Introduction

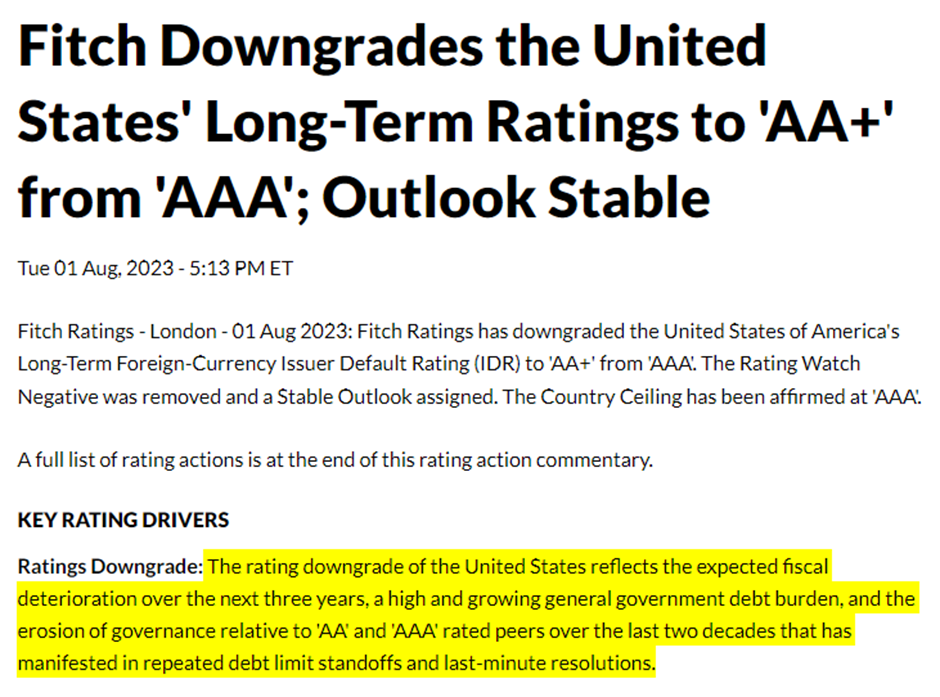

On 1st August, the US faced a significant blow as Fitch Ratings downgraded its top-tier sovereign credit rating from AAA to AA+. This move echoed a similar downgrade made by S&P Global Ratings over a decade ago. While the new rating of AA+ is still considered relatively strong, it does raise questions about the country’s creditworthiness and potential global impact.

Understanding the Downgrade

The downgrade was a response to the actions taken by US lawmakers in dealing with the debt ceiling crisis. The country faced a risky situation when lawmakers waited until the last moment to reach an agreement on a debt ceiling deal in May of the same year. This procrastination put the US at risk of experiencing its first-ever default, leading to worldwide concerns among investors and governments.

It’s important to note that the downgrade was not solely a response to the recent debt ceiling crisis. Fitch Ratings also considered the overall deterioration of the US fiscal situation over the past few years, including the growing government debt burden.

Key Takeaways

What are Credit Ratings?

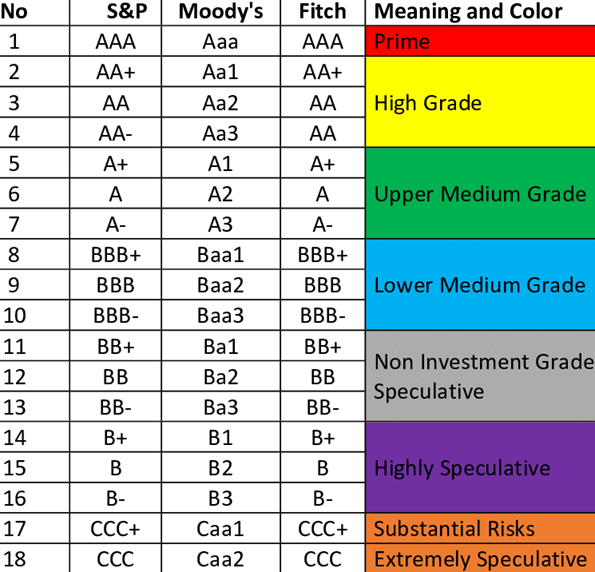

Credit ratings provide an assessment of the creditworthiness of an individual, company, or government. Each rating agency follows its own practices in assigning these ratings. For Fitch Ratings, ‘AAA’ is considered the best rating, indicating the highest credit quality, while ‘AA+’ signifies a high-quality rating.

