Introduction

Do you remember these lines from an ad film featuring Boman Irani?

Bhaiya Yeh Deewar Tootti Kyu Nahi?!! Tutegi Kaise? Ambuja Cement se jo bani hai.

Similarly, Ambuja Cement has strengthened itself as one of the well-known cement brands thanks to its effective marketing strategy, strategic logo placement in highly visible locations, and its commitment to delivering superior quality cement.

Ambuja Cement is one of India’s top cement companies with a diverse product portfolio that caters to home construction and infrastructure project requirements. This article will analyze Ambuja Cement share price and perform a company analysis.

Ambuja Cements History

1981: Ambuja Cement was incorporated in 1981 as Ambuja Cements Private Limited by two traders, Narotam Sekhsaria and Suresh Neotia.

1983:Its name was changed to Gujarat Ambuja Cements Limited in 1983

2007:The company was named Ambuja Cements Limited in 2007.

2005: It was remarkable when Holcim Group, a Swiss multinational company that manufactures building materials, bought a stake in Ambuja Cements and ACC, paving the way for enhanced growth and synergies in the construction and cement sector.

2013:In a restructuring process, Ambuja Cements acquired a 50.01% stake in ACC in 2013, and Holcim India was also merged into Ambuja Cements.

2016: ACC also became a subsidiary of Ambuja Cements in 2016.

2022: Adani Group acquired Ambuja Cement and ACC’s controlling stake from Holcim Group last year for $10.5 billion. From a single plant with a capacity of 70,000 tonnes per annum in 1986, today Ambuja Cement has become a cement giant with a capacity of 31.45 million tonnes per annum (MTPA).

Ambuja Cements Business Overview

Ambuja Cement’s core business revolves around cement production, clinker (a vital raw material for cement production), and other building materials. The company operates six integrated plants and eight grinding units spread across India, with a manufacturing capacity of 31.45 MTPA.

Regarding business segment reporting, Ambuja Cement has only one business segment, i.e., Cement and Cement Related Products, and all its revenue is earned within India. In FY23, 77% of cement sales came from retail and 23% from institutional customers.

Product Portfolio

Ambuja Cement specializes in producing high-performance ordinary portland cement (OPC), pozzolana portland cement (PPC) suitable for home building, and other cement types for infrastructure projects.

Its products are sold under the brand name Ambuja Cement, Ambuja Cement Kawach, Ambuja Cement Plus, Ambuja Cement Powercem, Ambuja Cement Railcem, Ambuja Cement Cool Walls, Ambuja Cement Compocem.

Ambuja Cements Management Team

Mr. Ajay Kapur is the CEO and Whole-time Director of Ambuja Cements and has spent over 30 years closely monitoring India’s cement, power, construction, and heavy metals sectors. He joined Ambuja Cements in 1993 and held many strategic roles. Mr. Kapur has completed his MBA from K.J. Somaiya Institute of Management and has a degree in economics.

Mr. Vinod Bahety is the Chief Financial Officer and is a qualified Chartered Accountant and Cost & Works Accountant. He has more than 19 years of experience in banking & finance with companies like Yes Bank, ICICI Bank, and Grasim Industries.

Mr. Sukuru Ramarao is the Chief Operating Officer and is a Chemical Engineer from Sri Venkateswara University.

Mr. Jayant Kumar is the Chief Human Resource Officer. He has nearly 30 years of experience managing human resource-related affairs in some of India’s leading companies like NTPC, Tata Power, Marico Ltd., etc.

