Arguing with your local shopkeeper for change, waiting in bank queues for hours, and desperately hoping you remember your ATM card PIN is a thing of the past in India. A vibrant fintech landscape brimming with innovation and opportunity is replacing inconveniences. But just how big is this boom, and where is it headed?

Big Numbers, Big Dreams

India’s fintech scene is on fire. As per a recently released report by Inc42 on the State of Indian Fintech, since 2014, a cool $28 billion has been poured into the sector, with a whopping $15.8 billion flooding in just the last two years. Experts predict this ain’t slowing down anytime soon, with a projected $2.1 trillion market size by 2030, growing at a crazy 18% per year.

Lending tech is the current rockstar, but don’t be surprised to see other segments steal the show. And guess what? Global giants are noticing and lining up to be part of this hotshot industry. So, get ready for a fintech revolution, Indian style!

| Sector & Segments | Market Size (2022) | Market Size (2030) | CAGR (2022 to 2030) | % Share Market Size (2030) |

| Overall Fintech Market | $ 584 Bn+ | $ 2.1 Tn+ | 18% | – |

| Lending Tech | $ 270 Bn+ | $ 1.3 Tn+ | 22% | 60% |

| Insurtech | $ 87 Bn+ | $ 307 Bn+ | 17% | 40% |

| Payments | $ 165 Bn+ | $ 253 Bn+ | 5% | 12% |

| Neobanking | $ 48 Bn+ | $ 183 Bn+ | 18% | 9% |

| Investment Tech | $ 9.2 Bn+ | $ 74 Bn+ | 30% | 3% |

| Fintech SaaS | $ 4.6 Bn+ | $ 31 Bn+ | 27% | 1.5% |

Unicorns and Soonicorns

India boasts 24 fintech unicorns (startups valued over $1 billion) with a combined worth of $75 billion+. And there’s more to come! 36 “soon-to-be-unicorns” are waiting in the wings, representing another $13 billion potential. Big deals like Zolve’s $100 million and InsuranceDekho’s $60 million in Q4 2023 highlight investor confidence in this space.

Funding Trends: A Mixed Bag with Bright Spots

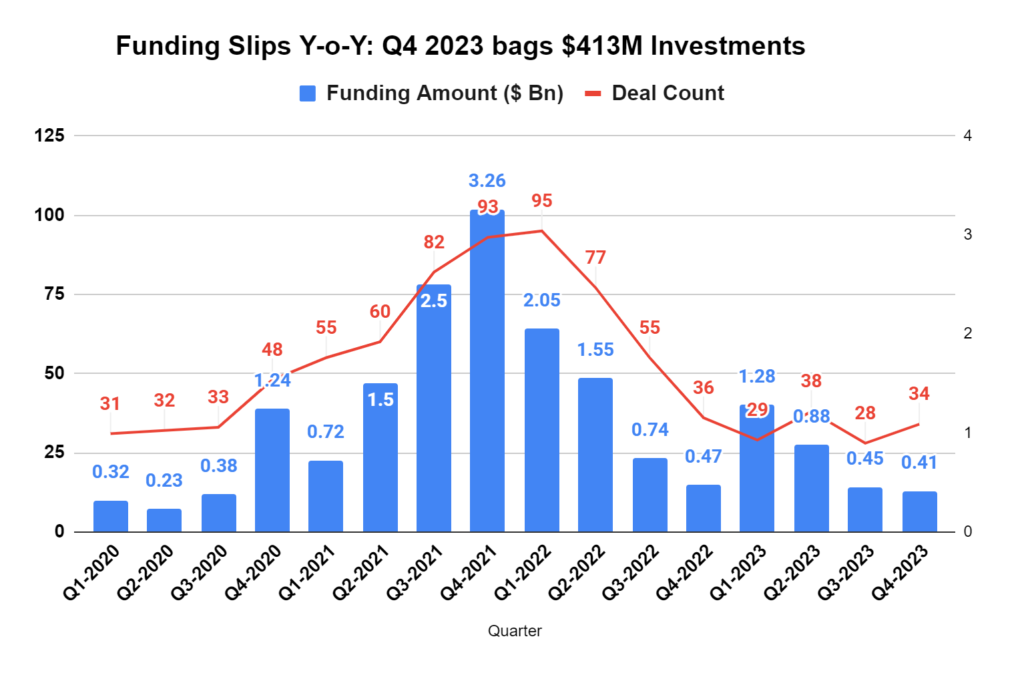

While 2023 saw a 12% dip in overall fintech investment compared to the previous year, a closer look reveals a clearer picture. The final quarter of 2023 defied the trend, witnessing a healthy $413 million pumped into 34 deals. This suggests that investor confidence in the sector remains strong, with strategic shifts in focus rather than a complete decline.

The Spotlight is on Bengaluru

Interestingly, Bengaluru emerged as the undisputed champion, attracting nearly half the total funding in Q4. This highlights the city’s vibrant startup ecosystem and growing appeal to fintech investors. Significant hubs like Delhi NCR and Mumbai followed suit but with a smaller share of the pie.

Stagewise Funding

Another noteworthy trend lies in the stage-wise distribution of funds. Seed-stage startups, brimming with fresh ideas and potential, garnered a respectable $55 million. This indicates a healthy pipeline of innovative ventures waiting to take flight. However, the real spotlight shone on growth-stage companies, which secured a staggering $272 million. This suggests that investors increasingly support proven players with demonstrated traction and scalability.

Beyond the Big Cities: Rural Fintech Takes Root

The story doesn’t end with the metros. Rural India is witnessing its fintech revolution, with over $1.3 billion invested since 2015. Lending dominates this segment, accounting for 73% of the total funding. This signals a crucial step towards financial inclusion for millions.

Key Trends to Watch in 2024

- AI/GenAI Integration: Expect AI to revolutionize the financial landscape, adding $70 billion to the industry’s value by 2029. AI-powered products in regional languages will further boost accessibility.

- Regulatory Scrutiny: As fintech adoption grows, so will regulations to protect consumers. Recent actions against prominent players indicate a stricter stance on responsible practices.

- Embedded Fintech: Look for seamless integration of financial services within non-financial offerings, like contactless payments in stores or fintech products on e-commerce platforms.

- Cybersecurity Focus: Despite concerns, fintech startups are expected to embrace AI/GenAI, leading to increased investments in cybersecurity to mitigate risks.

- Blockchain’s Comeback: Enterprise blockchain solutions are gaining traction, with the potential to address security, transparency, and trust issues. Government initiatives like e-rupee and platforms like SingularityNET suggest a promising future for blockchain in fintech.

So, is the Indian fintech boom just hype? The numbers and trends suggest otherwise. But the real test lies in execution – can these innovations reach the masses, bridge the digital divide, and truly revolutionize how Indians interact with their finances? Only time will tell, but the future looks bright for India’s fintech story.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

How useful was this post?

Click on a star to rate it!

Average rating 4.4 / 5. Vote count: 8

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/