The Indian cement industry has witnessed a significant move with the Adani family’s recent strategic investment in Ambuja Cements. The family has raised their stake to a commanding 70.3%, following an additional infusion of Rs 8,339 crore into the company. This move is not isolated but part of a larger capital infusion strategy that has seen the family invest Rs 20,000 crore in Ambuja Cements.

A Vision for Expansion

The Adani family’s investment in Ambuja Cements is not just a financial decision; it’s a visionary move to propel the company into a new era of growth and market leadership. With a bold target to expand the company’s production capacity to an impressive 140 million tonnes per annum by 2028, this initiative is set to redefine the cement industry’s landscape.

This expansion is not merely about increasing numbers; it’s about setting a new standard of excellence and demonstrating the Adani family’s unwavering confidence in Ambuja Cements’ potential. Their commitment clearly signals their belief in the company’s strategic direction and ability to deliver long-term value.

The Journey of Infusion

A series of calculated and generous capital infusions have marked the Adani family’s journey with Ambuja Cements. It began with a substantial investment of Rs 5,000 crore on October 18, 2022, which laid the groundwork for the company’s future endeavors. This was followed by an even more significant investment of Rs 6,661 crore on March 28, 2024, underscoring the family’s dedication to Ambuja Cements’ growth trajectory.

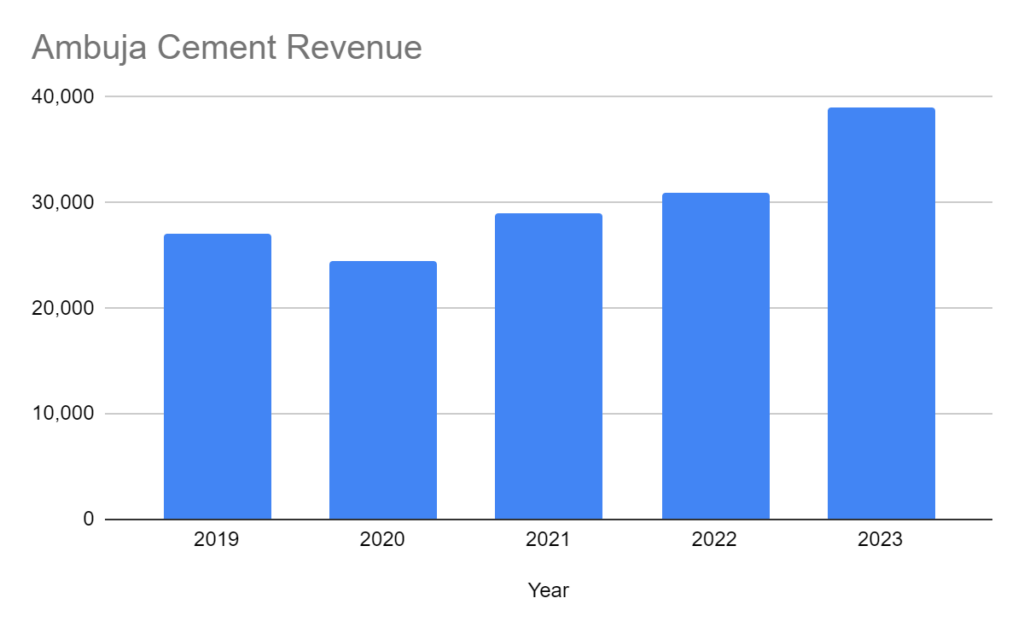

Each round of funding is a testament to their commitment to nurturing the company’s development and ensuring its competitive edge in the industry, as seen in its growing revenue.

Operational Excellence and Market Impact

The strategic allocation of funds for initiatives such as debottlenecking capital expenditure (capex) and enhancing operational performance clearly indicates the Adani family’s intent to drive Ambuja Cements towards unparalleled operational excellence.

This investment is about expanding capacity and optimizing every aspect of the company’s operations. From streamlining resources to refining the supply chain, the goal is to elevate efficiency and productivity to new heights, solidifying Ambuja Cements’ position as an industry frontrunner.

Leadership’s Enthusiasm

Ajay Kapur, the Full-Time Director and CEO of Ambuja Cements, has publicly expressed his enthusiasm for the Adani family’s primary infusion. His optimism is rooted in the belief that this newfound capital flexibility will fuel growth, enhance capital management initiatives, and fortify the company’s financial foundation. Mr. Kapur envisions a future where these strategic investments translate into long-term, sustainable value creation for all stakeholders, setting a precedent for how businesses can thrive through visionary leadership and robust financial backing.

Market Response

The market’s reaction to the Adani family’s investment has been overwhelmingly positive, with Ambuja Cements’ shares reaching unprecedented heights. This share price surge reflects the investor community’s confidence in the company’s prospects.

It’s a resounding endorsement of the Adani family’s investment strategy and its transformative impact on Ambuja Cements’ market valuation. As the company continues to navigate the competitive landscape, the market’s response is a barometer of the business community’s belief in the potential of strategic investments to yield significant returns.

Conclusion

The Adani family’s increased stake in Ambuja Cements is more than just a financial transaction; it’s a strategic move that underlines their belief in the company’s potential and commitment to its success. As Ambuja Cements embarks on this journey of expansion and operational enhancement, the industry and investors will be watching closely, anticipating the transformative impact this investment will have on the company and the cement industry.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the significance of the Adani family’s investment in Ambuja Cements?

The Adani family has increased their stake in Ambuja Cements to 70.3%, reflecting their confidence in its growth potential and commitment to its long-term success. This investment is significant as it aims to expand the company’s production capacity and market leadership.

How much has the Adani family invested in Ambuja Cements?

The Adani family has invested Rs 20,000 crore in Ambuja Cements, with the latest infusion being Rs 8,339 crore. This is part of a strategic plan to bolster the company’s growth and expansion.

What are the Adani family’s plans for Ambuja Cements?

The Adani family plans to expand Ambuja Cements’ capacity to 140 million tonnes per annum by 2028. This ambitious goal will enhance the company’s operational excellence and market position.

How has the market responded to the Adani family’s investment?

The market has responded positively, with Ambuja Cements’ shares hitting an all-time high. This reflects investor confidence in the company’s prospects and the strategic nature of the Adani family’s investment.

Who is Ajay Kapur, and what has been his reaction to the investment?

Ajay Kapur is the Whole Time Director and CEO of Ambuja Cements. He has expressed excitement about the Adani family’s investment, believing it will accelerate growth, improve capital management, and create sustainable stakeholder value.

How useful was this post?

Click on a star to rate it!

Average rating 3.8 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/