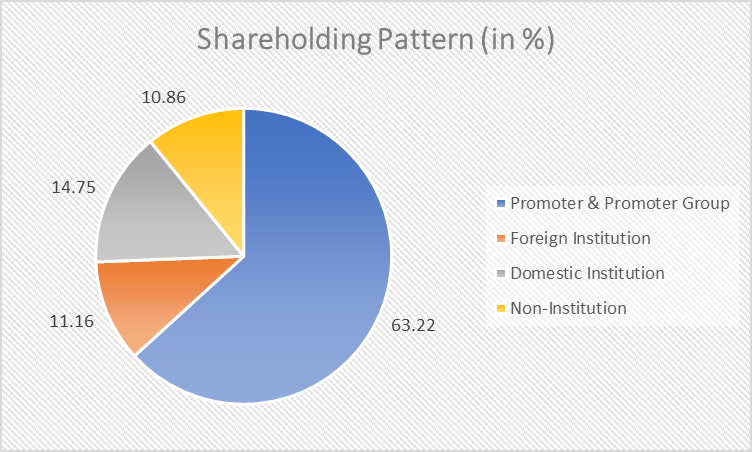

Ambuja Cements Shareholding Pattern

Ambuja Cements Company Analysis

Despite the strong external headwinds, Ambuja Cements delivered solid results between January 2022 and March 2023. Ambuja Cement displayed strong operational performance and recovery after facing strong headwinds during the period. The company recorded a sales volume growth of 3%, with strong demand coming from micro markets and Tier 2 & Tier 3 cities.

However, in the first nine months, EBITDA per tonne decreased to ₹829 at the end of December 2022 due to a huge spike in fuel costs. Through cost-saving measures, changing the fuel basket to reduce import dependency, ramping up coal production in capital coal blocks, and leveraging Adani group’s expertise in sourcing low-cost coal helped to mitigate the impact.

Ambuja Cements reduced its power and fuel costs to ₹1404 per tonne by the end of March 2023, down from ₹1434 per tonne in March 2022.

The share of premium products in total trade sales volume is 22%, which the company intends to increase to 29-30% in the medium term to help in higher realization.

Ambuja Cements Financial Overview

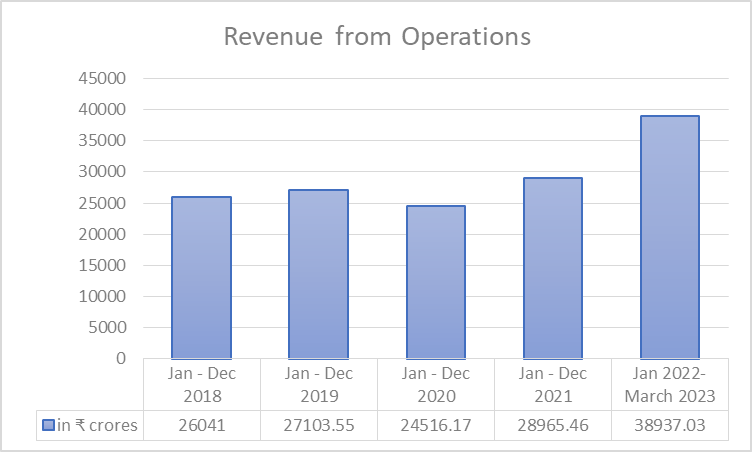

Before being acquired by Adani Group, Ambuja Cements had a fiscal year from January to December. Shareholders approved changing the fiscal year from April to March in October 2022. As a result, the most recent financial figures reported covered a 15-month period from January 2022 to March 2023.

Revenue

In FY23, Ambuja Cement reported a 34.4% growth in revenue from operations at ₹38,937.03 crores, compared to ₹28,965.46 crores.

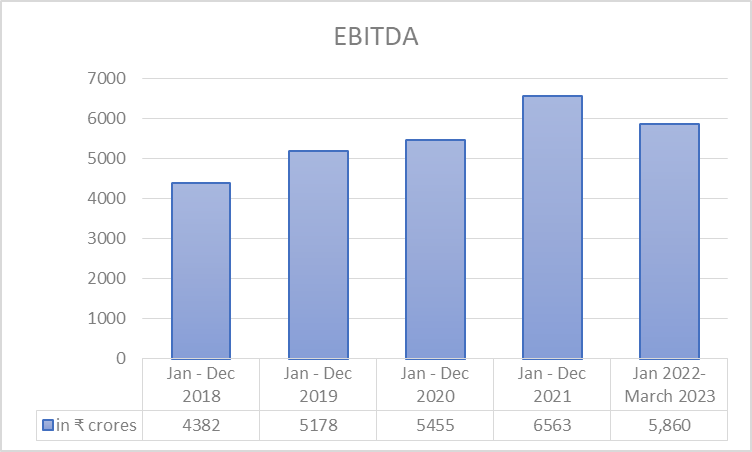

EBITDA

In FY23, Ambuja Cement reported a 10.7% decline in EBITDA at ₹5,860 crores, compared to ₹6,563 crores in FY22. The decline in EBITDA is due to a steep rise in fuel cost in Q2FY23, which was partly mitigated in the next two quarters by the reduction in logistics cost and coal supply from captive coal blocks.

