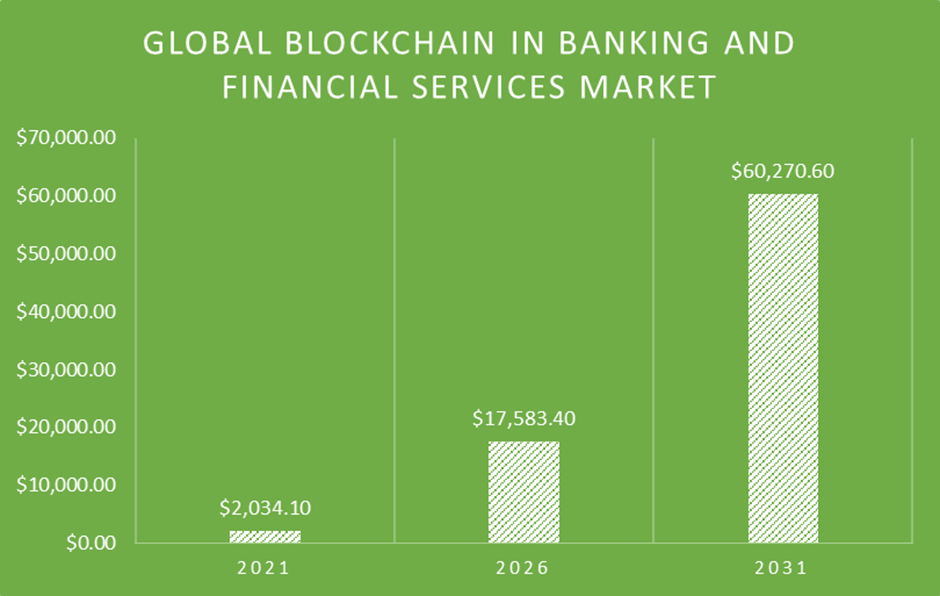

The market for blockchain in banking and financial services has increased at a CAGR of 62.7% from 2016, reaching a value of over $2,034.1 million in 2021. The market size may increase 53.9% from $2,034.1 million in 2021 to $17,583.4 million in 2026. From 2026 to 2031, the market is projected to grow at a CAGR of 27.9%, reaching $60,270.6 million.

Focus is placed on the following market-trend-based blockchain strategies for the banking and financial services market:

1. Blockchain technology for insurance

2. Application of blockchain to asset servicing

3. A strategic focus on digital currencies and mergers and acquisitions.

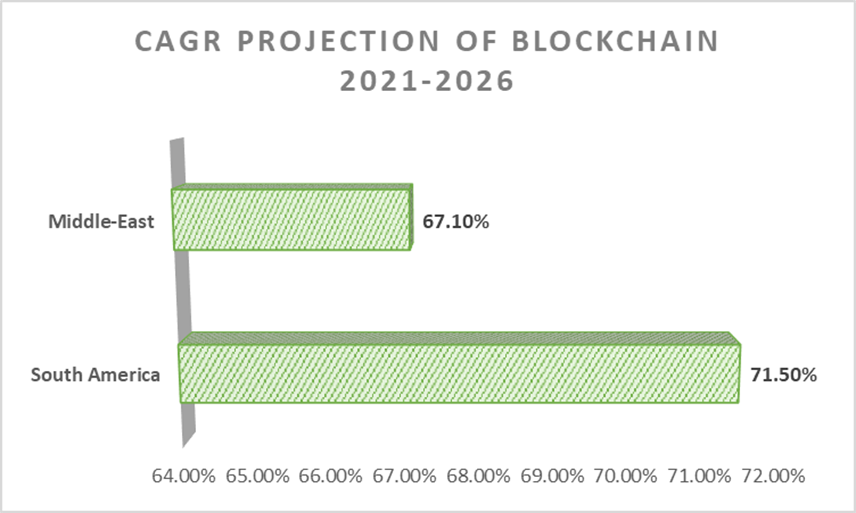

The blockchain market for banking and financial services was dominated by North America, which accounted for 37.5% of the worldwide market in 2021. Western Europe, Asia-Pacific, and other regions came after it.

