Thinking of grabbing a piece of India’s growing flexible workspace market? Awfis Space Solutions, a leading player in this space, is opening its doors to the public through an Initial Public Offering (IPO) tomorrow. But before you hit that subscribe button, let’s take a closer look at what’s on offer and what it means for you.

Awfis Space Solutions IPO details

| Offer Price | ₹364 – ₹383 per share |

| Face Value | ₹10 per share |

| Opening Date | 22 May 2024 |

| Closing Date | 27 May 2024 |

| Total Issue Size (in Shares) | 15,637,736 |

| Total Issue Size (in ₹) | ₹598.93 Cr |

| Issue Type | Book Built Issue IPO |

| Lot Size | 39 Shares |

What’s on Offer?

Awfis Space Solutions is looking to raise ₹598.72 crore through its IPO. This includes fresh issuance of shares worth ₹128 crore and an offer-for-sale (OFS) of over 1.22 crore shares by existing shareholders. Prominent names like Amit Ramani (promoter) and Peak XV Partners Investments (formerly Sequoia Capital India) are among those looking to offload some of their holdings.

Objectives of Awfis Space Solutions IPO

The company plans to utilize a significant portion of the raised capital for growth. ₹42.03 crore will be directed towards establishing new centers, further expanding their reach in the Indian market. Additionally, ₹54.37 crore will be used to meet working capital needs, ensuring smooth day-to-day operations. The remaining funds will be used for general corporate purposes.

Investor Share Allocation

The IPO follows a book-building process, with a predetermined allocation for different investor categories. Institutional investors with a strong track record (QIBs) get the lion’s share, with 75% of the net offer reserved for them. Non-institutional buyers (wealthy individuals and corporates) get the next biggest slice at 15%, while retail investors, the general public, have access to no more than 10% of the offering. A special employee reservation portion with a discount allows them to participate in the IPO.

Awfis Space Solutions IPO GMP

As of today, May 21st, 2024, there’s a buzz surrounding the IPO with an unofficial Gray Market Premium (GMP) of ₹165 per share. This translates to a premium of 43% over the upper price band of the IPO. It’s important to remember that GMP is an unofficial indicator of pre-listing interest, not a guaranteed future price performance.

Company Overview

Founded in 2014, Awfis Space Solutions has carved a niche for itself in India’s growing flexible workspace market. They cater to a diverse clientele, offering various workspace options to startups, small and medium businesses (SMEs), and even large corporations.

Beyond providing physical space, Awfis offers a comprehensive suite of ancillary services. These include catering, IT assistance, infrastructure support, and event organization—essentially a one-stop shop for businesses seeking a ready-to-go workspace solution.

Their reach is impressive, with 169 operational centers across 16 Indian cities as of December 2023. These centers offer a total of 105,258 seats and a significant 5.33 million sq. ft. of chargeable area. The company has also started offering in-house fit-out and facility management services for its centers.