Despite the downgrade to ‘AA+,’ Fitch Ratings maintained a ‘stable’ outlook, indicating that the creditworthiness of the US is still relatively strong. This stability might offer some reassurance to investors and market participants.

Global Impact and Response

The downgrade of the US rating is an extraordinary event that could have potential global repercussions. Governments and investors worldwide are now more cautious about the economic stability of the United States. The country’s credit rating determines its borrowing costs and overall financial health.

In response to the downgrade, Treasury Secretary Janet Yellen swiftly addressed the situation, describing it as “arbitrary” and “outdated.” She emphasized that the decision by Fitch Ratings does not alter the fact that US Treasury securities are still considered the world’s leading, safe, and liquid asset. Additionally, Yellen reaffirmed the fundamental strength of the American economy.

However, despite Yellen’s reassurances, the downgrade will likely prompt further discussions and attention regarding the US’s financial health and economic policies.

The credit rating downgrade from AAA to AA+ by Fitch Ratings has put the US in the spotlight, raising concerns about its economic stability and creditworthiness. While the downgrade might not indicate an immediate crisis, it serves as a reminder for the US government to address its fiscal situation and take proactive measures to restore investor confidence.

FAQs

Is AA+ a bad credit rating for the US?

AA+ is still considered a high-quality rating, but it indicates a slight decrease in the country’s creditworthiness compared to the previous AAA rating.

How will the downgrade affect the US economy?

The downgrade could lead to higher borrowing costs for the US government, potentially affecting interest rates and overall economic growth.

Will other rating agencies follow suit and downgrade the US credit rating?

It is possible, but decisions by rating agencies depend on their individual assessments of the country’s economic and fiscal situation.

What steps can the US government take to improve its credit rating?

The government can focus on reducing the budget deficit, implementing prudent fiscal policies, and addressing long-term debt sustainability.

Is the US still a safe investment destination despite the downgrade?

Despite the downgrade, US Treasury securities are still considered one of the world’s safest and most liquid assets.

India’s S&P Manufacturing PMI Softens to 57.7 in July, Indicating Robust Growth

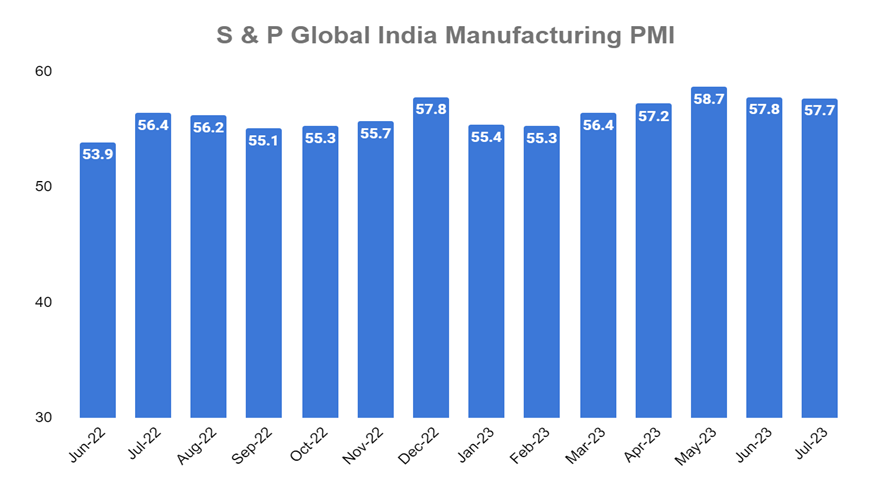

India’s global manufacturing sector, a star performer, continued to exhibit strength in July, although it experienced a slight softening in its Purchasing Managers Index (PMI) from 57.8 in June to 57.7. Despite this dip, the sector displayed minimal indications of slowing down, maintaining its growth trajectory and showcasing resilience amid global challenges.

