Introduction

In a promising turn of events, the primary market is gearing up for a surge in IPOs as a slew of 71 companies prepares to launch their Initial Public Offerings (IPOs) during the second half of the fiscal year 2024. This wave of IPO activity signals a revival for the IPO market after a period of relative sluggishness.

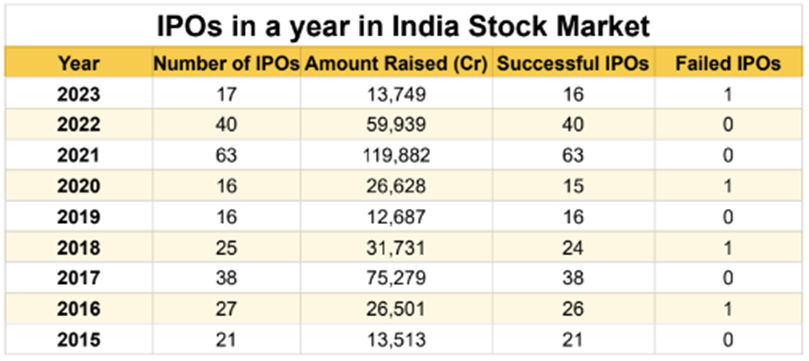

Following the tumultuous wake of the pandemic, the primary market embarked on an impressive journey (see chart below) by amassing a staggering sum of 1.19 lakh crore in 2021, setting a new record. However, the subsequent years witnessed a temporary lull in IPO momentum. With a surge in IPOs, 71 companies are set to grace the IPO stage during the latter half of FY24.

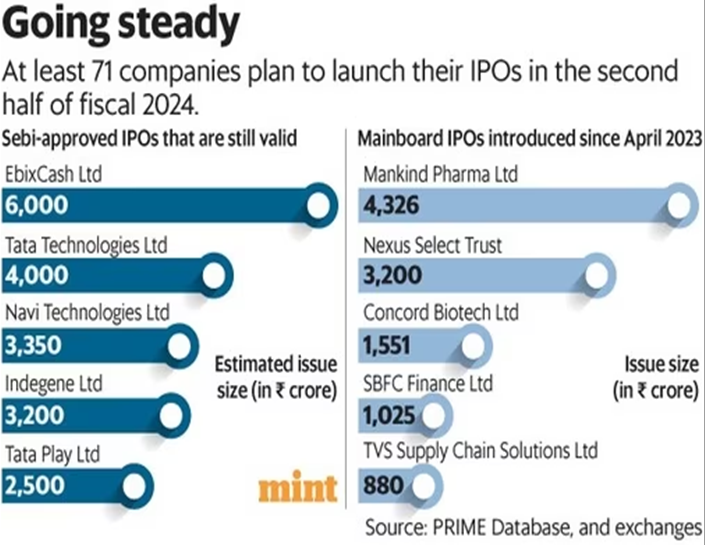

According to data from Prime Database (see chart below), these 71 companies have the potential to collectively raise an impressive $10.7 billion, equivalent to Rs 89,069 crores, by offering shares to the public and subsequently listing them on the exchange through IPOs.

Approval Status and Projections

Among the cohort of companies, 41 have successfully secured approval from the Securities and Exchange Board of India (SEBI). At the same time, 30 firms have submitted their Draft Red Herring Prospectuses (DRHP) and await approval. This surge in IPOs paints a promising picture for investors and companies eyeing the public markets.

Key Takeaways

The recent surge in the Sensex and Nifty, reaching unprecedented all-time highs fueled by Foreign Institutional Investor (FII) investments, has significantly bolstered confidence in the market. This surge in optimism within the secondary markets has paved the way for a surge in IPOs as many new enterprises seek to list on the stock exchanges.

Prominent players poised to enter the secondary market include Tata Technologies, Ebix Cash, Navi Technologies, and NSDL. These impending listings are anticipated to garner substantial attention and interest among discerning investors.

Despite global economic headwinds, the Indian IPO market showcases impressive resilience and an air of positivity. This tenacity underscores the nation’s robust economy and enduring investor confidence, even in international challenges.

