Introduction

Over the past three years, the landscape of digital transactions in India has undergone a fascinating and unprecedented transformation. In a time when traditional debit cards seemed firmly entrenched in our financial lives, they have experienced a sluggish pace of growth. At the same time, the Unified Payments Interface (UPI) has emerged as a game-changer.

The Rise of UPI: Launched in 2016, UPI initially served as a means for person-to-person money transfers. However, due to events like demonetization and the COVID-19 pandemic, the digitization of payments in India accelerated significantly. UPI gradually gained momentum during the first few years, but the real surge came later.

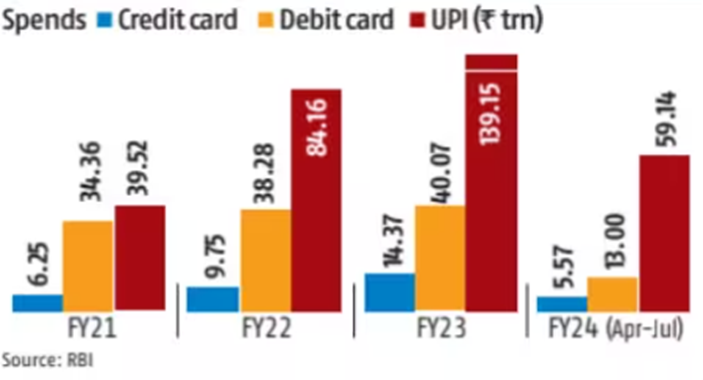

Comparing Debit Cards and UPI: In the fiscal year 2021, debit card and UPI spending were neck and neck. However, things took a dramatic turn, with UPI transactions rising in fiscal year 2023. Debit card transactions amounted to INR 40 trillion, whereas UPI transactions skyrocketed to INR 139 trillion. This stark contrast highlights the exceptional growth of UPI.

Milestones Galore: UPI transactions have been achieving milestone after milestone. One of the most recent achievements was crossing the 10 billion transactions mark for the first time in August.

The Remarkable Journey of UPI: The journey of UPI over the past decade has been remarkable. This growth has been driven by an expanding user base and increased penetration in rural India. Moreover, the convenience of UPI for micro and small transactions has caused debit card usage to stagnate, signaling a shift in consumer preferences.

The Ascendancy of Credit Cards: Intriguingly, credit card usage has remained robust and, in recent months, has even surpassed debit card transactions. This trend suggests a changing financial landscape in India.

Key Takeaways

The Future of Digital Payments: With the continued expansion of UPI transactions and the growing dominance of digital payments in India, the country is on the path to becoming a cashless economy. The success of UPI reflects the increasing adoption of digital payment methods and a significant shift in how Indians conduct their financial transactions.

In conclusion, the digital payment revolution in India, driven by the phenomenal growth of UPI, is reshaping the financial landscape and propelling the nation toward a future where cash is no longer king.

FAQs

Why has UPI grown so rapidly compared to debit cards in India?

Introduction of UPI during the government’s digitalization push.

UPI’s user-friendly and convenient features.

Interoperability across various banks and institutions.

Accelerated adoption due to the COVID-19 pandemic.

What is driving the shift from debit cards to credit cards in India?

Credit cards offer a line of credit for flexible spending.

Attractive rewards and cashback programs on credit cards.

Financially savvy users leveraging interest-free credit periods.

Building a credit history and financial management benefits.

What does India’s shift towards a cashless economy mean for the future?

Increased financial inclusion, especially in rural areas.

Reduced risks associated with physical currency.

Enhanced transparency in financial transactions.

Potential for innovation in financial services.

A more efficient, secure, and inclusive financial future for India.

August Marks Highest Demat Account Additions in 19 Months

In August, something truly remarkable unfolded in the financial landscape. It marked a significant milestone as it witnessed the highest surge in demat account openings in a span of 19 months. Let’s delve into the details of this noteworthy development.

Based on the data sourced from the Central Depository Services Limited (CDSL) and National Securities Depository Limited (NSDL), the number of demat accounts established in the month of August surpassed a staggering 31 lakh. To put this into perspective, this figure significantly outstrips the 29.7 lakh accounts added in the preceding month and the 21 lakh accounts created during the same period one year ago. In essence, we are witnessing an unmistakable upsurge in initiating demat accounts.

As of the latest data, India’s total count of demat accounts has now vaulted past the 12.66 crore mark. This represents a notable increase of 2.51 percent from the previous month and an impressive 25.83 percent growth compared to the previous year’s corresponding period.

These statistics undeniably reflect the burgeoning interest and active participation in the Indian stock market. Investors are flocking to establish demat accounts at an unprecedented rate, signifying a robust appetite for stock market engagement.

FAQs

Why were so many demat accounts being opened in August?

The surge in Demat account openings in August can be due to the increased interest in the Indian stock market, driven by various factors like economic recovery, attractive investment opportunities, and growing financial literacy.

What benefits do Demat accounts offer?

Demat accounts offer the convenience of holding and trading securities electronically, eliminating the need for physical share certificates. They provide easy access to stocks, mutual funds, and other financial instruments, making investment and trading more efficient.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.