The IPO season is showing no signs of slowing down! With several companies already making their debut, Aadhar Housing Finance is next in line, aiming to raise a substantial ₹3,000 crore.

Before you make a decision, let’s look into the details of the IPO. We’ll explore the company’s business model, financials, and other details.

Aadhar Housing Finance IPO details

| Offer Price | ₹300 – ₹315 per share |

| Face Value | ₹10 per share |

| Opening Date | 8 May 2024 |

| Closing Date | 10 May 2024 |

| Total Issue Size (in Shares) | 95,238,095 |

| Total Issue Size (in ₹) | ₹3000 Cr |

| Issue Type | Book Built Issue IPO |

| Lot Size | 47 Shares |

Here’s what the IPO offers

- Fresh Issue & Offer for Sale (OFS): The offering is a mix. Aadhar Housing Finance will issue new shares worth ₹1,000 crore, and existing promoters and shareholders will sell shares worth ₹2,000 crore through the OFS route.

- Fund Usage: The company plans to use ₹750 crore from the proceeds to meet lending and other corporate needs. The remaining funds will be used for general corporate purposes.

- Investor Allocation: Up to 50% of the IPO shares are reserved for institutional investors (QIBs), retail investors get a minimum of 35%, and non-institutional investors (NIIs) get a minimum of 15%.

Aadhar Housing Finance IPO GMP

As of May 6th, market analysts estimated a Grey Market Premium (GMP) of ₹240 for Aadhar Housing Finance. Remember, GMP is an unofficial indicator of investor interest in the unlisted market, not a guaranteed future price.

Company Overview

Established in 2010, Aadhar Housing Finance focuses on the underserved lower-income housing segment. Their strategy involves targeting Tier 4 and 5 towns, often through “Aadhar Mitras, ” which are potential customers’ referral points.

They offer various loan options for residential and commercial properties, including construction, home improvement, and extension loans. As of September 2023, they boast a network of 471 branches spread across 20 states and union territories.

