Are you thinking about buying gold this Akshaya Tritiya? You’re not alone. With gold prices down nearly ₹3,000 from their record highs, it’s a tempting time to invest. But before you empty your savings, let’s quickly examine how gold has performed in the past few years on this auspicious occasion.

Golden Returns, Not Always Guaranteed

This year, gold prices are down considerably from their all-time highs, offering a potential buying window. Experts predict 7% to 19% returns by the next Akshaya Tritiya, which may be a tempting proposition for investors with a medium to long-term view. However, a look back reveals a mixed bag.

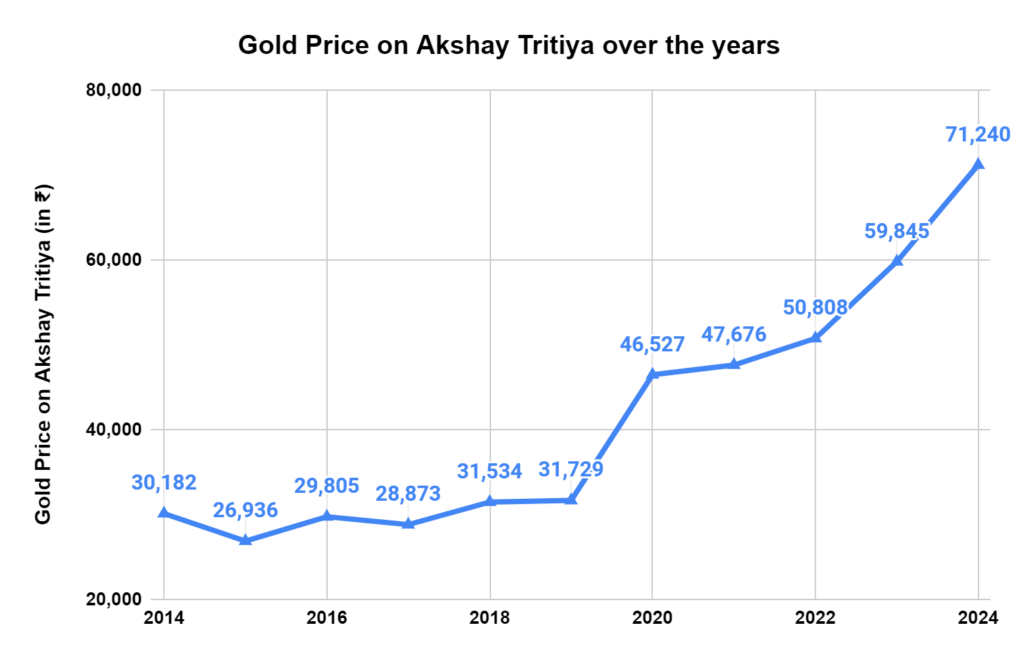

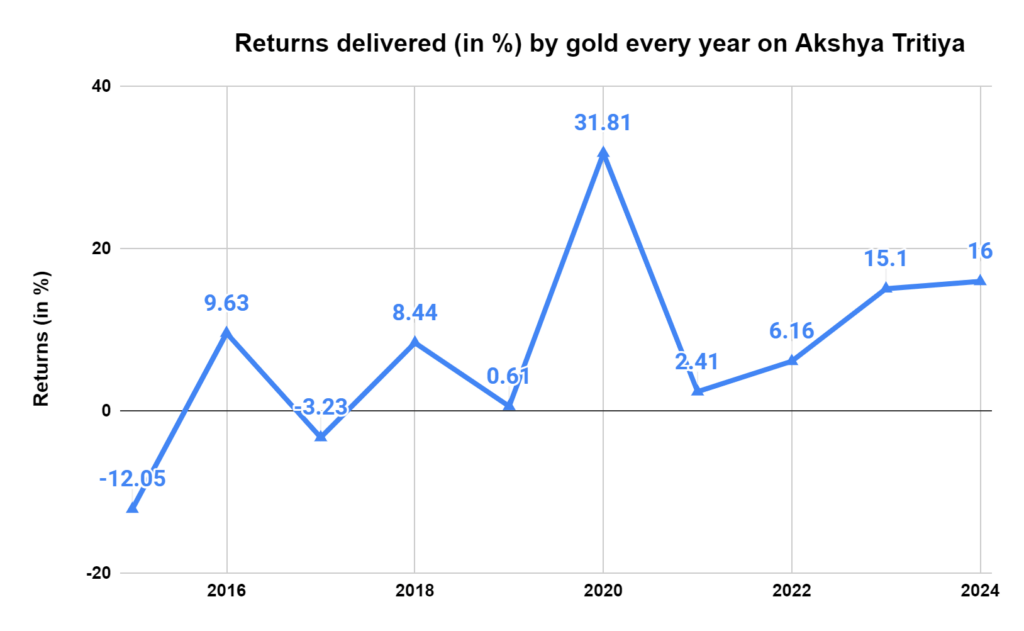

A Look Back: Gold’s Performance on Akshaya Tritiya

But past performance isn’t always indicative of future results. Look at how gold has fared over the past decade on Akshaya Tritiya. The picture is mixed. While 2020 saw a stellar 32% return, other years like 2015 and 2017 witnessed price drops of 12% and 3.23%, respectively.

However, considering the last five years, gold has delivered positive returns on eight occasions, with this year and 2023 boasting double-digit gains. An investor who consistently bought gold on Akshaya Tritiya over the past five years would look at a compounded annual growth rate (CAGR) of around 17.5%.

What’s Driving the Shine?

So, the recent surge in gold prices and the optimistic outlook for the future can be attributed to a confluence of factors. Let’s break them down:

- Geopolitical Jitters: Investors flock to safe-haven assets like gold when tensions rise on the world stage, like the recent conflict between Israel and Hamas. This increased demand drives prices up as investors seek to protect their wealth during uncertain times.

- The Fed Factor: The Federal Reserve’s interest rate decisions significantly influence gold’s price movement. When the Fed lowers interest rates, holding gold becomes more attractive than other investments, offering lower returns. This year, hopes of multiple interest rate cuts in 2024 triggered a buying frenzy in March and April, pushing gold prices to record highs.

- China’s Golden Touch: China, a major gold consumer, has also contributed to the recent rally. Increased gold buying by Chinese investors can significantly influence global gold prices.

Investing in Gold: Options and Considerations

Whether Akshaya Tritiya is the perfect time to invest in gold depends on your financial goals and risk tolerance. There are various avenues to explore when it comes to investing in gold. Physical options like bars, coins, and jewelry offer tangible ownership, while digital options like Gold ETFs, Sovereign Gold Bonds, and Digital Gold provide a more flexible and potentially more liquid way to hold this precious metal.

Each method has its advantages and risks. The choice ultimately depends on your investment horizon and risk tolerance. The recent correction shouldn’t deter those considering gold. Experts recommend entry points around ₹69,000 – ₹69,500, suggesting further upside potential with prices expected to reach ₹80,000 – ₹85,000 by next year’s Akshaya Tritiya. They say adopting a “buy in parts” strategy might be a good idea, gradually adding to your holdings over time.

The Final Word: Information is Gold

While the past performance of gold on Akshaya Tritiya is encouraging, it’s not a guarantee of future gains. Do your research, understand the various investment options, and consider your financial goals before making any decisions. Gold can be a valuable addition to a diversified portfolio, but it’s not a magic bullet for wealth creation.

Know more about

SIP CALCULATOR | RETIREMENT CALCULATOR | CAGR CALCULATOR | FINANCIAL CALCULATORS

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.7 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/