Challenges such as regulatory hurdles and rising pricing pressures cannot keep India’s pharmaceutical prowess down! The US pharmaceutical export numbers prove this, with a whopping 15% increase during the first 11 months of FY2023-24. Moreover, this growth rate more than doubled to 6.18% in the same period of the previous financial year (FY23), from $6.8 billion in FY23 to $7.83 billion in the current period.

Strong Overall Growth in Pharma Exports

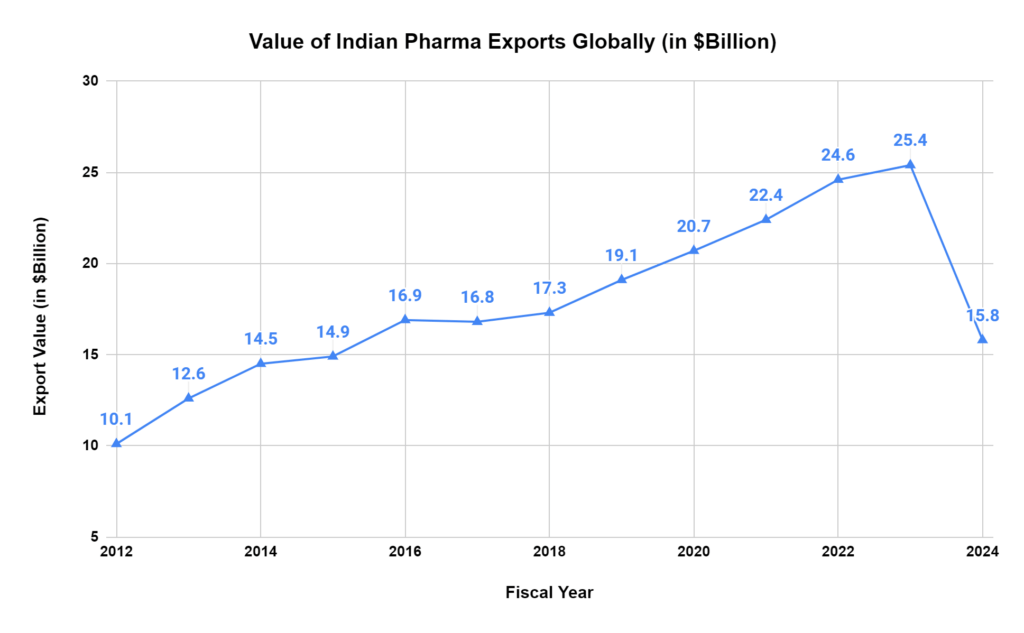

While the value of pharmaceutical exports to the US climbed significantly, India’s total exports also showed strong growth, reaching $25.04 billion, a 9.34% increase compared to $22.9 billion in the previous year. The Indian Pharmaceutical Industry continues to perform phenomenally globally, as the figures in 2024 are already soaring to touch $15.8 billion even before we have reached the half-year mark.

The US remains an important market for Indian pharma, making up for approximately 30% of the total exports. Some sections of pharma experts believe the surge in exports to the US quash the notion that the country’s importers are looking for alternatives to Indian drugs in crucial areas such as oncology.

What makes this surge more outstanding is that it comes at a time when the world is caught in turbulent geopolitical crises like the Ukraine war and the Red Sea Crisis. If India continues to grow at the current rate, the country’s total pharma exports for FY2023-24 could register an astounding $27.5 billion to $28 billion.

The 3 Main Reasons For The Surge in Pharma Exports

So, what factors can we credit for the significant pharma export growth to the US? There are three main reasons:

- Faster Approvals: According to the Pharmaceutical Export Promotion Council (Pharmexcil), the initial growth is thanks to quicker approvals of Abbreviated New Drug Applications (ANDAs) until FY16, which allowed generic drugs to gain approval in the US. Although this pace slowed in subsequent years, in 2023, the approval process regained its earlier speed, with India securing nearly 40% of approvals, including first-time generic medications.

- US Government Intervention: The US government enacted the Inflation Reduction Act (IRA), which played a role in this growth. The Act aimed to reduce prescription drug costs, prompting some US manufacturers to withdraw products from the market. This opened up opportunities for Indian companies to fill the gap. Introducing various medications in critical areas like cardiology, oncology, and anti-infectives further boosted exports.

- FDA Clearances: The resumption of US Food and Drug Administration (USFDA) inspections in India at a faster pace after a COVID-induced break significantly contributed to the export surge. India boasts the highest number of USFDA-approved manufacturing facilities (around 670) outside the US. These inspections resulted in product clearances, allowing Indian companies to introduce these medications into the US market swiftly.

Future Outlook

The continued growth looks optimistic. As ANDA approvals will likely reach their full potential by the end of FY24, the strong growth witnessed this year may carry forward into the next financial year. India can foresee a further increase in exports to the US, with the total growth projected to be $30 billion for the pharmaceutical sector in the coming year.

India’s pharmaceutical industry is experiencing a strong resurgence in its exports to the US market. The industry is set to succeed continually in the coming year, and it has the potential to reach new heights in exports and overall growth.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/