Sound Financials

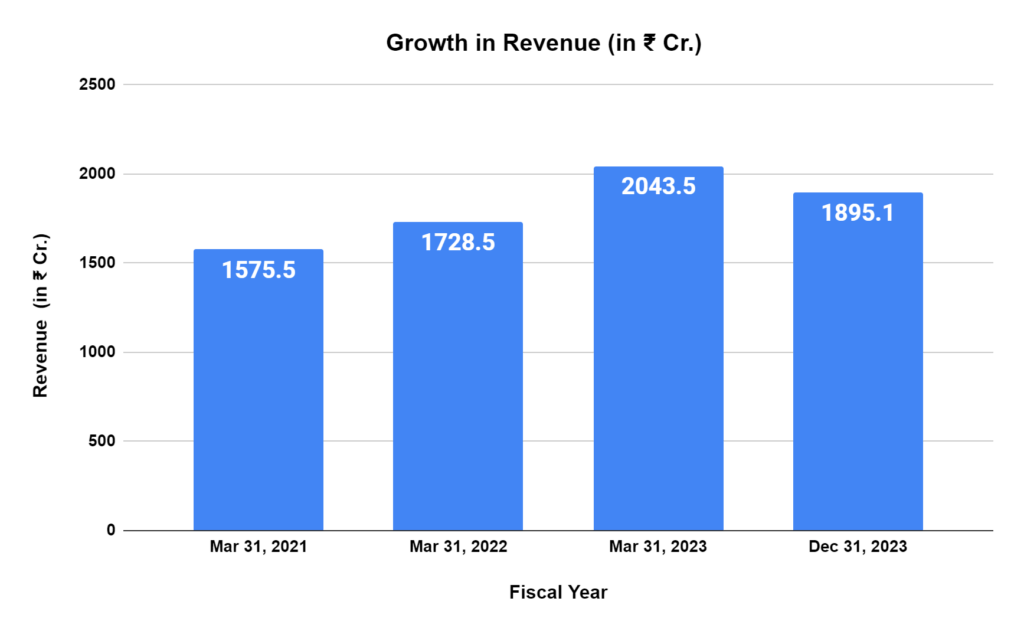

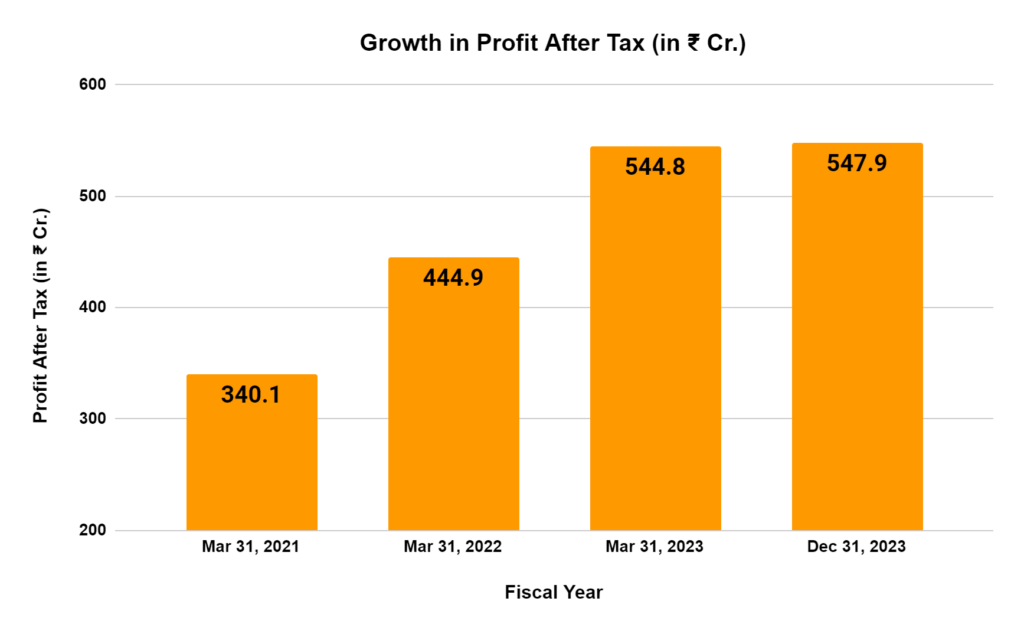

Aadhar Housing Finance has shown consistent growth. In FY 2022-2023, they reported a net profit of ₹544.8 crore with a revenue of ₹2,043.52 crore. Looking back at the past three fiscal years, they’ve steadily climbed in total income and net profit. This trend continued in the first nine months of FY 2024, with a net profit of ₹547.88 crore on a total income of ₹1895.17 crore.

SWOT Analysis of Aadhar Housing Finance Limited

| STRENGTHS | WEAKNESSES |

| Focus on Underbanked Segment: Aadhar Housing Finance targets the lower-income housing segment, often underserved by traditional banks. This could give them a significant market opportunity. Extensive Network: With 471 branches spread across 20 states and union territories, Aadhar Housing Finance has a well-established network to reach potential customers. Proven Track Record: The company has shown steady revenue and net profit growth over the past three fiscal years. This indicates financial stability and potential for future growth. | High Dependence on Interest Rates: As a housing finance company, Aadhar Housing Finance’s profitability is heavily influenced by interest rates. Rising interest rates could put pressure on their margins. Asset Quality Concerns: The company focuses on the lower-income segment, which is statistically more prone to loan defaults. This could impact their asset quality. Competition: The housing finance sector is a crowded space with established players. Aadhar Housing Finance will need to differentiate itself to attract customers. |

| OPPORTUNITIES | THREATS |

| Government Initiatives: Government schemes promoting affordable housing could benefit Aadhar Housing Finance as they cater to the same segment. Growing Demand: The demand for housing in India, especially in Tier 4 and 5 towns, may continue growing. This presents a significant opportunity for Aadhar Housing Finance. Technological Advancements: Utilizing technology to streamline loan processes and reach customers more efficiently could give Aadhar Housing Finance a competitive edge. | Economic Downturn: An economic slowdown could dampen demand for housing loans, impacting Aadhar Housing Finance’s business. Regulatory Changes: Changes in government regulations on housing finance could negatively impact the company’s operations. Rising Operational Costs: Aadhar Housing Finance must manage its operating costs effectively to maintain profitability. |

The Final Verdict

The IPO market can be exciting but also requires careful consideration. Remember, thorough research is crucial before investing in any IPO. Don’t solely rely on the Grey Market Premium (GMP), as it’s an unofficial indicator. Consult with a financial advisor if needed to make an informed decision that aligns with your financial goals.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/