Introduction

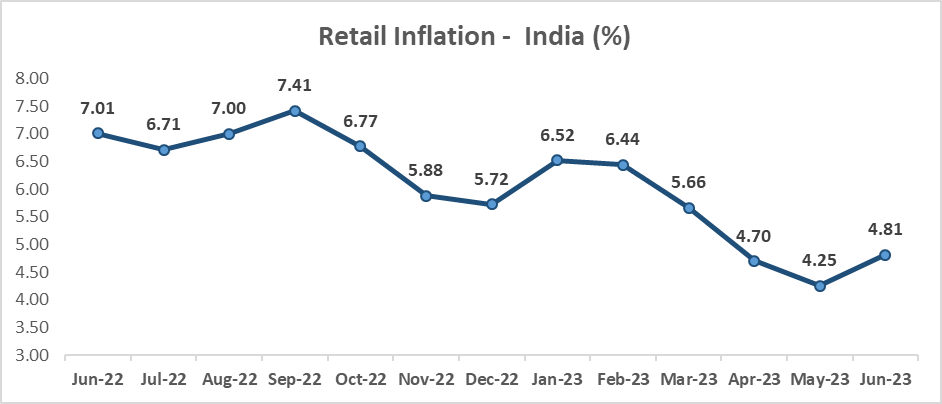

In the aftermath of the pandemic, inflation soared, exacerbated by the supply crisis triggered by Russia’s invasion of Ukraine. India experienced a peak inflation rate of 7.41%. However, as time has passed, these factors have subsided, gradually easing inflation. In May 2023, retail inflation stood at 4.25%, and although it rose slightly to 4.81% in June, it remained within the tolerance range established by the Reserve Bank of India (RBI).

The Factors Behind the Inflation Inches up Spike:

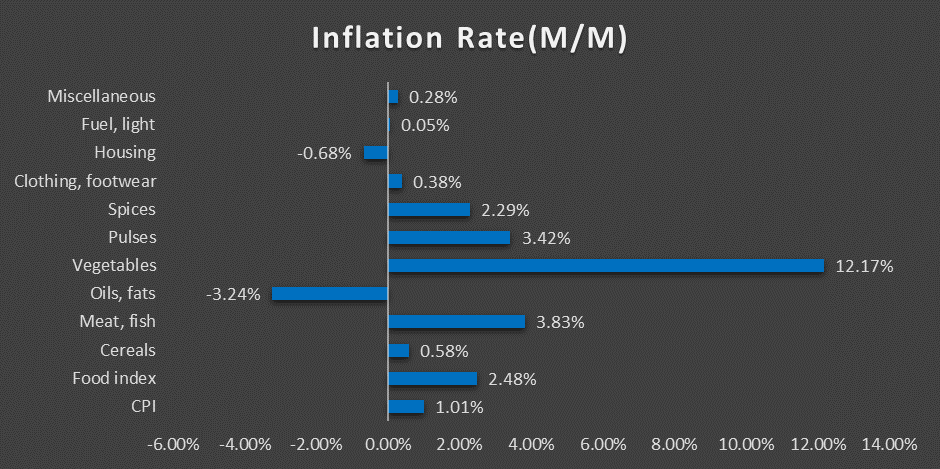

The recent increase in inflation is primarily attributed to surging food prices, particularly vegetables. Products such as cereals, meat and fish, eggs, pulses, and spices also had increased prices. Unfavorable monsoon rains and heat waves have damaged crops, leading to shortages of essential cooking ingredients. The progress of the monsoon is critical, as uneven rainfall distribution could further impact kharif crop sowing and worsen food inflation.

Key Takeaway

RBI’s Inflation Management: The RBI’s objective is to maintain inflation around 4%, within a target range of 2% to 6%. In June, the RBI decided to keep interest rates unchanged for the second consecutive time. The inflation rate in June, at 4.81%, fell within the RBI’s acceptable limit of 6% but exceeded the ideal target of 4%, indicating a slight increase compared to the previous month.

Addressing Inflation Challenges: Given that the surge in inflation is primarily driven by rising food prices, the RBI is expected to prioritize tackling supply-side issues rather than resorting to raising interest rates. Instead of implementing monetary tightening, the focus will likely be on resolving the underlying causes of food inflation. This approach acknowledges that addressing supply constraints and improving agricultural productivity will significantly impact curbing inflation in the long term.

With inflation gradually easing in India, the question arises as to whether the RBI will opt for another rate hike. While inflation remains within the acceptable range, the recent uptick in food prices necessitates focused efforts to address supply-side issues. As the RBI aims to strike a balance between taming inflation and supporting economic growth, it will likely prioritize resolving supply constraints rather than resorting to raising interest rates.

IIP Rises To A Three-month High of 5.2%!