Financial Performance

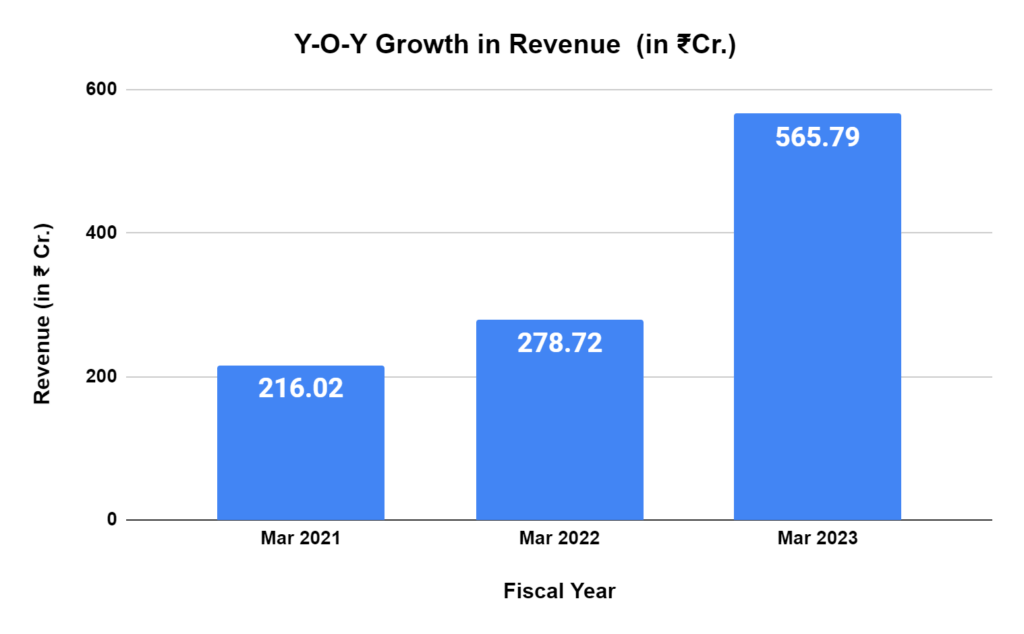

Awfis Space Solutions’s revenue increased substantially by 103% between March 2022 and March 2023.

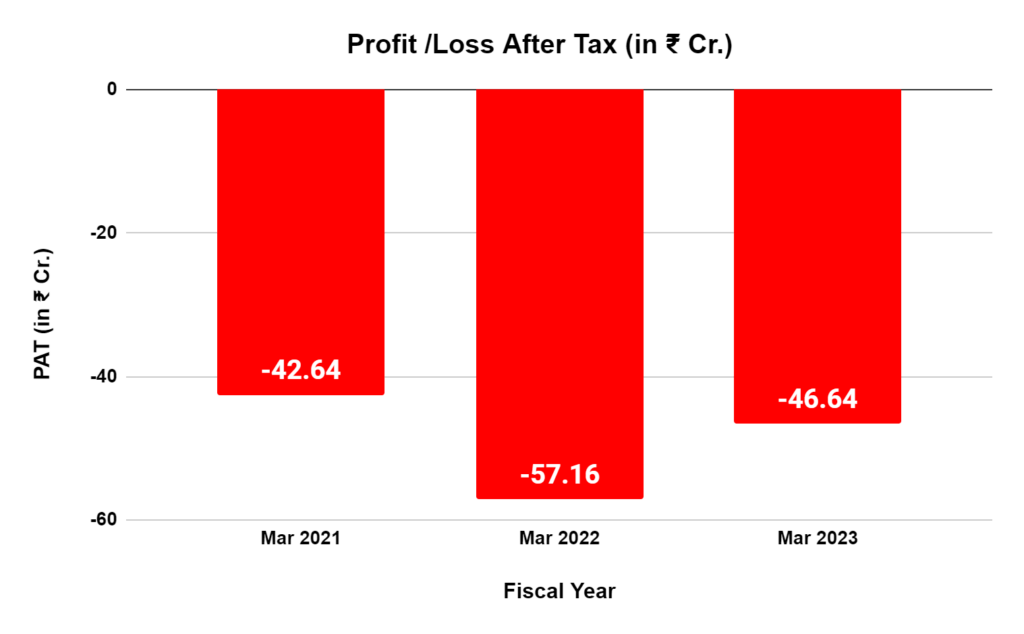

However, a key point to consider is their profitability. While their profit after tax (PAT) did show an 18.4% rise during the same period, it’s important to note that the company is still operating in the red. This raises questions about their long-term financial sustainability.

SWOT analysis of Awfis Space Solutions

| STRENGTHS | WEAKNESSES |

| First-mover advantage in the Indian flexible workspace market A diverse range of workspace solutions and ancillary services A strong network of centers across major Indian cities | Lack of profitability despite revenue growth Reliance on real estate market conditions Competition from established players and new entrants |

| OPPORTUNITIES | THREATS |

| First-mover advantage in the Indian flexible workspace market Diverse range of workspace solutions and ancillary services A strong network of centers across major Indian cities | Economic slowdown impacting business growth Fluctuations in office space rental rates Technological advancements impacting workspace needs |

The Final Word

Awfis Space Solutions IPO may seem like an opportunity to invest in a growing market leader. However, considering the lack of profitability and the competitive landscape is crucial. You must carefully weigh the risks and potential rewards before deciding. Remember, thorough research and a well-defined investment strategy are key in navigating the IPO market.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/