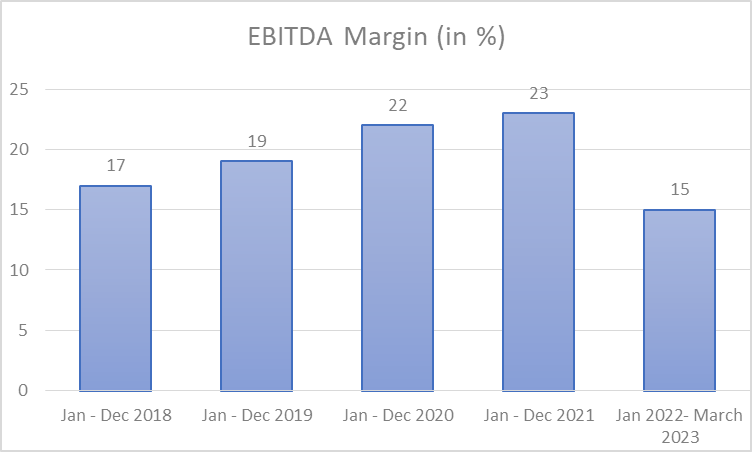

EBITDA Margin

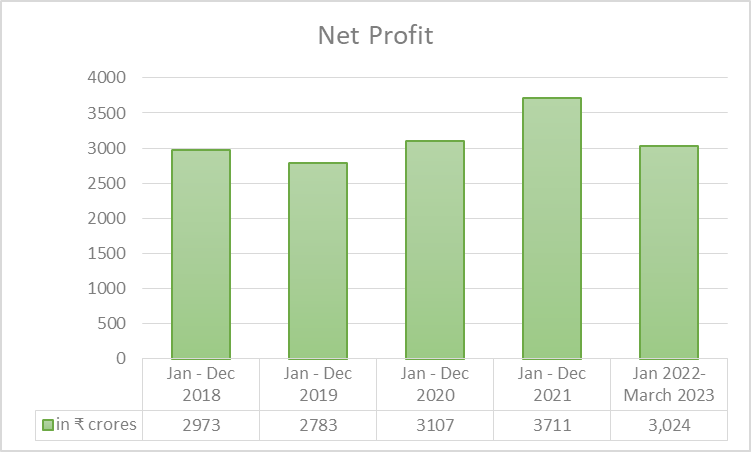

Net Profit

In FY23, Ambuja Cements reported an 18.5% decline in net profit at ₹3,024 crore, compared to ₹3,711 crore in FY22.

Key Financial Ratios

Current Ratio: At the end of 31st March 2023, the company’s current ratio improved to 1.75 times from 1.27 at the end of December 2021. The increase in current assets is attributed to cash received against the issue of share warrants.

Return of Capital Employed (ROCE): At the end of 31st March 2023, the ROCE of Ambuja Cement was 8.1%, declining from 9.8% at the end of December 2021.

Net Debt to Equity Ratio: The company has no long-term debt on its book. Therefore, the company doesn’t report a net debt-to-equity ratio.

Debt Service Coverage Ratio: At the end of 31st March 2023, Ambuja Cement’s debt service coverage ratio is 59.90 times.

Ambuja Cements Share Price History

The shares of Ambuja Cements were listed on the Bombay Stock Exchange, and National Stock Exchange in 1993, and its IPO was oversubscribed by 21.7 times. As of 7th July 2023, Ambuja Cements share price has given a CAGR return of 29% and 15% in the last three and five years, respectively.

Ambuja Cement had three bonus issues in 1994, 1999, and 2005 at 1:1, 1:1, and 1:2 ratios. And it underwent a stock split in the ratio of 10:2 on 20th June 2005. Meaning 100 shares held at IPO are now 6000 shares

| Ratio | Number of Shares | |

| Shares held at IPO | – | 100 |

| Bonus Issue on 21st Oct 1994 | 1:1 | 200 |

| Bonus Issue on 20th Dec 1999 | 1:1 | 400 |

| Bonus Issue on 20th June 2005 | 1:2 | 1200 |

| Stock Split on 20th June 2005 | 10:2 | 6000 |

Ambuja Cements has a consistent track record of paying dividends to its shareholders. In the last three years, the company has paid ₹1 in 2021, ₹6.3 in 2022, and ₹2.5 in 2023 as dividends.

