Ever wake up feeling that the world has shifted under your feet while you are sleeping? Well, that’s the common sentiment felt by investors today when the stock market suddenly took a turn overnight. Let’s look closely at what’s causing jitters in the Indian stock market this morning.

Nifty Posts Worst Loss in 6 Months

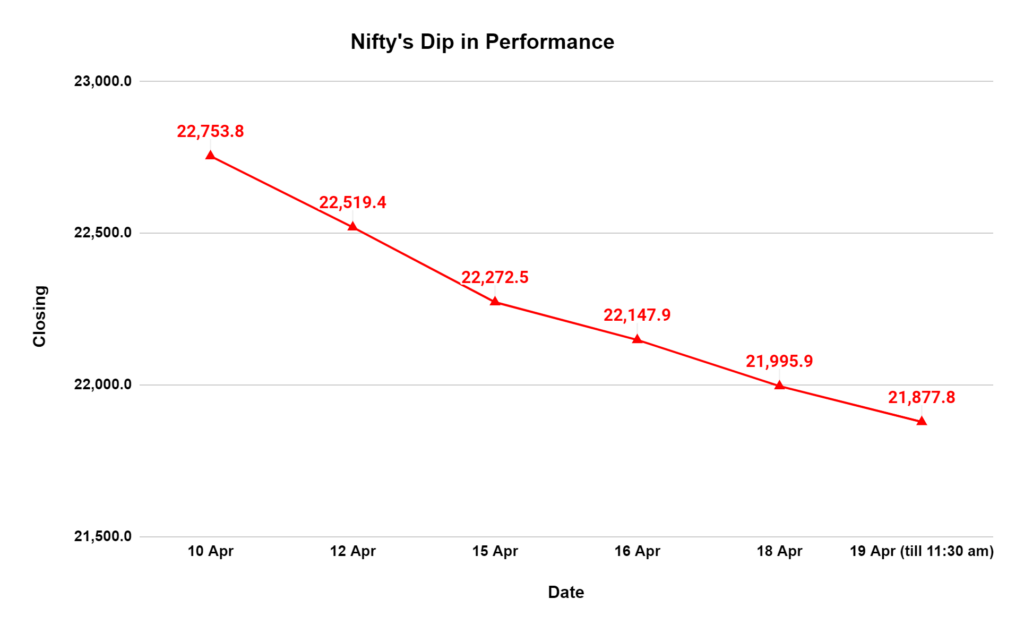

On Thursday, the Indian stock market indices continued to reel under selling pressure and closed lower for the fourth consecutive session amid mixed global cues. Nifty recorded the worst losing streak since October 26, 2023, settling 152.05 points, or 0.69%, lower at 21,995.85. Gift Nifty was trading around the 21,765 level, a discount of nearly 300 points from the Nifty futures’ previous close, indicating a gap-down start for the Indian stock market indices.

Global Cues Weigh Heavy

The Indian market also reflects the happenings in international markets. This morning, Asian markets are wearing a shade of red, with most indices trading lower. Japan’s Nikkei 225 dropped 1.88%, while the Topix declined 1.3%.

South Korea’s Kospi fell 1.8%, and the Kosdaq dipped 1.34%. Hong Kong’s Hang Seng index futures opened weaker, setting a negative tone for the domestic market, as investors often take cues from global trends.

Iran-Israel Conflict: A Geopolitical Cloud

Geopolitical tensions can also affect the stock market. Israel’s recent missile attack on the Iranian city of Ishafan is a cause for concern. Multiple flights had to be redirected to Iranian airspace. Investors don’t like instability, and any escalation in this conflict could disrupt global oil supplies and trade. This, in turn, could impact the Indian economy and stock market.

Infosys Q4 Results: A Mixed Bag

Infosys, a major Indian IT company, recently released its quarterly results. For Q4FY24, a net profit of ₹7,975 crore was reported, a 30% year-on-year (YoY) rise from ₹6,134 crore in the same quarter last year. Investors keenly watch these results as they can provide insights into the health of the IT sector and the broader economy. On the one hand, the company reported a decent profit. On the other hand, its revenue growth wasn’t as impressive as some analysts had hoped for.

This mixed performance has left investors unsure of how to react. Some see the profit as a positive sign, while others are concerned about the slowdown in revenue growth. Infosys’ stock price will likely reflect this uncertainty when the market opens today.

US Markets End Mixed

Remember that saying, “When the US sneezes, the rest of the world catches a cold”? Well, there’s some truth to it regarding stock markets. Yesterday, the US market ended on a mixed note.

The S&P 500, a key benchmark for the US stock market, ended its longest losing streak since October, falling for five consecutive sessions. However, the decline was relatively small, dropping only 0.24%, ending at 5,010.19 points, while the Nasdaq Composite declined 82.35 points, or 0.52%, to 15,601.02.

However, the Dow Jones Industrial Average, which tracks 30 large blue-chip companies, reached 37,777.18. This lack of clear direction from a primary market like the US can create uncertainty for investors in India, leading to cautious trading.

Corporate Earnings Dictate Wall Street

Netflix shares took a hit in after-hours trading, falling about 4% despite exceeding Wall Street’s expectations for the second quarter in a row. The company’s earnings per share jumped to $5.28 from $2.88 a year earlier, reflecting significant growth. Revenue also rose a healthy 14.8% to nearly $9.4 billion.

Meanwhile, the broader market displayed a mixed reaction to various earnings reports. Meta Platforms’ share price gained 1.54%, while Genuine Parts’ enjoyed a significant surge of 11.22%. However, the hospitality and credit reporting sectors faced setbacks. Las Vegas Sands’ stock price dropped 8.66%, and Equifax’s shares tumbled 8.49%.

Dollar, Treasury Yields

The US dollar and Treasury yields climbed after positive economic data and comments from Federal Reserve officials hinting at a more aggressive stance on interest rates. This fueled speculation that borrowing costs would remain elevated for an extended period.

The dollar index, which gauges the US currency against major rivals, gained 0.2% to 106.15, extending its year-to-date rise to 4.5%. Treasury yields also climbed, with the two-year note nearing 5% and the benchmark ten-year yield jumping six basis points to 4.64%.

Bond Yields on the Rise

Another key factor impacting markets today is the rise in bond yields. These yields represent the return investors earn for holding a bond. When they increase, stocks can become less appealing by comparison. This shift occurs because investors may prioritize the guaranteed returns offered by bonds over the higher potential returns (but also greater risk) associated with stocks.

What Does This Mean for You?

So, what should you do with all this information? The important thing to remember is that the stock market is dynamic. What happens today doesn’t necessarily dictate what happens tomorrow. These are just some of the factors that are influencing the market right now.

If you’re a long-term investor, it’s probably best not to get caught up in the short-term noise. However, if you’re a day trader or actively manage your portfolio, you’ll want to be aware of these developments and how they might affect your investment decisions.

The key is to stay informed, make well-considered decisions based on your risk tolerance and investment goals, and avoid making impulsive moves based on market jitters.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/