Thinking of investing in Bharti Hexacom’s upcoming IPO? This subsidiary of Bharti Airtel is all set to hit the market on April 3rd, and it’s natural to have questions. Let’s break down the key details to help you decide if this offering aligns with your investment goals.

What’s on Offer?

Bharti Hexacom is looking to raise ₹4,275 crore through its Initial Public Offering (IPO). This is the first major IPO of the new financial year (FY25). This is purely an OFS, meaning the existing shareholder, Telecommunications Consultants India Ltd (TCIL), will be offloading a 15% stake (7.5 crore shares) to the public. So, the company itself won’t receive any funds from the IPO.

Bharti Hexacom IPO Details

| Offer Price | ₹542 – ₹570 per share |

| Face Value | ₹5 per share |

| Opening Date | 3 April 2024 |

| Closing Date | 5 April 2024 |

| Total Issue Size (in Shares) | 75,000,000 |

| Total Issue Size (in ₹) | ₹4,275 Cr |

| Issue Type | Book Built Issue IPO |

| Lot Size | 26 Shares |

What’s the GMP?

The grey market premium (GMP) for Bharti Hexacom shares is currently at ₹ 50, indicating a potential listing gain of around 8.77%. However, remember, GMP is unofficial and reflects market sentiment, which can be volatile.

Company Profile

Founded in 1995, Bharti Hexacom Limited specializes in providing fixed-line telephone and broadband services, primarily catering to regions in Rajasthan and the North East, encompassing states such as Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, and Tripura.

Through substantial investments totaling ₹206 billion in digital infrastructure by December 2023, the company has established itself as a key player, serving a vast customer base of 27.1 million individuals across 486 census towns. This extensive reach is facilitated by a robust distribution network of 616 distributors and 89,454 retail touchpoints.

Financials

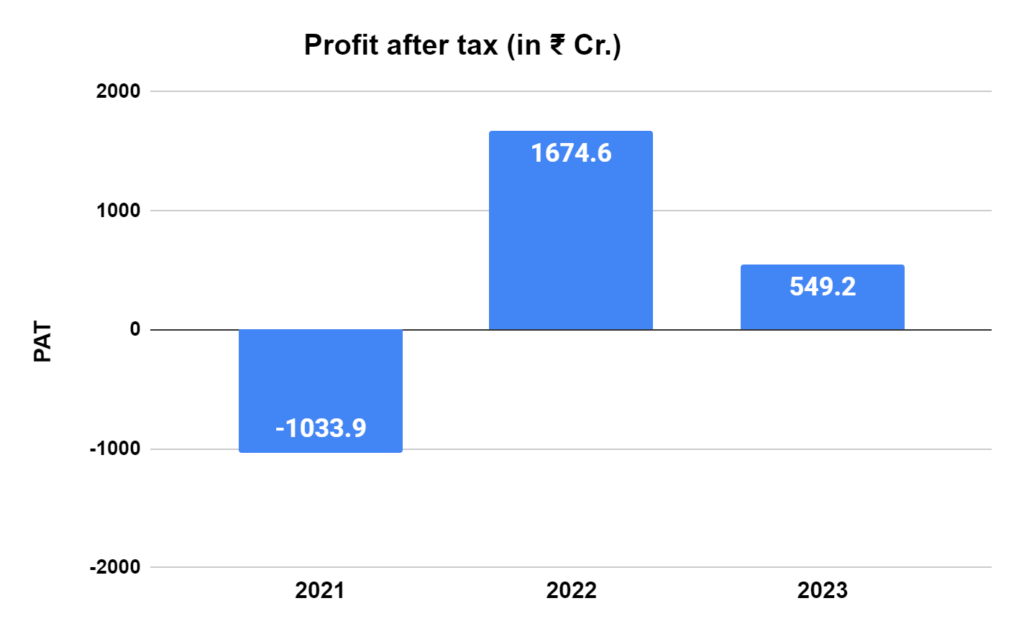

During fiscal year FY23, the company’s net profit decreased significantly by 67.2 percent yearly, reaching ₹549.2 crore.