The graph below shows the blockchain market’s fastest-growing banking and financial services regions.

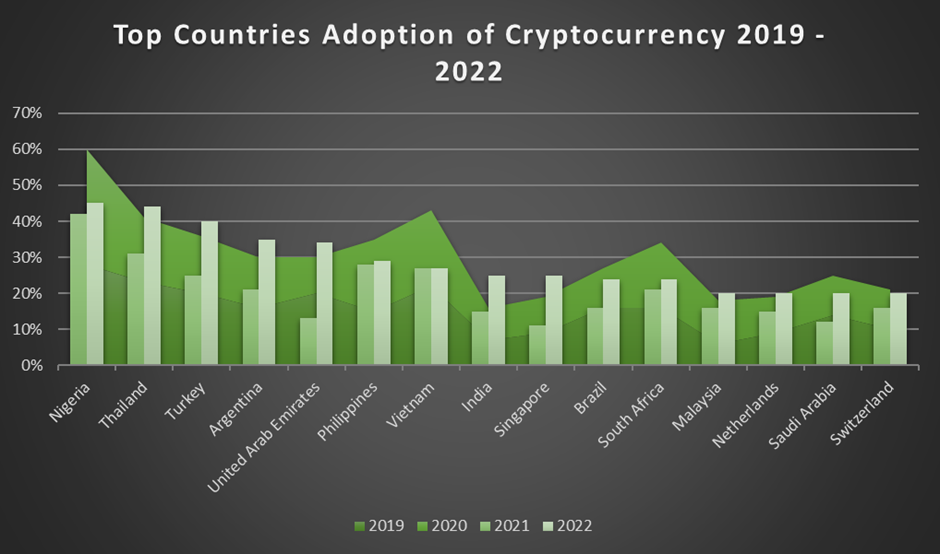

The graph below depicts the adoption of cryptocurrencies from 2019 to 2022. With an increase of 45% in 2022, Nigeria took the lead in using cryptocurrencies.

Fintech Trends -Increased Adoption of Open Banking and API-based Services

Financial institutions recognize the importance of Open Banking efforts and the critical function of APIs. Traditional banks are aware that they must improve their digital skills to compete more effectively in the market and prevent being disintermediated by new players who offer better products and services.

Open Banking APIs can improve traditional banks’ services and raise client involvement if it has access to the bank’s financial data. It allows current clients to manage their accounts using cutting-edge technologies and draws in new customers looking for more sophisticated banking solutions.

Additionally, granting access to new channels, like financial apps and services, lets banks boost their digital revenue. It is especially crucial in a market that is becoming increasingly competitive as customers demand access to cutting-edge technologies. Since most traditional banks do not provide these services, FinTech companies could fill a market gap.

Fintech Trends – Greater use of Artificial Intelligence (AI) and Machine Learning (ML) in finance

Global spending on AI is expected to double during the ten years from 2020 to 2030, going from $50 billion in 2020 to more than 110 billion in 2024. Business Insider has predicted that by 2023, financial AI may save banks and other corporate entities $447 billion.

Machine learning (ML) and artificial intelligence (AI) are increasingly used in the financial sector. These technologies are used for portfolio optimization, risk management, and fraud detection. In addition, AI and ML enhance the effectiveness and precision of financial forecasting. These technologies can also assist financial institutions in providing better customer service by offering individual guidance and recommendations.

