You must be busy planning your investments to save tax.

But have you ever wondered if it would help you create wealth?

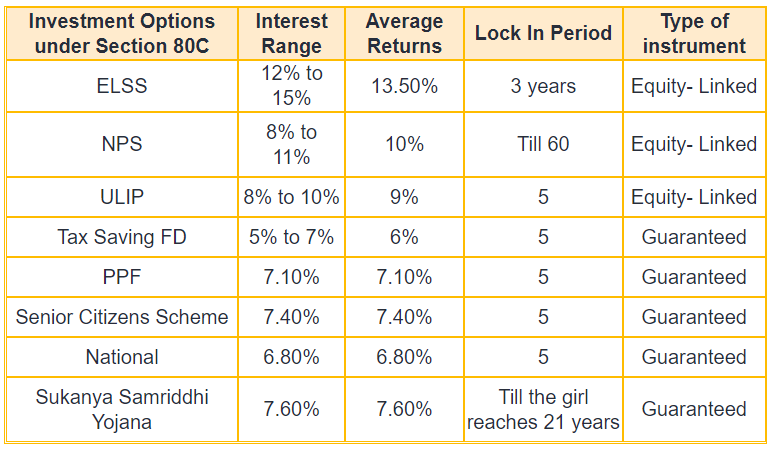

Let us check out some of the popular tax saving investing options under Section 80C of the Income Tax Act

If you keep the returns offered by ELSS aside, then the average returns offered by the remaining instruments are 8%.

Although these instruments help you save tax, it is not easy to create wealth by investing in these instruments. Incidentally, some of these products also require a lock-in period, which can cause liquidity issues.

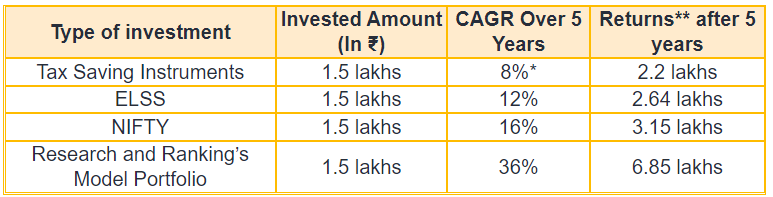

Now, check out this table

**Returns are rounded off for easy calculations

It is clear that the tax saving instruments and some ELSS funds have underperformed as compared to NIFTY over a five-year period

However, our model portfolio outperformed NIFTY delivering 36% returns over the last five years (from 1st April 2017 to 31st December 2021).

This means, if you had invested Rs 1.5 lakhs on 1st April 2017, then the value of your investment would be worth Rs 6.85 lakhs on 31st December 2021.

So, apart from saving taxes, you must consider investing in equities to create substantial wealth over the long term.

Subscribe to our 5 in 5 Wealth Creation Strategy and begin your journey to creating wealth.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.