The new financial year is here, and the markets are always buzzing with anticipation. This week promises to be particularly action-packed, with many events that could significantly impact investor sentiment.

So, before you dive headfirst into trading, here’s a breakdown of the top 10 factors you should be keeping an eye on:

RBI Policy Decision

The big event of the week is, without a doubt, the Reserve Bank of India’s (RBI) monetary policy committee meeting scheduled for April 5th. The market is keenly waiting to see if the RBI will maintain the status quo on the repo rate or if there’s a surprise rate hike. This decision will significantly impact interest rates, liquidity, and overall market sentiment.

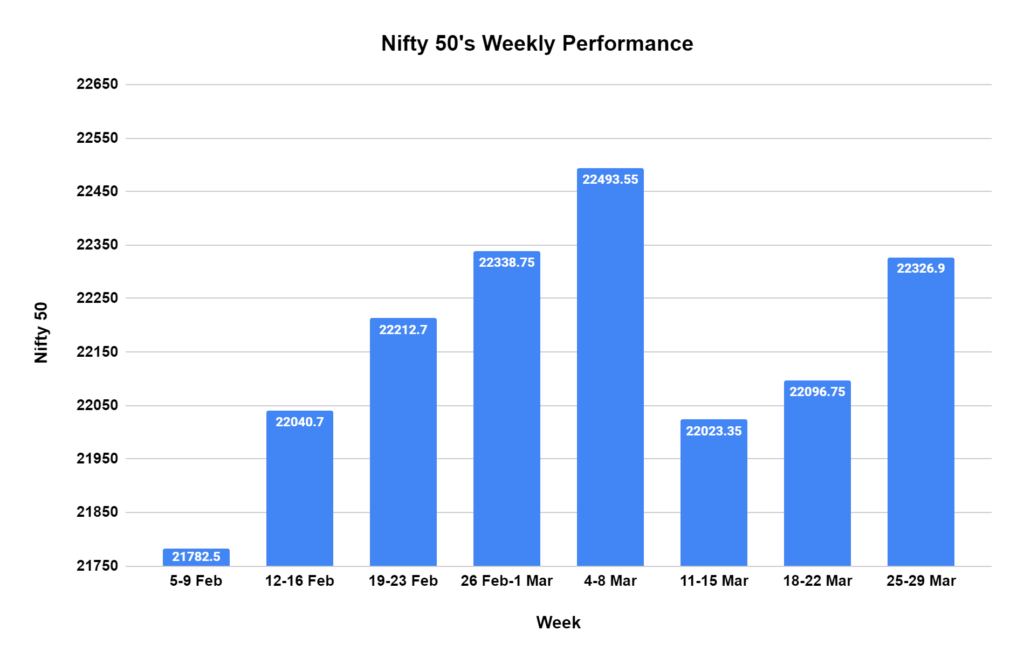

Nifty 50 Stages a Comeback

The Nifty 50 clawed its way back to 22,300 with above-average volumes. It successfully held above a key resistance trendline, all key moving averages, and the 10-week EMA (acting as support). This week, watch for potential upside around 22,550-22,650, with immediate support at 22,200-22,100.

Auto Sales Data

The monthly auto sales data for March 2024 will be released in the coming week. This data is a crucial indicator of consumer spending and the overall health of the automobile industry. Strong sales figures from major automakers could boost investor confidence and lift the stocks of auto companies.

Corporate Earnings

Many companies are scheduled to release their quarterly earnings reports this week. Investors will scrutinize these reports to assess their financial performance and future growth prospects. Strong earnings reports could lead to a surge in stock prices, while disappointing results could trigger sell-offs.

Global PMI Data

Purchasing Managers’ Index (PMI) data from major economies like the US, China, and Europe will be released this week. PMI is a critical gauge of manufacturing and services sector activity. A strong PMI reading indicates expansion, while a weak reading suggests contraction. Positive PMI data from key economies could provide a much-needed fillip to the Indian stock market.

Domestic Data Download

The HSBC Manufacturing PMI for March lands on April 2nd, followed by the Services PMI on April 4th. Bank loan and deposit growth figures for the fortnight ending March 22nd and foreign exchange reserves data for the week ending March 29th will be out on April 5th.

IPO Watch

- The new financial year, FY25 kicks off with the Bharti Hexacom IPO. Their ₹4,275 crore public issue opens for a 3-day subscription on April 3rd, with a price band of ₹542-₹570 per share.

- Seven companies in the SME segment will close their IPOs next week.

- SRM Contractors, the only mainboard listing next week, debuts on April 3rd, while nine SME companies join the bourses throughout the week.

Oil Prices Heat Up

Keep an eye on oil! Brent crude futures jumped to their highest closing level since October 2023, settling at $87.07 a barrel after a marginal decline the week before. This marks three consecutive months of gains, with a 6.3% rise in March and a 13% increase for the quarter. Remember, India relies on oil imports, so rising prices pose a risk.

Fed Chair in Focus

Globally, markets are tuned into Federal Reserve Chair Jerome Powell’s speech on April 3rd. Don’t expect a rate cut announcement anytime soon. With strong employment data, the Fed wants inflation to approach its 2% target consistently. In the March meeting, Powell hinted at three rate cuts this year.

Options Market Murmurs

Options data suggests the Nifty 50 might face resistance at 22,500-22,600 in the new series, with support at 22,200 and 22,000. The India VIX, the fear gauge, rebounded 5% to close the week at 12.83, still considered comfortable territory despite a 10.74% correction the week before.

So, what should you do with all this information?

You can learn more about gift nifty with our blog. The key is to stay informed and adapt your investment strategy accordingly. By carefully considering these factors, you can make well-informed investment decisions and effectively navigate market volatility. Remember, there’s no guaranteed formula for success in the stock market. However, by being aware of the key drivers and staying disciplined, you can increase your chances of making sound investment choices.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/