Introduction

The global economy has faced numerous challenges in the past three years, including the COVID-19 pandemic, geopolitical tensions, tightening monetary policies, and a recent banking crisis. Despite these obstacles, the Indian benchmark indices have soared to new heights, setting records such as the Sensex reaches lifetime high of 66000!

Positive Global Cues Boost Indian Equity Markets: The Indian equity markets are not isolated from global market sentiment, emphasizing the interdependence between domestic and international market conditions. Positive trends in global markets have played a significant role in the gains witnessed in the Indian market.

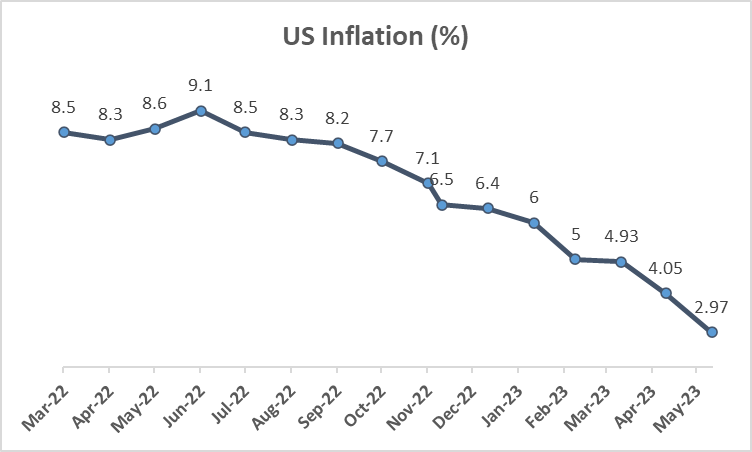

US Inflation Data Brings Optimism: Before 2022, the consumer price index hadn’t gained more than 8.3% on a year-over-year basis in any month since 1982. However, post-Covid 19 supply chain disruptions, pent-up consumer demand, and the tight labor market drove prices sharply higher. This led to Inflation in the US peaking at 9.1%.

The recent release of US inflation data has brought relief to investors. After months of high inflation rates, the latest figures reveal a more moderate increase. In June, the headline inflation rate stood at just 3%, marking a considerable decline from the peak of 9.1% during the pandemic-induced supply chain disruptions and pent-up consumer demand.

Key Takeaway

A shift in Monetary Policy Expectations: The lower-than-expected US inflation reading has ignited optimism among investors for the months ahead. This positive sentiment stems from the belief that the days of aggressive monetary policy and the Federal Reserve’s rate hike cycle may be coming to an end. The anticipation of a more accommodative stance from the central bank has led to a rally in the US and global stocks.

Global Market Interplay with Indian Indices: The global market’s influence on Indian benchmark indices cannot be overlooked. As global markets experience positive shifts, it creates a ripple effect that permeates domestic markets, ultimately contributing to the surge in Indian equity indices.

Conclusion: Despite facing a turbulent economic landscape in recent years, the Indian benchmark indices have reached unprecedented levels. This rally can be attributed to a combination of positive global cues, including the decline in US inflation and the expectation of a shift in monetary policy. As the interconnectedness between global and domestic markets persists, investors eagerly anticipate further positive developments that could continue to drive the Indian equity markets to new heights.

Indian Economy Shows Resilience as Inflation Rises and Industrial Production Grows

Foreign Investors Fuel Indian Equities, Driving Benchmark Indices to New Heights

Introduction

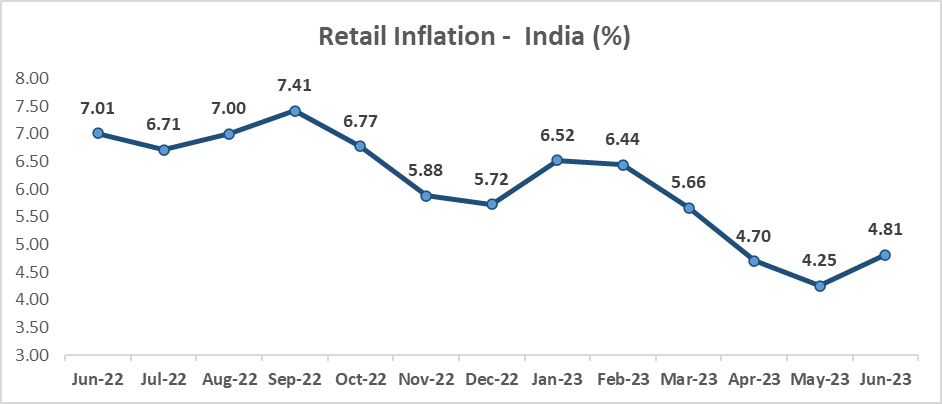

In the midst of recent economic developments in India, the Consumer Price Index (CPI) witnessed a rise in inflation to 4.81 percent in June. However, this increase was largely anticipated, attributed to higher prices of essential commodities such as vegetables, meat, and milk. On a positive note, the Index for Industrial Production (IIP) for May indicated a robust growth of 5.2 percent, showcasing a strong momentum in the country’s economy. These concurrent factors set the stage for significant changes in the Indian financial landscape.

Key Takeaway

Foreign Investors’ Interest in Indian Equities: After two consecutive years of being net sellers, Foreign Institutional Investors (FIIs) have demonstrated an increased interest in Indian equities since March 2023. In the current year, they have injected approximately ₹1.01 lakh crore into Indian equities, with notable inflows of ₹25,009 crore in July alone, following ₹47,148 crore in June.

Remarkably, FIIs have consistently remained net buyers of Indian equities for the fifth consecutive month. This surge in foreign investment has had a profound impact on the Indian stock market.

Benchmark Indices Reach New Heights: Buoyed by the positive economic indicators and the influx of foreign investment, the Indian benchmark indices have skyrocketed to new heights. The Sensex, a key market index, has surged to unprecedented levels, representing not only a triumph of numerical figures but also an affirmation of India’s unwavering economic resilience and its relentless pursuit of progress.

With each milestone achieved, the Indian stock market continues to allure investors, promising untapped potential and an array of unprecedented opportunities.

India’s economy has demonstrated resilience in the face of rising inflation and an increasing industrial production index. Moreover, the renewed interest of Foreign Institutional Investors in Indian equities has injected substantial funds into the market, propelling the benchmark indices to unprecedented levels. As the Indian stock market continues to thrive, it paints a promising picture for investors, brimming with untapped potential and unparalleled opportunities.

Read more: How Long-term investing helps create life-changing wealth – TOI.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.