Introduction

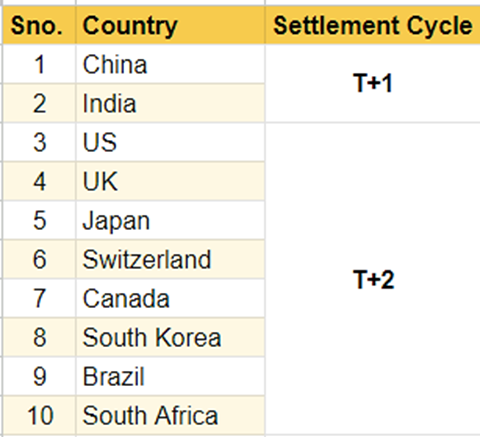

In a monumental stride towards modernizing the Indian financial landscape, SEBI (Securities and Exchange Board of India) implemented a T+1 settlement cycle earlier this year, firmly establishing India as a trailblazer in the global financial arena.

This leap comes before major global players like the USA, UK, and Japan could transition, positioning India second only to China in embracing this impressive T+1 settlement cycle. In the past, Indian markets operated on a T+2 settlement cycle, making this transition remarkable.

But that’s not where the story ends. SEBI’s Chairperson recently unveiled plans for an even more ambitious timeline. By March 2024, SEBI aims to introduce a groundbreaking one-hour trade settlement, setting the stage for trades to be settled almost instantaneously by October 2024.

In simpler terms, when this one-hour settlement is in place, if an investor sells a share, the proceeds will be credited to their account within an hour, while the buyer will receive the shares in their demat account within an hour.

What is the significance of India moving to a T+1 settlement cycle?

India’s transition to a T+1 settlement cycle holds immense importance on multiple fronts. First and foremost,

· It streamlines the entire trading process

· reduces the time taken to settle transactions

· enhances liquidity in the market

· minimizes credit and counterparty risks

· positions India as a frontrunner in global financial markets

· attracts more foreign investments, and boosts investor confidence

What impact will these changes have on retail investors and stock market?

These changes are poised to have a profound effect on both retail investors and the overall market. Retail investors will benefit from faster access to their funds, increased market transparency, and reduced risks associated with extended settlement periods. Moreover, it encourages more retail participation in the market.

For the broader market, reduced settlement times enhance market efficiency and attractiveness to institutional and foreign investors, ultimately leading to increased trading volumes and market growth. It’s a win-win for all stakeholders in the Indian financial ecosystem.

Key Takeaways

This bold move towards faster settlement processes marks a pivotal moment for SEBI and the Indian financial sector. While developed nations like the USA and Canada are still operating on a T+2 settlement cycle, India is poised to shift to a T+1 hour cycle and, ultimately, an instantaneous settlement system.

These proposed changes signify a seismic shift in the Indian stock market landscape, emphasizing a commitment to reducing settlement times and enhancing investors’ convenience and efficiency. It’s a momentous leap towards making the Indian stock market globally competitive and more accessible and user-friendly for investors. Stay tuned as we follow these developments and witness the transformation of India’s financial markets.

Indian Automobile Retail Sales Surge 9% in August!

In a recent development that significantly impacts India’s economic landscape, we focus on the thriving auto retail sales sector. This crucial economic indicator sheds light on the number of vehicles sold, providing valuable insights into the nation’s overall financial well-being.

