India’s journey towards an ethanol revolution is a transformative movement with significant implications for the country’s energy landscape and the stock market. The government’s ambitious Ethanol Blending Program (EBP) aims to blend 20% ethanol with petrol by 2030. This initiative is a stride towards energy self-sufficiency and a potential game-changer for the Indian stock market, particularly for companies within the ethanol production chain.

The Ethanol Drive: A Snapshot

Ethanol, a biofuel derived from the fermentation of sugars in crops like sugarcane and maize, is a renewable and cleaner alternative to fossil fuels. India’s push for ethanol is due to the need to reduce its hefty crude oil import bill and utilize excess agricultural produce effectively. By this process, waste generated from sugar production is used as fuel.

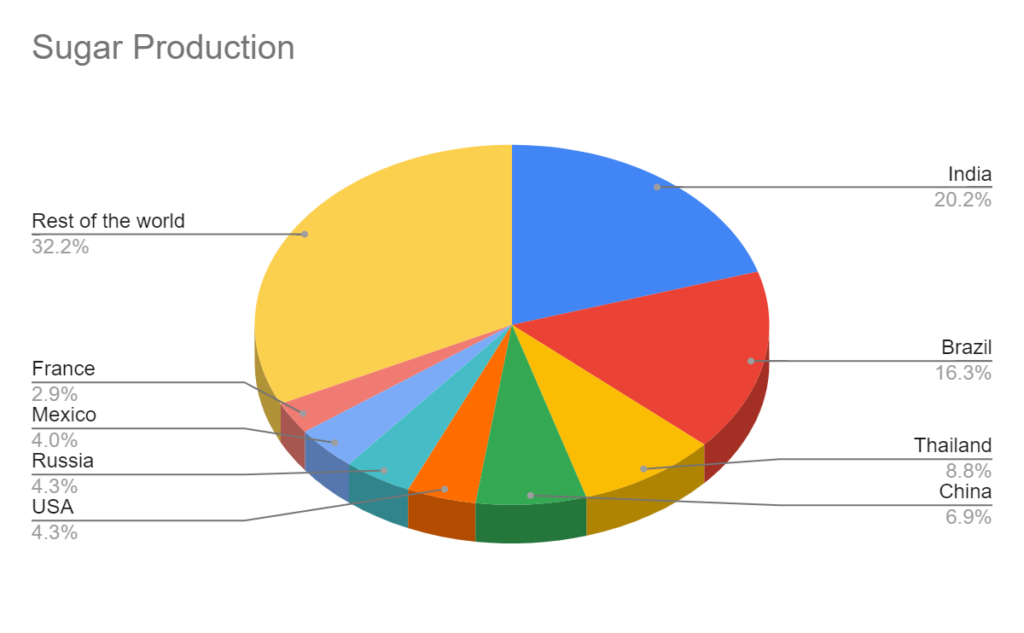

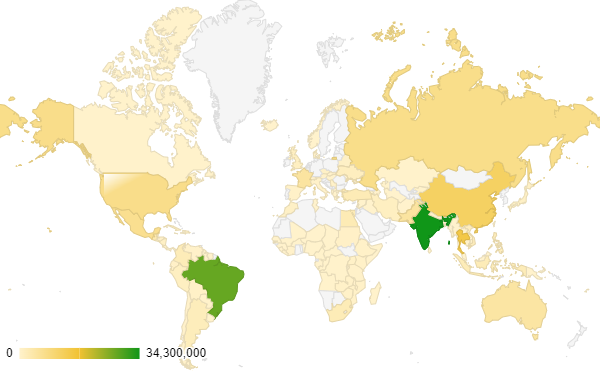

Furthermore, unlike crude wells, this source won’t dry, as India is the largest sugar producer, producing 20% of the world’s sugar. Extracting Ethanol from this much sugar will provide the country with a healthy amount of biofuel. The EBP has already progressed, with blending rates climbing from 1.6% in 2013-14 to over 10% in recent years.

Stock Market Surge: Ethanol’s Ripple Effect

As the demand for ethanol increases, the market will naturally flock toward companies that produce it to get a piece of this cake. The ethanol initiative has sparked a rally in related stocks. Companies like Praj Industries and Shree Renuka Sugars have seen their stock prices soar, reflecting investor optimism about the sector’s growth prospects.

The expansion of ethanol production capacity, backed by government incentives, has led to a bullish sentiment among investors. Ethanol stocks outperform the broader market. By 2025, the Ethanol industry is expected to grow by over 500% from around ₹9,000 Crore to over Rs ₹50,000 Crore.

Here are some business companies that may benefit from the Ethanol revolution.

Ethanol Machinery Manufacturers

- Praj Industries Ltd. is a frontrunner in ethanol technology, with a significant market capitalization and robust return on equity.

- ISGEC Heavy Engineering Ltd: Another key player that offers engineering solutions for ethanol plants.

Ethanol Manufacturing Sugar Companies

- Balrampur Chini Mills Ltd: A significant sugar and ethanol producer benefiting from the increased demand for ethanol.

- Dwarikesh Sugar Industries Ltd: Known for its substantial growth in stock value over the past year.

- Triveni Engineering & Industries Ltd: Another key player in the sugar and ethanol market with potential growth due to the ethanol blending program.

Challenges and Opportunities

While the ethanol revolution presents a promising outlook, it has challenges. Fluctuations in sugarcane production due to variable monsoon patterns can impact ethanol output and, consequently, the performance of related stocks. Moreover, the transition towards grain-based ethanol to meet targets adds another layer of complexity, potentially affecting food supply chains.

The Road Ahead

The ethanol revolution is poised to reshape India’s energy paradigm and stock market dynamics. As the country moves closer to its blending targets, we can expect a continued focus on companies within the ethanol value chain. Investors may look to capitalize on this green shift, but they must stay attuned to the agricultural and policy factors that could influence the market’s trajectory.

In conclusion, India’s ethanol revolution is more than an energy initiative; it catalyzes economic and environmental change. Its impact on the stock market underscores the interconnectedness of sustainable practices and financial growth, heralding a new era for investors and the nation.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is India’s Ethanol Blending Program (EBP)?

The EBP is a government initiative that aims to blend 20% ethanol with petrol by 2030. This program is part of India’s commitment to reducing reliance on fossil fuels and greenhouse gas emissions.

Why is ethanol considered a game-changer for the Indian stock market?

Ethanol production is expected to boost the performance of companies involved in its supply chain, including sugar mills and engineering firms. As the demand for ethanol increases, these companies may see a surge in their stock prices.

Which companies could benefit from the ethanol revolution?

Companies like Praj Industries Ltd, ISGEC Heavy Engineering Ltd, Balrampur Chini Mills Ltd, Dwarikesh Sugar Industries Ltd, and Triveni Engineering & Industries Ltd might benefit from the increased demand for ethanol.

What challenges does the ethanol revolution face?

Challenges include fluctuations in sugarcane production due to variable monsoon patterns and the transition towards grain-based ethanol, which could affect food supply chains.

How significant is the ethanol industry’s expected growth?

By 2025, the ethanol industry is projected to grow by over 500%, from around ₹9,000 Crore to over ₹50,000 Crore, reflecting its potential impact on the stock market.

What should investors consider before investing in ethanol-related stocks?

Investors should consider the agricultural and policy factors that could influence the market’s trajectory and the individual performance and growth prospects of the companies within the ethanol production chain.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/