A Turning Point for India’s Debt Market

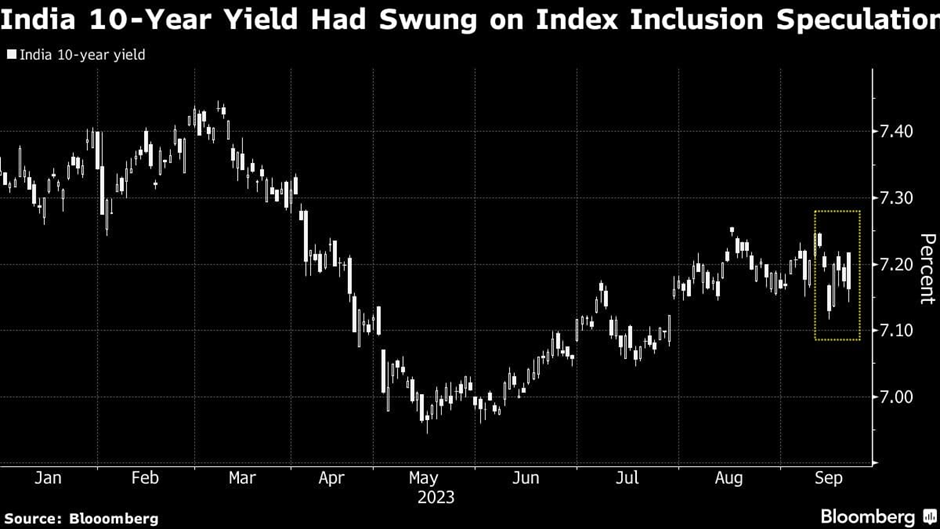

In a significant move that promises to inject billions of dollars into India’s debt market, JPMorgan Chase & Co. is poised to include Indian government bonds (IGBs) into its benchmark Government Bond Index-emerging markets (GBI-EM) starting from 28 June 2024.

A Gradual Integration Process

This monumental step will be implemented over ten months, marked by a steady 1% increase in index weighting. JPMorgan envisions India ultimately attaining the maximum allocation of 10%. Remarkably, there are 23 qualifying Indian government bonds with a collective notional value of $330 billion, as JPMorgan’s official statement affirmed.

Key Takeaways

1. Diversification Trends and Global Shifts

The anticipation of India’s inclusion in international bond indices has surged in recent times, driven by a desire among many companies to diversify their index holdings. Notably, Russia’s involvement in Ukraine led to its exclusion from these indices, while China’s economic challenges tarnished the appeal of its sovereign debt.

2. Access to the Booming Indian Economy

In addition to this prestigious global benchmark, India will provide international investors with unprecedented access to the world’s fastest-growing major economy. India is renowned for offering some of the highest investment returns in the region. According to HSBC Holdings Plc, this inclusion could trigger capital inflows of up to $30 billion.

3. Expanding Investment Horizons

The global recognition of Indian bonds in the index is expected to widen investment opportunities. This development is poised to lower India’s borrowing costs and catalyze growth in both the bond market and the value of the rupee.

Navigating the Financial Landscape: Implications and Prospects

4. Impetus for Economic Growth

Integrating Indian bonds into the GBI-EM index signifies a powerful endorsement of India’s economic potential. This move will bolster investor confidence and stimulate economic growth on multiple fronts.

5. Strengthening the Rupee’s Position

As India’s financial prowess gains international validation, the value of the rupee is poised to appreciate. This will have far-reaching implications for India’s position in the global financial arena.

Incorporating Indian government bonds into JPMorgan’s benchmark index represents a watershed moment for India’s debt market. This move promises to reshape the dynamics of the financial landscape, offering Indian and international investors a unique opportunity to participate in India’s growth story.

Tesla looks to set up a battery storage facility in India

In a groundbreaking move that could revolutionize India’s automotive sector, Tesla has set its sights on the Indian market. The EV giant is sourcing auto parts from India and eyeing a grand entrance by establishing a battery storage factory in the country.

In 2021, Tesla attempted to enter the Indian market but faced a roadblock due to a disagreement with the Indian government. Tesla aimed for lower tariffs on imported cars, while the Indian government insisted on local manufacturing.

Tesla’s Investment in India

However, what worked in India’s favor is that Tesla imported auto component parts worth $1 billion from the country last year. This year, the target ranges between $1.7 billion to $1.9 billion. This significant investment has compelled Tesla to make and sell battery storage systems nationwide. Moreover, the company plans to introduce its ‘Powerwall’ system to store power from solar panels or grids.

Key Takeaways

1. Electrification Trend in the Automotive Industry

Tesla’s expansion into India aligns perfectly with the global shift towards electrification in the automotive industry. This move signifies a pivotal moment in India’s pursuit of sustainable transportation solutions.

2. Domestic Manufacturing Facility

Tesla has expressed a keen interest in establishing a domestic manufacturing facility to produce electric vehicles priced at around $24,000. This strategic move not only caters to the Indian market but also facilitates exports, positioning India as a hub for Tesla’s regional operations.

3. Beyond Electric Vehicles

The Powerwall system’s introduction indicates Tesla’s broader plans for a significant presence in India beyond electric vehicles. This aligns seamlessly with the “Make in India” initiative and the ambitious goal of shifting towards non-fossil fuel power, targeting a capacity increase to 500 GW by 2030.

Tesla’s renewed focus on the Indian market is pivotal in the country’s automotive evolution. With an emphasis on local production and innovative energy solutions, Tesla is poised to leave an indelible mark on India’s automotive landscape.

FAQs

When did Tesla first attempt to enter the Indian market?

Tesla first attempted to enter the Indian market in 2021 but faced a disagreement with the Indian government regarding import tariffs.

What is Tesla's investment in auto component parts from India?

Tesla imported auto component parts worth $1 billion from India last year, with this year's target ranging between $1.7 billion to $1.9 billion.

What is the significance of Tesla's 'Powerwall' system?

The Powerwall system is designed to store power from electric panels, such as solar panels or grids, providing an innovative energy storage solution.

What is Tesla's pricing strategy for electric vehicles in India?

Tesla aims to produce electric vehicles priced at around $24,000, catering to the Indian market and facilitating exports.

How will the integration into the EM Index impact India's debt market?

This integration is expected to inject significant capital into India's debt market, potentially leading to lower borrowing costs and increased investment activity.

What are the key benefits for global investors?

Global investors will gain enhanced access to India's rapidly growing economy, known for its high investment returns, potentially attracting substantial capital inflows.

What is the long-term outlook for India's debt market post-integration?

The integration is expected to stimulate growth in both the bond market and the value of the rupee, signaling a positive trajectory for India's financial landscape.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.