Introduction

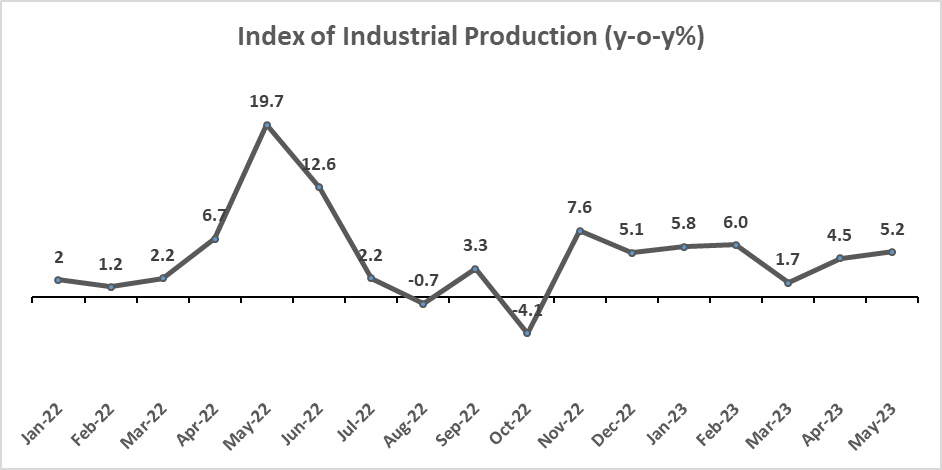

India’s industrial sector experienced a remarkable surge in May 2023, with industrial output reaching a three-month high of 5.2%. This growth outpaced expectations and surpassed the 4.5% expansion witnessed in April 2021. Let’s delve into the key drivers behind this impressive upswing and examine the various factors that propelled India’s industrial activity.

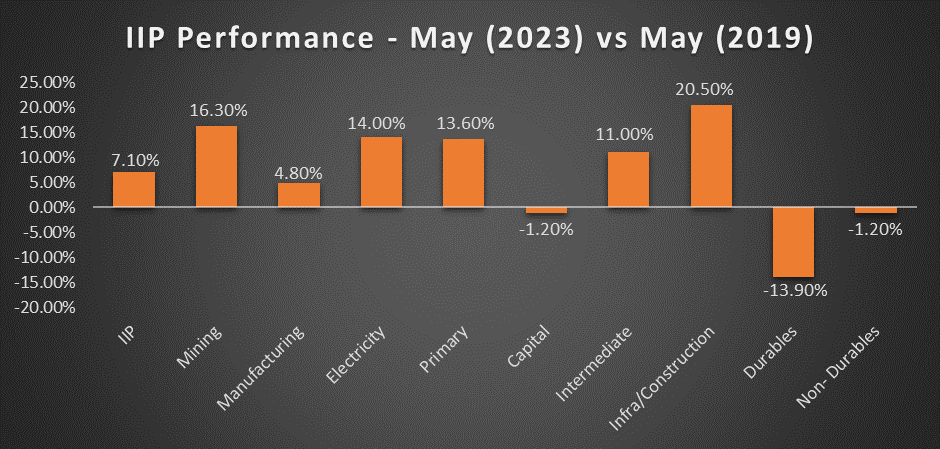

Mining and Manufacturing Sectors Thrive: The mining and manufacturing sectors were leading the charge, exhibiting robust performance. The mining industry witnessed a notable increase of 16.3%, while manufacturing, although slightly lower, still showcased significant growth at 4.8%. These sectors played a pivotal role in driving India’s industrial output to new heights.

Electricity Production Bounces Back: After a couple of lackluster months, electricity production experienced a welcome rebound. It recorded improvements, contributing to the overall industrial growth. A remarkable 14.0% surge in electricity generation bolstered the sector, reinstating its crucial role in India’s industrial landscape.

Consumer Goods Segment Shows Promise: The consumer goods segment, encompassing both durable items such as appliances and vehicles, as well as non-durable goods like food and clothing, displayed positive momentum on a year-on-year basis. This encouraging growth in consumer goods further propelled India’s industrial output.

Comparison to Pre-COVID Levels: When comparing the current industrial output to pre-pandemic levels, May 2023 showed a 7.1% increase. This growth can be attributed to a 14.0% rise in electricity generation and a remarkable 16.3% surge in the mining sector. However, the manufacturing sector experienced a relatively lower growth of 4.8%.

Remaining Challenges: Despite the positive trends, certain challenges persist in India’s industrial landscape. Both capital goods and consumer goods are still below pre-COVID levels, indicating room for further recovery.

Key Takeaway

Sustained growth in industrial activity hinges on continuous consumer spending, as external demand remains somewhat sluggish. Rising retail inflation, mainly driven by high food prices, presents a concerning aspect that needs attention. Moreover, weather-related disruptions pose potential risks to the recovery of rural demand.

May 2023 witnessed robust growth in India’s industrial output, exceeding expectations and instilling optimism in the sector. The mining and manufacturing sectors took center stage, while electricity production rebounded and the consumer goods segment exhibited promising signs.

While challenges remain, such as the recovery of capital goods and consumer goods and potential risks from inflation and weather disruptions, India’s industrial growth trajectory presents a positive outlook. Continued focus on stimulating consumer spending and addressing these challenges will be crucial for sustaining and enhancing the industrial sector’s contribution to the Indian economy.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.