In the ever-evolving world of online commerce, Zomato’s acquisition of Blinkit in August 2022 for $568 million caught the attention of industry experts and consumers alike. The merger was initially met with skepticism, as critics questioned the compatibility and synergy between Zomato’s food delivery services and Blinkit’s quick commerce model.

However, Zomato’s leadership had a clear and ambitious vision: to establish a comprehensive ecosystem capable of catering to customers’ immediate needs, from essential groceries to gourmet meals.

A Valuation Surge to Remember

As we fast forward to the present day, Blinkit’s valuation has experienced an exponential surge, now valued at an impressive $13 billion, according to Goldman Sachs. This remarkable increase is not merely a reflection of financial success but indicates Blinkit’s seamless integration into Zomato’s broader ecosystem and its emerging dominance in the quick commerce sector. The valuation speaks volumes about the strategic foresight of Zomato’s decision-makers and the operational excellence achieved post-acquisition.

The Market Impact of a Visionary Move

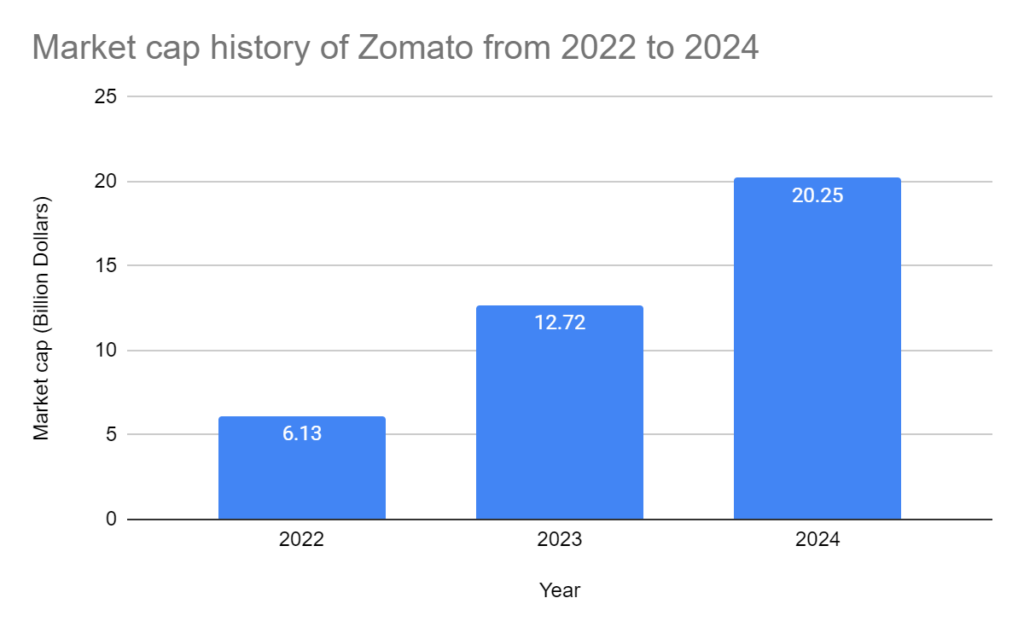

Zomato’s market capitalization, currently at $20 billion, has witnessed a significant resurgence of investor interest, primarily fueled by Blinkit’s stellar performance. The positive response from the stock market mirrors the growing confidence among shareholders and potential investors in Zomato’s expanded business model, which now promises even greater potential for growth and innovation.

Investor Perspective: A Calculated Approach

Despite the compelling success narrative, seasoned investors remain cautiously optimistic. They recognize Blinkit’s achievements under Zomato’s umbrella but also maintain a discerning eye toward the myriad of other attractive investment opportunities in the market. The decision to invest in Zomato’s stock is calculated in the context of a diversified investment portfolio and a strategic long-term outlook. This can be seen in the numbers as well. Since Zomato acquired Blinkit, Zomato’s share price has been moving towards an upward trajectory and has grown by 317.41%, reaching Rs 195.35 in May 2024 from Rs 46.8 in July 2022, while before that, the stock was fluctuating highly.

| Open | Price | Chg% |

| May 2024 | 195.35 | 1.14% |

| Apr 2024 | 193.15 | 6.07% |

| Mar 2024 | 182.1 | 10.06% |

| Feb 2024 | 165.45 | 18.56% |

| Jan 2024 | 139.55 | 12.81% |

| Dec 2023 | 123.7 | 4.34% |

| Nov 2023 | 118.55 | 12.80% |

| Oct 2023 | 105.1 | 3.55% |

| Sep 2023 | 101.5 | 4.00% |

| Aug 2023 | 97.6 | 16.05% |

| Jul 2023 | 84.1 | 12.06% |

| Jun 2023 | 75.05 | 8.69% |

| May 2023 | 69.05 | 6.39% |

| Apr 2023 | 64.9 | 27.25% |

| Mar 2023 | 51 | -4.67% |

| Feb 2023 | 53.5 | 7.54% |

| Jan 2023 | 49.75 | -16.10% |

| Dec 2022 | 59.3 | -9.12% |

| Nov 2022 | 65.25 | 3.41% |

| Oct 2022 | 63.1 | 1.20% |

| Sep 2022 | 62.35 | 7.59% |

| Aug 2022 | 57.95 | 23.82% |

| Jul 2022 | 46.8 | -13.09% |

| Jun 2022 | 53.85 | -27.86% |

| May 2022 | 74.65 | 4.04% |

| Apr 2022 | 71.75 | -12.82% |

| Mar 2022 | 82.3 | 2.94% |

| Feb 2022 | 79.95 | -11.56% |

| Jan 2022 | 90.4 | -34.21% |

| Dec 2021 | 137.4 | -9.93% |

| Nov 2021 | 152.55 | 15.96% |

| Oct 2021 | 131.55 | -3.70% |

| Sep 2021 | 136.6 | 1.52% |

| Aug 2021 | 134.55 | 0.79% |

The Road Ahead

The acquisition of Blinkit by Zomato raises several pertinent questions about the future trajectory of both entities. Will Blinkit continue on its path of rapid growth and market dominance? How will Zomato leverage this success to solidify its market leader position further? And perhaps most importantly, how will consumers benefit from this enhanced synergy between the two giants of the online commerce world?

In conclusion, Zomato’s acquisition of Blinkit is more than a business transaction—it’s a strategic move that has set a new precedent in the industry. With careful analysis and strategic planning, Zomato has expanded its portfolio and created a ripple effect that is felt across the market. How this strategic move pans out is yet to be seen.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Why did Zomato acquire Blinkit?

Zomato acquired Blinkit to expand its offerings beyond food delivery and enter the quick commerce space. The goal was to create a one-stop solution for customers’ immediate needs, including groceries and gourmet meals.

How much did Zomato pay for Blinkit?

Zomato acquired Blinkit for $ 568 million in August 2022.

What has been the impact of the acquisition on Blinkit’s valuation?

Since the acquisition, Blinkit’s valuation has increased significantly. Goldman Sachs recently valued it at $13 billion.

How has the acquisition affected Zomato’s market cap?

Zomato’s market cap is currently at $ 20 billion, and the acquisition has sparked renewed interest among investors, positively impacting the stock market’s view of Zomato.

What does Blinkit’s valuation surge mean for Zomato’s future?

The valuation surge indicates confidence in Blinkit’s integration into Zomato’s ecosystem and suggests potential for further growth and innovation within Zomato’s business model.

How useful was this post?

Click on a star to rate it!

Average rating 3.7 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/