FAQs

What is the current state of the IPO market in India?

The IPO market in India is on the brink of a revival, with 71 companies gearing up to launch their Initial Public Offerings during the second half of FY24.

How did the primary market perform after the pandemic?

Following the pandemic, the primary market experienced a remarkable upswing, amassing a record-breaking 1.19 lakh crore in 2021.

What is the potential fundraising projection for the upcoming IPOs?

Data from Prime Database suggests that the 71 companies planning IPOs in H2 FY24 could collectively raise as much as $10.7 billion or Rs 89,069 crores.

Which prominent companies are expected to enter the secondary market?

Big names like Tata Technologies, Ebix Cash, Navi Technologies, and NSDL are among the notable companies poised to make their presence felt in the secondary market.

How has investor sentiment been influenced recently?

A surge in the Sensex and Nifty, driven by Foreign Institutional Investor (FII) investments, has contributed to renewed investor confidence and optimism in the market

Is the Indian IPO market resilient despite global challenges?

Despite global economic headwinds, the Indian IPO market remains robust and exudes a sense of positivity, highlighting the nation’s enduring economic strength and investor faith.

Understanding the Increase in Inflation: Unpacking the Recent Data

Introduction

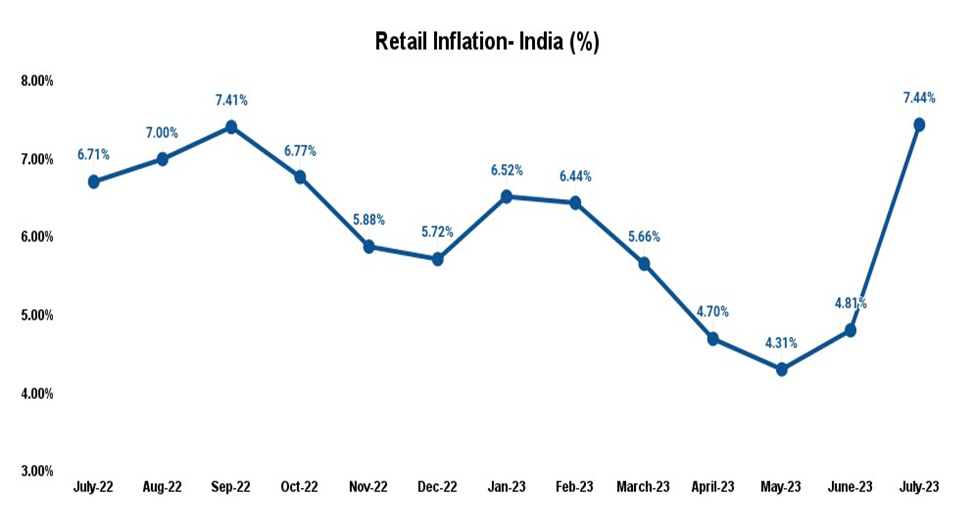

The latest inflation figures, unveiled on Monday evening, have sent shockwaves through the economic landscape, drawing the attention of experts, decision-makers, and even political figures. The Consumer Price Index (CPI) inflation, a crucial gauge of retail inflation within the nation, has taken an unexpected leap, soaring to a staggering 7.44% in July 2023. This surge marks a peak not witnessed in the last 15 months, far exceeding the market’s initial estimates that ranged from 6.6% to 6.7%.

