HDFC Bank Merger

In a surprising and groundbreaking decision that reverberated across the financial world, HDFC and HDFC Bank, two influential entities in India’s financial sector, announced their merger on April 4, 2022. This momentous merger, set to be finalized by July 1, is poised to reshape India’s banking and investment landscape.

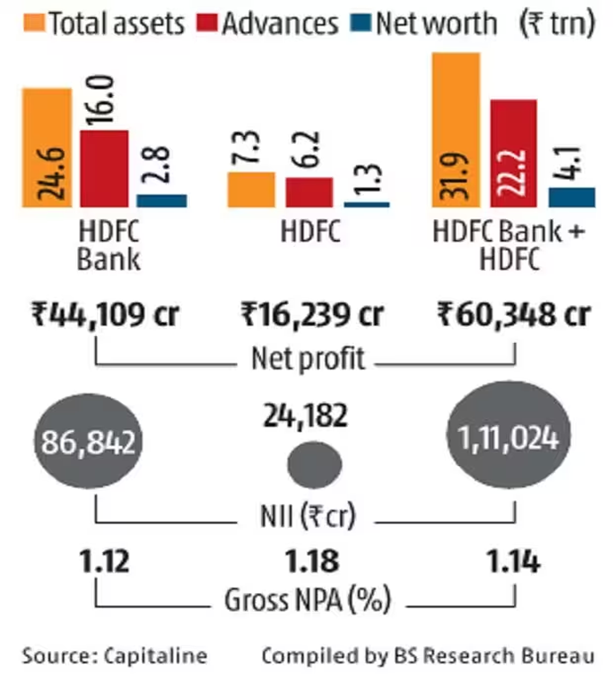

Considered the largest transaction in India’s corporate history, this merger will create a combined asset base of approximately 31.92 lakh trillion rupees. HDFC Bank will emerge as the surviving entity, fully owned by public shareholders, while the existing shareholders of HDFC will hold a 41 percent stake in the bank.

To provide perspective on the merger, every shareholder of HDFC Limited will receive 42 shares of HDFC Bank for every 25 shares they currently hold. Consequently, HDFC will be delisted from the stock market effective July 13, with a new entrant joining the prestigious Nifty 50 Index.

Preliminary calculations by Nuvama indicate that LTIMindtree is likely to be included in the Nifty50, resulting in anticipated inflows of $150 million to $160 million. This merger between the HDFC Twins will establish India’s second-largest financial institution by assets, following the country’s leading lender, State Bank of India (SBI).

India’s Current Account Deficit Drops to 0.2% of GDP in March 2023 Quarter

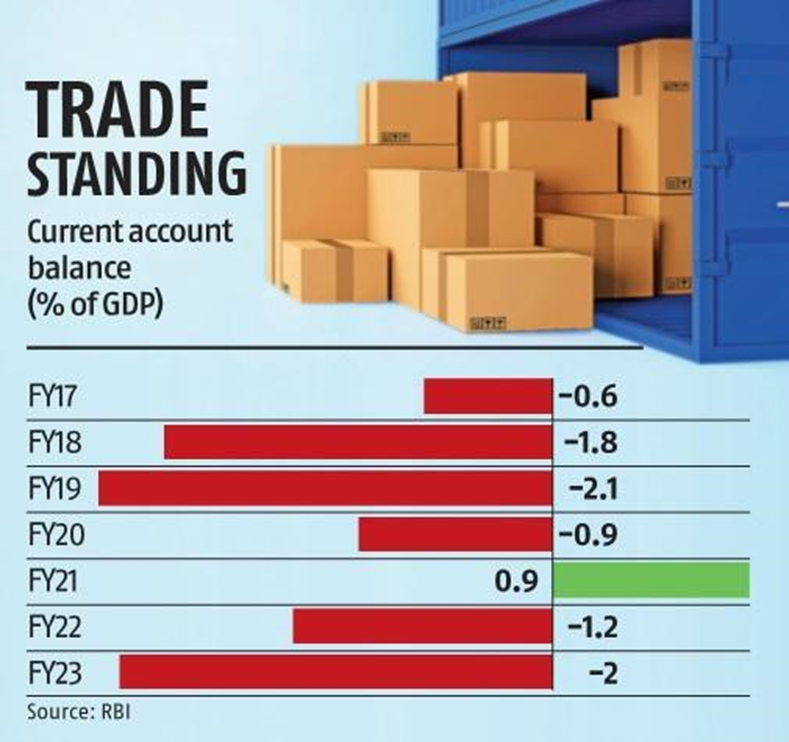

In the March 2023 quarter, India experienced a significant decline in its current account deficit (CAD), which decreased to 0.2 percent of GDP from 2 percent in the previous quarter of FY23.

Before delving into the details, let’s understand the concept of CAD.

A current account deficit arises when the value of a country’s exports of goods, services, and other revenues is lower than the value of its imports of goods and services. Typically, the trade deficit constitutes the largest portion of a current account deficit. The current account comprises the trade gap, net current transfers, and net income abroad.

Current Account = Trade gap + Net current transfers + Net income abroad

The reduction in India’s CAD during the March 2023 quarter can be attributed to two primary factors. Firstly, moderation in the trade deficit played a pivotal role. Secondly, robust services exports made a significant contribution to narrowing the CAD.

Over the course of FY23, India’s CAD widened to 2 percent of GDP, compared to 1.2 percent in the previous fiscal year (FY22). This widening was primarily driven by increased merchandise imports, influenced by higher global commodity prices, leading to a larger merchandise trade deficit.

Key Takeaway

- It’s crucial to acknowledge that the current account balance, whether in deficit or surplus, is a vital indicator of an economy’s external health. A current account deficit is expected since India is a net importer.

- Looking ahead, there is a possibility of some moderation in the CAD as India’s export and import values are anticipated to soften. Weak external demand and lower international commodity prices might contribute to a more balanced current account situation in the future, reducing India’s external vulnerability amidst global economic uncertainties.

- Ultimately, this reduction in external vulnerability will fortify India’s position and resilience in the face of uncertain global economic conditions.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.