As the summer season approaches, many of us are preparing for the scorching heat. But for some companies, this season brings discomfort and a potential surge in sales. These companies, primarily dealing in white goods like air conditioners, coolers, and refrigerators, see their fortunes rise and fall with the mercury.

So, with the India Meteorological Department (IMD) predicting a hotter-than-average summer this year, will these stocks experience a similar rise in temperature?

Let’s see what the analysts have to say.

A Look Back: The Chilling Effect of Delayed Summers

White goods companies haven’t had the smoothest ride for the past few years. Between 2020 and 2022, their underperformance can be partly attributed to delayed or shortened summer seasons, particularly in North India. This significantly impacted their peak selling period, leading to lower revenues and profits.

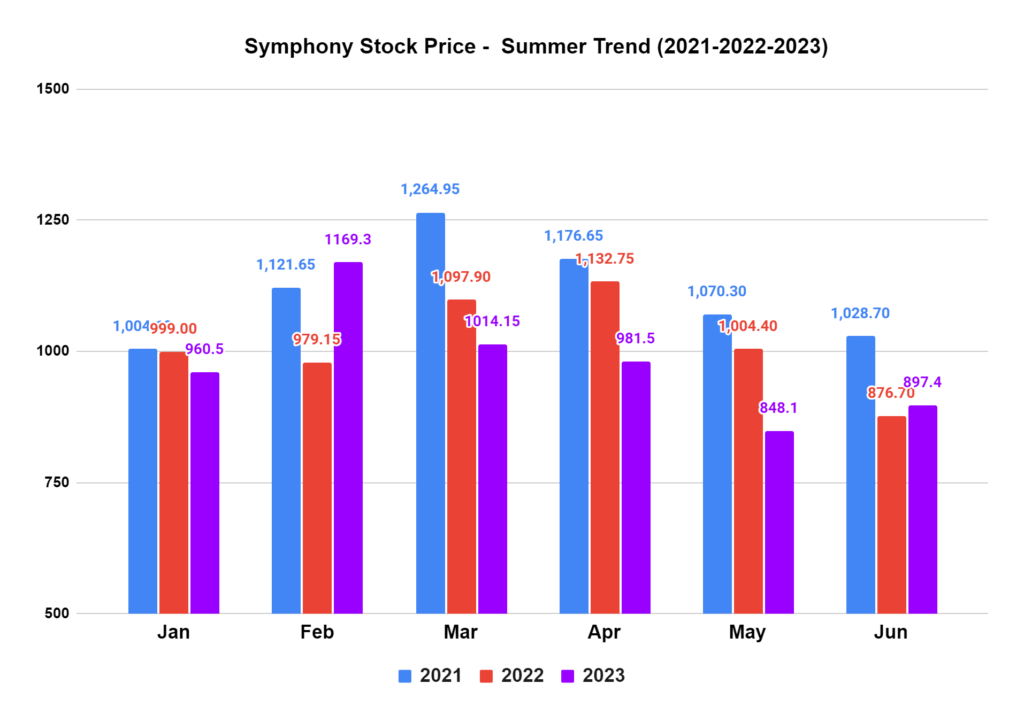

For example, let’s take a look at the stock prices of Symphony Ltd. during the last three summers.

The Forecast for 2024: A Hotter Market?

With the IMD predicting higher average temperatures this year, there’s renewed interest in these companies. The potential for a longer and hotter summer could lead to increased demand for their products, particularly air conditioners and coolers. However, it’s important to remember that this is just a prediction, and past forecasts haven’t always been accurate.

These companies are heavily reliant on two key factors:

1. The length of the summer season: A more extended summer translates to a longer selling period for their products.

2. Average summer temperatures: The hotter it gets, the more likely people are to invest in cooling solutions.

Beyond the Heat: Other Factors to Consider

While the summer season plays a crucial role, it’s not the only factor influencing these companies’ performance. Other important aspects include:

- Supply chain disruptions: Recent improvements in the supply chain have led to lower component prices, potentially boosting margins. However, rising international freight costs for certain imported goods could pose a challenge.