Understanding the S&P Manufacturing PMI

The Purchasing Managers Index (PMI) is a forward-looking economic indicator that assesses the manufacturing sector’s operating conditions. It is based on a survey of purchasing managers who rate various business conditions, including employment, production, new orders, prices, and inventories. A reading above 50 indicates expansion, while a reading below 50 signals contraction.

Steady Growth and Resilient Demand

In July, India’s S&P Manufacturing PMI softened slightly from the 31-month high of 58.7 achieved in May. Despite this moderation, the sector showed remarkable resilience, bolstered by substantial new orders that kept production processes robust. The increase in new export ventures further fueled growth, reaching its fastest pace since November of the previous year. Manufacturers responded to the upswing in new orders by scaling up their production efforts, leading to a rise in employment rates within the sector.

Outperforming Global Peers

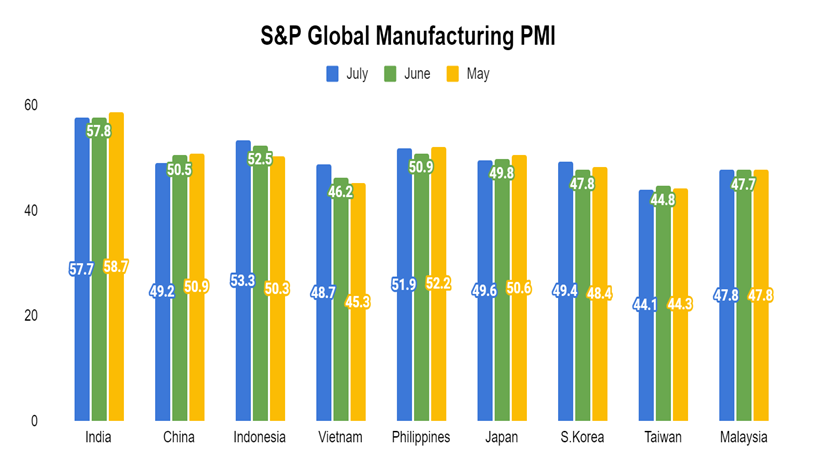

India’s manufacturing sector’s strong performance is noteworthy compared to global peers, particularly when many other regions face weak demand trends. The ability of the Indian manufacturing sector to maintain its growth momentum amid macroeconomic headwinds and a potential global slowdown highlights its position as a standout performer on the global stage.

Continuing Overall Improvement

Despite the slight softening of the Manufacturing PMI number in June, India’s manufacturing sector has now experienced improved operating conditions for an impressive 25 consecutive months. This extended period of sustained growth underscores the sector’s resilience and adaptability to changing economic dynamics.

India’s S&P Manufacturing PMI softened marginally in July, yet the manufacturing sector remains on a solid growth path. With robust production processes, a surge in new export ventures, and increased employment rates, the sector is defying global challenges and maintaining its position as a star performer internationally. The Indian economy’s ability to withstand headwinds and display consistent growth is a positive sign for investors and businesses.

FAQs

What is the significance of the S&P Manufacturing PMI?

The S&P Manufacturing PMI is a crucial economic indicator that provides insights into the manufacturing sector’s operating conditions, offering valuable information on growth trends.

What does a PMI reading above 50 indicate?

A PMI reading above 50 signals expansion in the manufacturing sector, indicating growth and favorable economic conditions.

How did India’s manufacturing sector respond to the softening of PMI in July?

Despite the slight dip in PMI, the manufacturing sector displayed resilience by maintaining robust production processes and scaling up efforts in response to increased new orders.

How does India’s manufacturing sector compare to global peers?

India’s manufacturing sector outperforms many global peers, showcasing strong growth despite weak demand trends in other parts of the world.

What does the continued improvement in overall operating conditions indicate for India’s economy?

The sustained improvement in overall operating conditions for 25 consecutive months reflects the Indian manufacturing sector’s resilience and ability to navigate macroeconomic challenges.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.