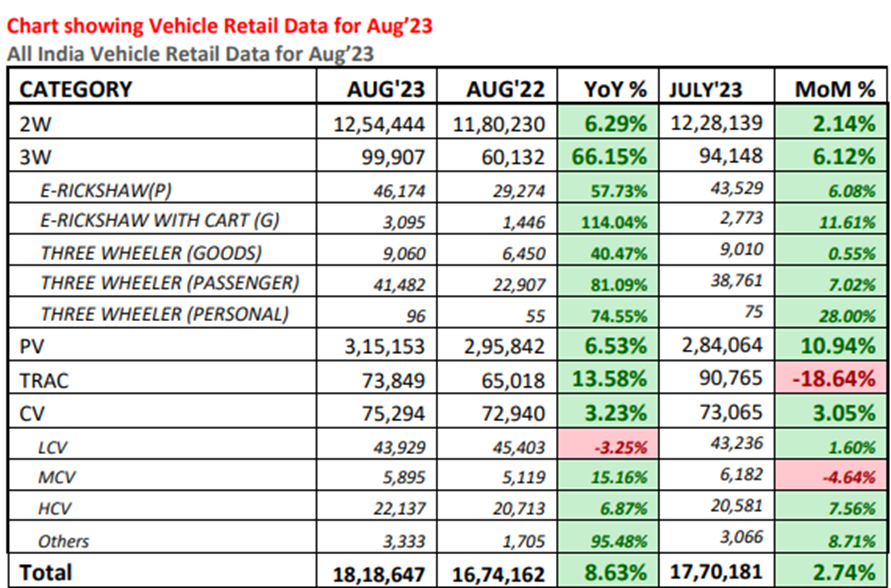

According to data from the Federation of Automobile Dealers Associations (FADA), India’s auto retail sales experienced a remarkable upswing of 9 percent during August 2023. This upturn was bolstered by impressive growth across all automobile market segments, signifying a burgeoning economic resurgence.

To put this achievement into perspective, August 2023 witnessed the sale of 18.18 lakh vehicles in India, a substantial rise from 17.70 lakh in July of the same year and a significant leap from 16.74 lakh in August of the previous year.

Breaking down the numbers, the specific categories within the auto retail sector displayed distinctive trends. Two-wheelers (2W) recorded a commendable 6 percent growth, while passenger vehicles (PV) registered an encouraging 6.5 percent increase. Tractors experienced a remarkable surge of 14 percent, and commercial vehicles (CV) saw a commendable rise of 3 percent. Remarkably, three-wheeler sales reached an all-time high, marking an astounding 66 percent year-on-year growth.

Key Takeaways

- Positive Growth in Passenger Vehicles and Three-Wheelers: Recent auto retail figures indicate significant growth in passenger and three-wheeler segments, underscoring improving consumer confidence and market performance.

- Mixed Results for Two-Wheelers and Tractors: Two-wheelers and tractors, often considered indicators of India’s rural economic health, presented mixed results. While two-wheelers showed gradual improvement, tractor sales surged by 14 percent year-on-year but experienced a notable 19 percent contraction in month-over-month figures.

- Rural Demand on the Rise: FADA reports a burgeoning demand in rural areas after prolonged stagnation. However, this recovery’s fragility hinges on the monsoon season’s final phase. The monsoon season plays a pivotal role in India’s agriculture, and this year has raised concerns due to the prospect of the lowest monsoon levels in eight years.

FADA’s outlook for the overall Indian automobile industry remains cautiously optimistic.

These conditions have led to apprehensions regarding soil moisture levels and their potential impact on winter crops. These factors are expected to significantly influence rural demand, especially during the crucial Navratri-Diwali period.

In conclusion, while recent auto retail figures showcase promising growth in specific segments, the Indian automobile industry remains cautiously optimistic about the future. The performance of two-wheelers and tractors, often seen as barometers of rural economic strength, warrants close monitoring.

Although fragile, the recovery in rural demand offers hope for a brighter economic outlook, contingent upon the upcoming monsoon season’s performance. As India navigates these challenges, its resilience and adaptability will likely be key determinants of its economic trajectory in the coming months.

FAQs

What does the recent 9 percent increase in auto retail sales signify for India’s economy?

The 9 percent increase in auto retail sales during August 2023 is a positive sign for India’s economic recovery. It suggests growing consumer confidence and economic stability, as reflected in increased vehicle purchases across various segments.

Which segments of the auto market saw the most growth?

In August 2023, all segments of the auto market experienced growth. Notable increases were seen in passenger vehicles (6.5 percent), tractors (14 percent), and three-wheelers (66 percent year-on-year).

What does the mixed performance of two-wheelers and tractors indicate for India’s rural economy?

Two-wheelers and tractors are often seen as indicators of rural economic strength. While tractor sales surged 14 percent year-on-year, two-wheelers showed slower but steady improvement. The mixed performance suggests that rural areas are recovering, but challenges persist.

How can policymakers and businesses use these auto retail sales insights to make informed decisions?

Policymakers and businesses can use auto retail sales data to gauge the effectiveness of economic policies, plan production and marketing strategies, and make informed investment decisions. It provides a real-time pulse of consumer behavior and economic health, helping stakeholders adapt to changing market conditions.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.