- Metal prices: Lower metal prices, a significant cost component, can improve profitability.

- Product diversification: Companies that have diversified their product portfolios beyond summer essentials might experience more stable financial performance throughout the year.

Analyst View: A Mixed Bag

Analysts’ opinions on these companies vary. Some recommend holding onto existing shares, while others suggest selling. It’s important to remember that these assessments are based on current information and might change as circumstances evolve. As always, conducting independent research and considering your risk tolerance is crucial before making investment decisions.

| White Goods | |||||

| Company Name | Latest Avg Score | *Upside Potential | Institutional Stake (%) | M-Cap Type | MCap (in ₹ Cr.) |

| Whirlpool of India | 5 | 56 | 28 | Mid | 15,726 |

| Symphony | 3 | 27 | 12 | Mid | 6,188 |

| Voltas | 4 | 21 | 48 | Large | 35,894 |

| Blue Star | 6 | 19 | 37 | Large | 25,191 |

| Johnson Controls – Hitachi | 5 | 11 | 9 | Small | 2,995 |

This research delves deep into five critical areas of each company, using numbers to create a score for each. These scores are then averaged out following a bell curve, resulting in a final score from 1 to 10. 8-10 means things look good, 4-7 is neutral, and 1-3 suggests some challenges.

The 5 Key Players

Here’s a quick introduction to five companies whose fortunes are often tied to summer temperatures:

1. Symphony Limited

- Focus: They are primarily known for their air coolers, which are available in a diverse range catering to various needs, from personal coolers for individual spaces to large coolers for commercial settings.

- Products: Popular models include the Symphony Sumo 70, a powerful desert cooler, and the Symphony Diet 8i, a personal tower cooler.

- Market Reach: Operates in domestic and international markets, offering a wider customer base.

2. Whirlpool of India Limited

- Product Portfolio: A broader home appliance player offering air conditioners alongside refrigerators, washing machines, and other appliances.

- Air Conditioning Expertise: Provides split AC units, catering to the growing demand for efficient cooling solutions.

- Brand Recognition: Established brand name with a strong presence in the Indian market.

3. Johnson Controls-Hitachi Air Conditioning India Limited

- Brand Power: Leverages the renowned Hitachi brand for its air conditioners, refrigerators, and other cooling products.

- Diverse Offerings: Offers a range of ACs, including commercial options like Cassette ACs and chillers, alongside residential split and window ACs.

- Industry-Specific Solutions: Caters to the specific needs of various sectors like entertainment, education, and hospitals.

4. Voltas Limited

- Beyond Air Conditioning: While offering a range of air conditioners, Voltas also provides diverse solutions like engineering projects, water treatment solutions, and textile machinery.

- Unitary Cooling Products: Their dedicated segment manufactures and sells cooling appliances like air conditioners and cold storage products.

- Established Player: A well-established company with a strong presence in the Indian market.

5. Blue Star Limited

- Specialization: Primarily focuses on air conditioning and commercial refrigeration, along with offering related services like electrical and plumbing work.

- Project Expertise: Undertakes large-scale electro-mechanical projects involving central air conditioning systems, catering to commercial and industrial needs.

- Unitary Products Segment: Offers individual cooling appliances like air conditioners and cold storage solutions.

As the summer sun heats up, interest in these cooling comfort stocks increases. While analyst perspectives offer valuable insights, they shouldn’t be the sole factor driving your investment decisions. Remember, the weather can be as unpredictable as the market itself.

Conduct your own research, consider your risk tolerance, and consult a financial professional before investing. After all, staying cool-headed in the face of opportunities is a recipe for informed decisions.

Read More: How To Make Passive Income

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considerea d as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/

-

Archana Chettiarhttps://www.equentis.com/blog/author/archana/