Have you noticed the price of gold sparkling a little brighter lately? It’s not your imagination. Gold has been on a tear, recently hitting a fresh all-time high of Rs 70,275 per 10 grams in the domestic market. But what’s driving this surge? Let’s look into the reasons behind gold’s record-breaking rally.

Overview of Gold’s latest performance

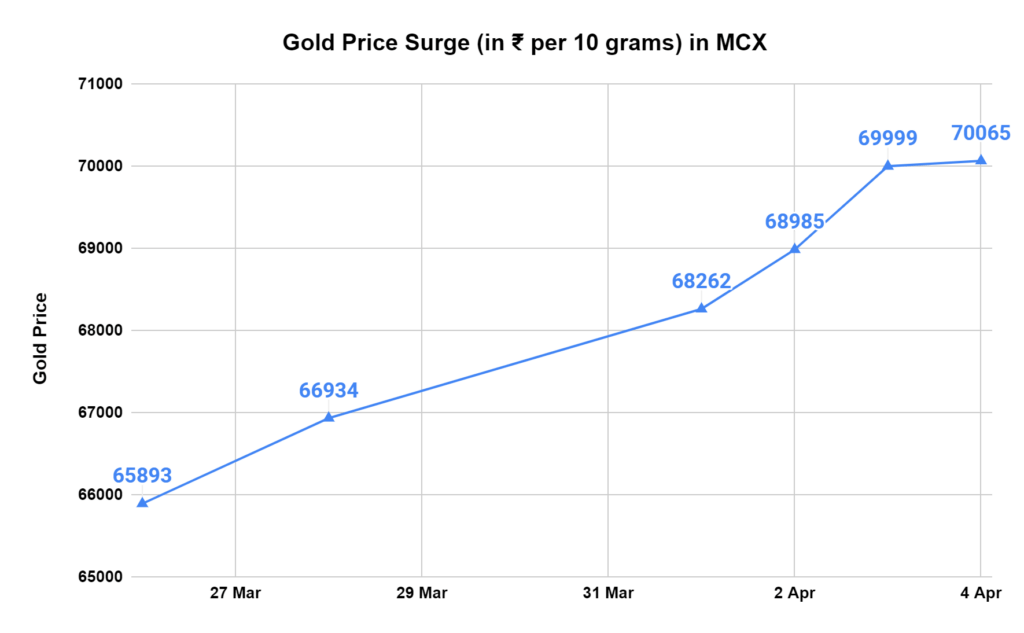

Since the beginning of 2024, gold has been on a tear, outperforming the broader stock market with a rise of over 6%. Just to give you an idea, gold on the MCX shot up by more than 12% in FY24, going from around ₹59,400 per 10 grams at the start of the year to roughly Rs 67,000 by year-end. This momentum has continued into the current trading sessions. Gold has brushed aside challenges over the last six days and set new highs on the MCX and COMEX.

Yesterday, April 4th, gold on COMEX crossed a significant milestone, closing above $2300 for the first time. Interestingly, even strong economic data from the US, which usually puts downward pressure on gold, couldn’t stop the rally. It includes higher-than-expected US ADP Non-farm payroll data and a weak ISM service PMI reading. Gold prices kept climbing despite a recent dip in the probability of a US rate cut in June (from 60% to 58%, according to CME’s FedWatch tool) due to more robust US manufacturing data.

6 reasons behind the Surge in Gold Price

- Interest Rates on Hold

One major factor fueling the gold rush is the possibility of a shift in US interest rates. Jerome Powell, the chair of the US Federal Reserve, has made recent comments hinting at rate cuts, which have sent a wave of excitement through the gold market. Here’s why:

Typically, when interest rates rise, holding gold becomes less attractive. Why? Because, unlike bonds, gold doesn’t offer interest payments. However, with potential rate cuts on the horizon, the appeal of gold increases. This shift in interest rate expectations has been a key driver behind the recent rally.

- Gold vs. Everything Else

While the stock market can be a bit of a rollercoaster, gold has steadily climbed in 2024. It’s up by 6% compared to the broader market, making it a haven for those seeking stability. Looking beyond the US, global uncertainties also play a role. With several elections this year in various countries, investors seek safe havens for their money. With its long history of stability, gold has become a natural choice during such times. Additionally, the strong institutional buying we’ve seen in recent years provides a solid foundation for gold prices. - Geopolitical Jitters Seek Refuge in Gold

The world isn’t exactly a calm place right now. From the ongoing war in Ukraine to political uncertainties in various countries, investors are seeking safe havens for their money. With its historical reputation for stability, gold becomes a natural choice during such times. This “safe-haven demand,” as it’s called, pushes gold prices higher as more investors flock to the precious metal. The recent earthquake in Taiwan and persistent tensions in the Middle East have further contributed to this trend.

- Inflation worries

Rising energy costs, partly fueled by the Ukraine war, are stoking inflation fears. Investors see gold as a hedge against inflation, as its value historically tends to hold steady even when currencies weaken.

- Oil prices on the rise

The recent oil price hike due to the attack on Russian refineries in Ukraine is one of the concerns drivers have. Rising oil prices often signal broader inflationary pressures. Investors worried about inflation turn to gold as a hedge. Since gold’s value tends to hold steady over time, it becomes a way to protect wealth from the eroding effects of inflation.

- A Dollar on the Decline

The US Dollar is not having its best moment. Weakness in the Dollar tends to push gold prices up. Gold is priced in Dollars, so a weaker Dollar makes it cheaper for investors holding other currencies to buy gold. This dynamic is adding fuel to the gold price fire.

So, is this a good time to invest in gold? That’s a question only you can answer, considering your financial goals and risk tolerance. However, understanding the factors driving the current surge can help you make an informed decision. Remember, gold prices can be volatile, so it’s crucial to do your research before diving in.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 16

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/