Unmasking the Culprit: Food Prices Take Center Stage

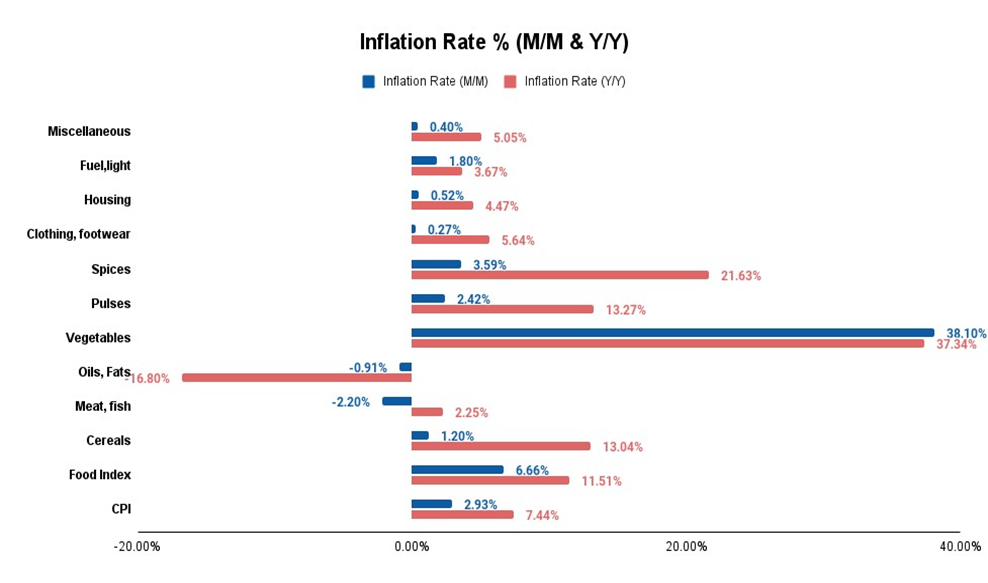

At the heart of this significant escalation lies the food price component, driven primarily by skyrocketing vegetable prices. The Consumer Food Price Index has surged by a noteworthy 696 basis points, propelling the index to an alarming 11.51% in July, a stark contrast to the 4.55% reported just a month prior in June. Delving deeper, it becomes apparent that cereals, constituting nearly 10% of the CPI, have undergone an astonishing 13% price hike since July 2022, nearly doubling the monthly pace of increase to 1.2%.

Vegetables: The Star of the Inflation Show

Among these food items, vegetables have emerged as the true outlier. With a staggering 37.3% year-on-year price surge and an equally remarkable 38.1% month-on-month spike in July, they have stolen the limelight. This surge in vegetable prices has become a focal point of concern, contributing significantly to the overall inflation surge.

Finding Solace in Core CPI

Offering a glimmer of hope amidst these soaring prices, the core CPI, which excludes food and beverages, fuel and light, and petrol and diesel prices, has shown some respite. It has eased to a 21-month low of 5.1% in July 2023, providing a counterbalance to the overwhelming inflationary pressures.

Crucial Factors for the Road Ahead

Looking forward, one pivotal factor will be the progress of the monsoon. Uneven distribution of rainfall could potentially spell trouble for the sowing of Kharif crops, exacerbating the existing problem of food inflation. This makes monitoring the monsoon’s trajectory of paramount importance for economic stability.

The Role of RBI and Monetary Policy

Earlier this month, the Reserve Bank of India (RBI) made a significant move by opting to maintain the repo rate at a steady 6.50%. The central bank attributed the surge in vegetable prices to a disconnect between supply and demand dynamics.

It’s important to note that while the RBI’s power to influence food supply management is limited, the easing of core inflation to 5.1% was emphasized by the Monetary Policy Committee (MPC). This underscores the need for vigilance and preparedness to take appropriate measures to address the prevailing inflationary pressures.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

FAQs

What is causing the recent spike in inflation?

The surge in inflation can be attributed primarily to the significant increase in food prices, especially vegetables, as indicated by the Consumer Price Index (CPI) inflation data for July 2023.

How high has inflation risen?

The Consumer Price Index (CPI) inflation reached a startling 7.44% in July 2023, marking a 15-month high and surpassing earlier market estimates.

What is driving the increase in food prices?

Vegetable prices have played a pivotal role in driving up food prices, with a year-on-year surge of 37.3% and a month-on-month increase of 38.1% in July.

Can the RBI control the food supply to manage inflation?

No, the RBI’s influence over food supply management is limited. The focus has been on monitoring core inflation and being prepared to take necessary actions to address inflationary pressures.

What role does monsoon play in this scenario?

The progress of the monsoon is crucial as uneven rainfall distribution can negatively impact the sowing of Kharif crops, potentially worsening the food inflation situation.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/