Ambuja Cements share price increased from around ₹213 on 1st July 2019 to ₹417 as of 7th July 2023. It reached an all-time high level is ₹598 (adjusted to all corporate actions). As of 7th July 2023, Ambuja Cements has a market capitalization of ₹82,980 crores.

Ambuja Cement Share Price Growth Potential

- Adani Cement’s (combined Ambuja Cement and ACC) current cement manufacturing capacity is at 68 MTPA, which the company intends to double to 140 MTPA in the next five years or by FY28. Total capex outlay is planned at ₹7,000 crores in the next five years, which the company plans to meet through internal accruals.

- Management targets a cost reduction of ₹300-400 per tonne by optimizing energy, transportation, and other costs.

- Sales revenue is targeted at around 70,000 crores, with a CAGR of 19% over the next five years.

- EBITDA per tonne is estimated to grow at a CAGR of 8% in the next five years from ₹991 to ₹1470. EBITDA margin to expand from 19% to 25% during the period.

- ROCE is expected to increase 1.4 times to 19% over the next five years.

- The company is aggressively working towards streamlining its cement business operations to reduce costs. It has now a common regional head for both Ambuja Cement and ACC to look after volume growth, optimize logistics, and reduce costs.

- Ambuja Cements is aggressively working on reducing energy costs. It will increase the waste heat recovery system (WHRS) from 70 MW to 175 MW by Q2FY25. And share the mix of alternative fuel requirement (AFR) mix from 8.8% current to 30% over the medium term. It has set a 15% AFR mix target by the end of FY24.

Opportunities for Ambuja Cement

- India is the world’s second-largest producer of cement, accounting for 7% of the global installed capacity. In FY22, domestic cement production stood at 356 MTPA, expected to reach 456 MTPA by 2027.

- India has low per capita consumption of cement at 260-265 kg, compared to the world average of 500 kg.

- Demand growth for the cement sector will be driven by housing, infrastructure, roads, rails, and industrial segments. Huge capital expenditure outlaid by the government to modernize India’s infrastructure. Policies like the PLI scheme also aiding to the momentum.

Risks for Ambuja Cement

- Management Change: Ambuja Cement and ACC are undergoing a transitional phase following their acquisition by the Adani Group. This change in ownership necessitates the implementation of new policies and practices that align with the broader goals and interests of the group that may temporarily disrupt business operations and processes.

- Power & Fuel Costs: Cement production is an energy-intensive process, with energy costs accounting for a sizable portion of the total cost of production. A rise in energy and fuel costs can have an impact on the company’s unit economics.

- Interest Rate Risks: The consumption of cement can be significantly influenced by sustained elevated interest rates or a slowdown in the global economy. These factors have the potential to impact construction activities and infrastructure development, which are major drivers of cement demand.

- Regulatory Risk: Changes in environment protection laws, mining laws, trade laws, or non-compliance to any of these regulations can have financial implications and can affect the cost of innovation.

Cement, a price-sensitive commodity, tends to witness customers switching between brands in response to price fluctuations. In this context, efforts by Adani Cement to drive cost reduction and significantly increase its manufacturing capacity over the next five years hold great promise. These initiatives could impact the financial performance of the company.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

How has Ambuja Cements share price performed in the last 3 and 5 years?

As of 7th July 2023, Ambuja Cements share price has given a CAGR return of 27% and 15%, in the last 3 and 5 years, respectively. In comparison to the broader market, Ambuja Cements share price has outperformed the Nifty50 index over the last five years.

When was Ambuja Cements established?

Ambuja Cements was founded in the year 1983 by two traders, Narotam Sekhsaria and Suresh Neotia. In 1983, it was renamed Gujarat Ambuja Cements Limited, and in 2007, it was renamed Ambuja Cements Limited.

Who is the owner of Ambuja Cements?

Adani Group is the promoter of Ambuja Cements and ACC and has a 63.22% stake in the company, bought from Swiss-based building materials manufacturer Holcim Group in 2022 for $10.5 billion

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 6

No votes so far! Be the first to rate this post.