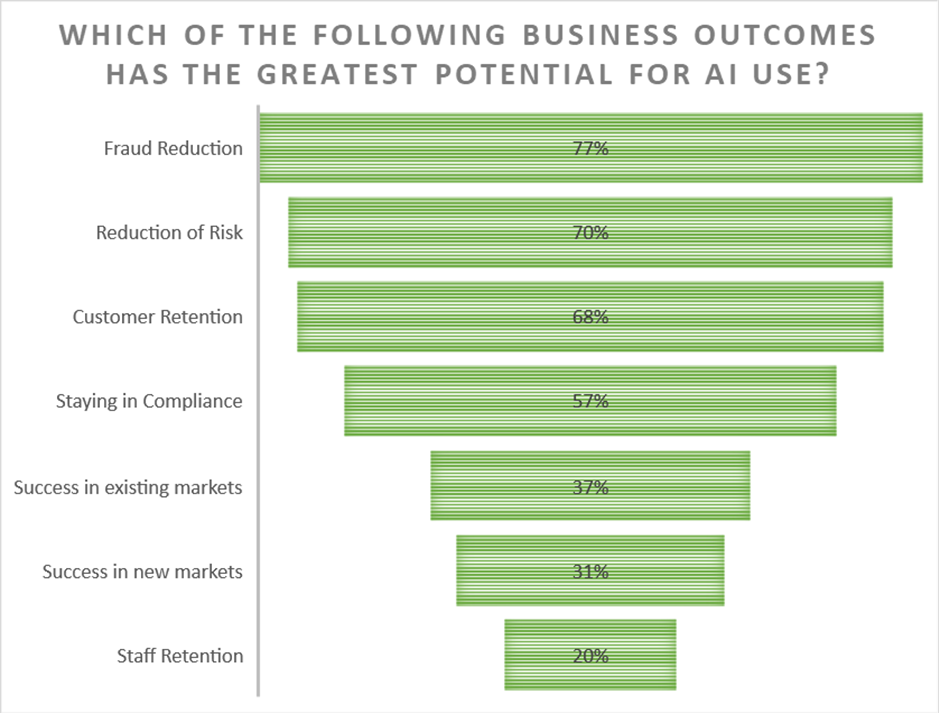

According to v7labs, reducing fraud has the highest potential usage of AI, at 77%.

Fintech Trends -Enhanced Cybersecurity Measures

With the increase in online fraud, attackers continually modify their strategies for maximum profit, resulting in financial and reputation damage for enterprises across sectors. Businesses looking beyond traditional ways and choosing digital-first solutions that integrate AI, machine learning, behavioral biometrics, and device intelligence are one of the fintech trends to watch for.

Fintech Trends – Increased Focus on Financial Inclusion

The Alliance for Financial Inclusion (AFI) is a practical step towards ensuring that fintech, which is quickly changing the global economy, does not exclude significant portions of society. Fintech holds up tremendous possibilities for both governments and individual customers. The largest project in this approach was launched in 2017 by Accenture and Microsoft. This enormous project will impact at least 1.1 billion people globally.

Fintech Trends -Continued Regulatory Developments

RegTech, short for regulatory technology, is a sub-sector of FinTech that uses technology to manage regulatory compliance. RegTech companies help with tracking, reporting, and compliance for financial institutions, and the industry has seen significant growth in recent years. The market for RegTech is projected to reach $44 billion by 2030, up from $8.2 billion in 2021. The development of FinTech has led to the need for more regulatory oversight, as the increased use of digital services also increases the risk of fraud, hacking, and data breaches.

Fintech Trends – Growth of Insurtech

The pandemic has led to a revolution in the insurance sector, with tech companies partnering with insurance companies to bring innovations in products and how they are distributed to customers, leveraging AI, machine learning, deep learning, artificial neural networks, and IoT.

Fintech Trends – Expansion of Alternative Lending Options.

Fintech funding topped the charts with $4.5, Billion raised across 250 deals, but over half of this, or $2.3 Billon, went to lending tech startups. Regulators looked to tackle the grey areas in digital lending in 2022, disrupting companies’ operations, and more disruptions can be expected as financial regulations are tweaked to meet the maturing market.

Fintech Trends – Growth of Robo-advisors

Robo-advisory services are more inexpensive and accessible, and they provide personalized investment advice based on an individual’s financial goals and risk tolerance. As a result, robo-advisoryy services will probably gain popularity as more individuals use digital tools to manage their finances.

Conclusion

It’s tough to anticipate how the future year will unfold. However, due to several new regulations, market trends, and technological advancements, 2023 will undoubtedly be a significant year for the financial industry.

FAQs

What are some of the biggest challenges facing fintech companies?

Some of the biggest challenges fintech companies face include regulatory compliance, data privacy and security, and competition with established financial institutions.

How do fintech companies protect customer data?

Fintech companies protect customer data by implementing robust security measures such as encryption, multi-factor authentication, and regular security audits.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.