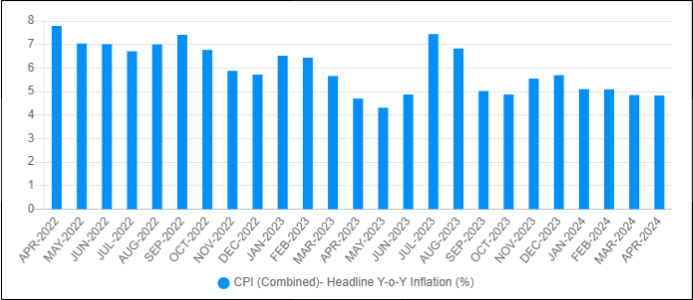

The 18th Lok Sabha election results have sprung many surprises, and it’s not just India’s political landscape that has been affected. Food inflation has been a significant concern for the Reserve Bank of India (RBI) for a while, making it difficult for the central bank to lower interest rates. Now, the election surprise has added another reason for the RBI to hold off on rate cuts in the near future.

The exit polls predicted a clear win for the current ruling party, BJP. This led many to believe the government might use the recent surplus dividends received from the RBI to lower its budget deficit. However, election results brought a different picture.

While a stable government is good for consistent policies and long-term planning, experts worry it might focus more on spending programs that appeal to lower-income voters in its upcoming third term. This ‘populist’ approach could change economic policies and make it harder to implement stricter financial reforms, leading to higher spending and potentially higher inflation.

According to economists, the upcoming July budget may still focus on reducing the deficit but with slightly more emphasis on spending that might be popular with voters. The financial markets now see a meager chance of the RBI cutting rates in 2024. This is because traders are concerned about the potential inflationary impact of increased government spending.

Market Expectations from RBI Rate Cuts

The financial markets weren’t expecting a rate cut at the RBI’s next meeting in June anyway. However, the possibility of the government sharply reducing its borrowing needs would have given the RBI more confidence to lower rates. With the new government potentially spending more, traders in the financial markets now see very little chance of rate cuts in 2024. Higher government spending can lead to inflation, which the RBI tries to control by keeping interest rates high.

The new government may need to consider the demands of its regional allies, such as Janatal Dal and Telugu Desam, which may lead to adjustments in spending plans. Also, the main party and its allies could feel the pressure to boost consumer spending in the economy.

RBI’s Surplus Dividend Bonanza

On the bright side, the government has its surplus dividend from the RBI. Experts believe that this additional ₹2.11 lakh crore provides some breathing room for spending without significantly disrupting the overall budget. The government also has other sources of income, with ₹1 lakh crore of additional earnings. Economists also believe that the government doesn’t face a significant dilemma and can likely stick to its existing plan of gradually reducing the deficit over time.

Ideally, the government could have aimed for a 4.9% fiscal deficit this year. But they’re cautiously aiming for a slightly higher deficit to gradually reach 4.5% over time. Overall, the election outcome has made the RBI’s decision on rate cuts more complex. While food inflation remains a concern, potential changes in government spending behavior are now an additional factor to consider.

FAQs

How does the new government's spending impact the RBI's decision on rate cuts?

Higher government spending can lead to higher demand for goods and services, putting upward pressure on prices. This makes it harder for the RBI to lower interest rates, as rate cuts can lead to inflation.

How will the surplus dividend received from the RBI help the new government?

The surplus dividend will allow the government to spend without significantly disrupting the budget. The government can focus on its spending plans without worrying as much about the deficit.

What is the ideal fiscal deficit target for the government?

Ideally, the government could have aimed for a 4.9% fiscal deficit this year. However, they are cautiously aiming for a slightly higher deficit to reach 4.5% over time gradually.

What are the other factors that the RBI needs to consider when making decisions on rate cuts?

The RBI also needs to consider food inflation, which has been a significant concern for a while. Food inflation can strain household budgets and lead to higher overall inflation. The RBI needs to balance the need for economic growth (which can be stimulated by lower interest rates) with the need to control inflation.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/