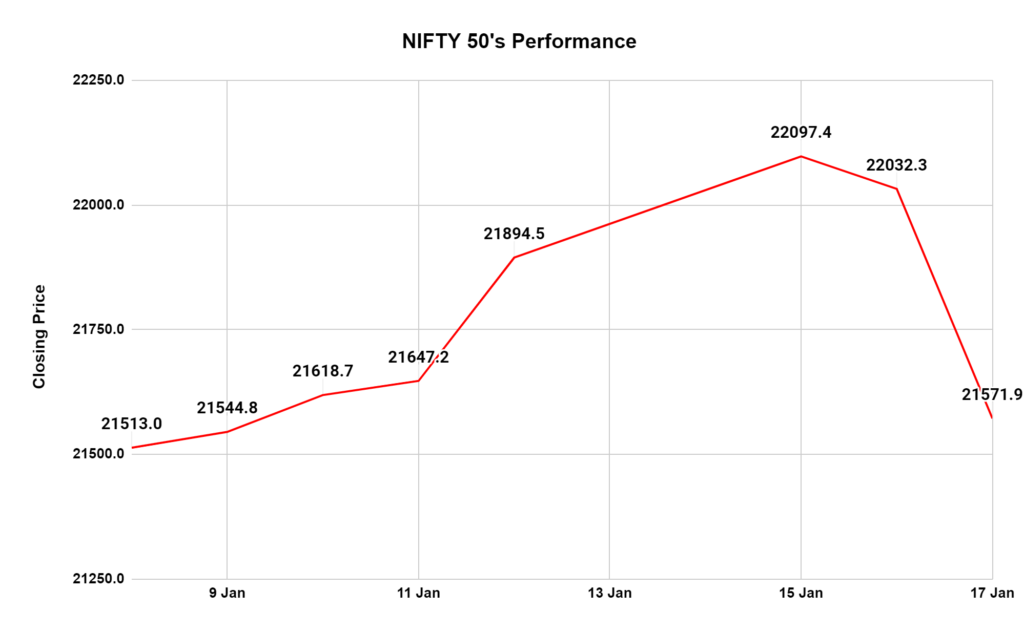

Yesterday, the stock market must have felt like your carefully built sandcastle came crashing down in a single, monstrous wave. The Sensex, India’s benchmark stock index, dropped a staggering 1,600 points, marking its worst day in 16 months and shaking investor confidence. The Nifty50, too, tumbled over 450 points, spreading the nervousness across the markets.

But what exactly triggered this market meltdown? Let’s find out the key reasons behind this dramatic downturn.

HDFC Bank’s Q3 Results

At the heart of the disaster stood HDFC Bank, the indices heavyweight. The banking giant’s quarterly results released the same day, fell short of investor expectations, dropping its shares by a shocking 8.5%. This marked its worst single-day percentage fall since March 2020, highlighting the deep disappointment with the bank’s stagnant margins. This, in turn, dragged the entire market with it.

Decline of the Asian Market

The Indian market wasn’t alone in its downfall. Asian equities, led by Chinese stocks, slumped on Wednesday, mirroring a global risk aversion trend. China’s GDP rose by just 5.2% in the fourth quarter, falling short of projections and raising concerns about the recovery of the world’s second-largest economy. This led to a significant drop in Asian equities, including a 2.5% decline in Hong Kong’s Hang Seng index.

Rise of the dollar

Adding fuel to the fire was the strengthening of the US dollar. Commodities like crude oil became more expensive as the dollar index climbed to a one-month high. This, in turn, increased India’s import costs and widened the current account deficit, further dampening investor spirits.

Climb of The Treasury yield

The 10-year Treasury yield in the US, a key indicator of borrowing costs, shifted upwards, crushing hopes of aggressive rate cuts by the Federal Reserve. The market had anticipated five or six rate cuts in 2024, but with these expectations dashed, investors turned cautious, leading to a sell-off in riskier assets like Indian equities.

Reality-check for Mid and Small-Cap Stocks

After a flying takeoff in the past year, mid and small-cap stocks are experiencing a downturn. Experts highlighted that the sector’s inflated valuations, driven by ample liquidity, will not last long. As the truth sets in, investors pull out of these segments, contributing to a downward trend.

What’s next?

The immediate future of the market remains uncertain. While short-term volatility is likely to persist, long-term prospects depend on various factors, including the trajectory of global economic growth, the central bank’s actions, and corporate earnings performance.

All said and done, let’s understand that the Sensex crash wasn’t a singular event but a mix of multiple factors – HDFC Bank’s worries, a resurgent dollar, Asian market downfall, rising bond yields, and a correction in the overvalued small and mid-cap space.

Investors must be cautious, prioritize fundamentals over sentiment, and adopt a diversified approach. Understanding these underlying reasons can help navigate this volatile market with greater awareness and make informed decisions.

How useful was this post?

Click on a star to rate it!

Average rating 3.8 / 5. Vote count: 39

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/