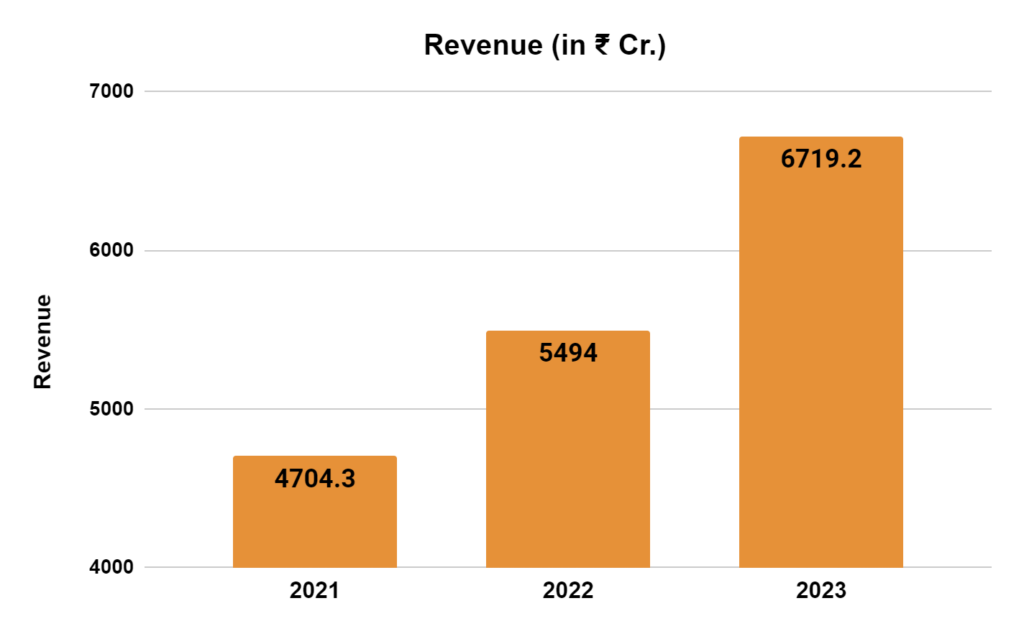

This decline was primarily due to a comparably higher base in the preceding year, including exceptional gains totaling ₹1,951.1 crore. Despite this setback in net profit, the company managed to sustain robust top-line and operating figures. Revenue from operations witnessed a notable growth of 21.7 percent, reaching ₹6,719.2 crore compared to the previous fiscal year.

Here’s a SWOT analysis of Bhatri Hexacom to provide a better understanding:

| STRENGTHS | WEAKNESSES |

| Strong Parentage: Bharti Airtel, a telecom leader, holds a 70% stake, offering brand recognition and potential for future synergies. Healthy Revenue Growth: Revenue grew 21.7% year-on-year in FY23, indicating strong demand in its operating regions. Wide Distribution Network: Reaches 27.1 million customers through a network of distributors and retail touchpoints. | Profitability: Net profit in FY23 declined by 67.2% due to a high base in the previous year that included exceptional gains. Organic profit growth needs evaluation. Limited Geographical Reach: Operates only in Rajasthan and the North East, which might limit future growth. High Customer Churn: Retaining customers in the competitive telecom industry can be challenging. |

| OPPORTUNITIES | THREATS |

| Data Consumption Boom: Growing data consumption in India presents a significant opportunity for broadband service providers like Bharti Hexacom. Government Initiatives: Government’s focus on digital infrastructure development in rural areas aligns with Bharti Hexacom’s regional presence. | Regulatory Environment: Price regulations and competition can impact profitability. Technological Advancements: New technologies and disruptive players can alter the telecom landscape. |

The Final word

This IPO offers a chance to invest in a well-known brand with a strong regional presence. However, the recent decline in net profit and limited geographical reach are factors to consider. Carefully evaluate your risk tolerance and investment goals before making a decision.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/